Question 69 interest tax shield, capital structure, leverage, WACC

Which statement about risk, required return and capital structure is the most correct?

You just signed up for a 30 year fully amortising mortgage loan with monthly payments of $2,000 per month. The interest rate is 9% pa which is not expected to change.

How much did you borrow? After 5 years, how much will be owing on the mortgage? The interest rate is still 9% and is not expected to change.

You're advising your superstar client 40-cent who is weighing up buying a private jet or a luxury yacht. 40-cent is just as happy with either, but he wants to go with the more cost-effective option. These are the cash flows of the two options:

- The private jet can be bought for $6m now, which will cost $12,000 per month in fuel, piloting and airport costs, payable at the end of each month. The jet will last for 12 years.

- Or the luxury yacht can be bought for $4m now, which will cost $20,000 per month in fuel, crew and berthing costs, payable at the end of each month. The yacht will last for 20 years.

What's unusual about 40-cent is that he is so famous that he will actually be able to sell his jet or yacht for the same price as it was bought since the next generation of superstar musicians will buy it from him as a status symbol.

Bank interest rates are 10% pa, given as an effective annual rate. You can assume that 40-cent will live for another 60 years and that when the jet or yacht's life is at an end, he will buy a new one with the same details as above.

Would you advise 40-cent to buy the or the ?

Note that the effective monthly rate is ##r_\text{eff monthly}=(1+0.1)^{1/12}-1=0.00797414##

Question 513 stock split, reverse stock split, stock dividend, bonus issue, rights issue

Which of the following statements is NOT correct?

Question 542 price gains and returns over time, IRR, NPV, income and capital returns, effective return

For an asset price to double every 10 years, what must be the expected future capital return, given as an effective annual rate?

The covariance and correlation of two stocks X and Y's annual returns are calculated over a number of years. The units of the returns are in percent per annum ##(\% pa)##.

What are the units of the covariance ##(\sigma_{X,Y})## and correlation ##(\rho_{X,Y})## of returns respectively?

Hint: Visit Wikipedia to understand the difference between percentage points ##(\text{pp})## and percent ##(\%)##.

Question 888 foreign exchange rate, speculation, no explanation

The current Australian exchange rate is 0.8 USD per AUD.

If you think that the AUD will depreciate against the USD, contrary to the rest of the market, how could you profit? Right now you should:

Question 905 market capitalisation of equity, PE ratio, payout ratio

The below graph shows the computer software company Microsoft's stock price (MSFT) at the market close on the NASDAQ on Friday 1 June 2018.

Based on the screenshot above, which of the following statements about MSFT is NOT correct? MSFT's:

Question 977 comparative advantage in trade, production possibilities curve, no explanation

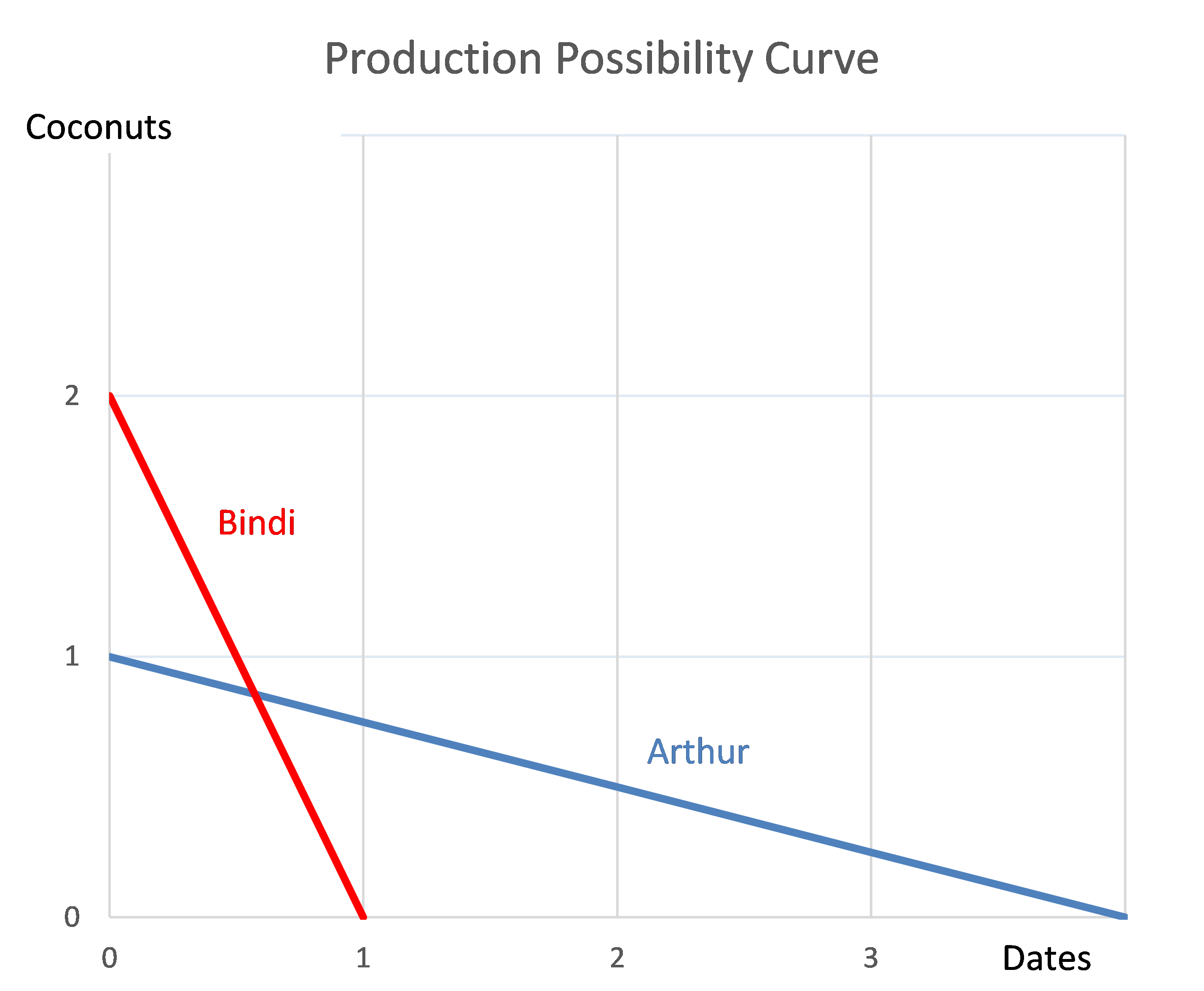

Arthur and Bindi are the only people on a remote island. Their production possibility curves are shown in the graph.

Which of the following statements is NOT correct?

Question 992 inflation, real and nominal returns and cash flows

You currently have $100 in the bank which pays a 10% pa interest rate.

Oranges currently cost $1 each at the shop and inflation is 5% pa which is the expected growth rate in the orange price.

This information is summarised in the table below, with some parts missing that correspond to the answer options. All rates are given as effective annual rates. Note that when payments are not specified as real, as in this question, they're conventionally assumed to be nominal.

| Wealth in Dollars and Oranges | ||||

| Time (year) | Bank account wealth ($) | Orange price ($) | Wealth in oranges | |

| 0 | 100 | 1 | 100 | |

| 1 | 110 | 1.05 | (a) | |

| 2 | (b) | (c) | (d) | |

Which of the following statements is NOT correct? Your: