| Portfolio Details | ||||||

| Stock | Expected return |

Standard deviation |

Correlation | Beta | Dollars invested |

|

| A | 0.2 | 0.4 | 0.12 | 0.5 | 40 | |

| B | 0.3 | 0.8 | 1.5 | 80 | ||

What is the beta of the above portfolio?

A firm wishes to raise $8 million now. They will issue 7% pa semi-annual coupon bonds that will mature in 10 years and have a face value of $100 each. Bond yields are 10% pa, given as an APR compounding every 6 months, and the yield curve is flat.

How many bonds should the firm issue?

In these tough economic times, central banks around the world have cut interest rates so low that they are practically zero. In some countries, government bond yields are also very close to zero.

A three year government bond with a face value of $100 and a coupon rate of 2% pa paid semi-annually was just issued at a yield of 0%. What is the price of the bond?

Let the variance of returns for a share per month be ##\sigma_\text{monthly}^2##.

What is the formula for the variance of the share's returns per year ##(\sigma_\text{yearly}^2)##?

Assume that returns are independently and identically distributed (iid) so they have zero auto correlation, meaning that if the return was higher than average today, it does not indicate that the return tomorrow will be higher or lower than average.

A European call option will mature in ##T## years with a strike price of ##K## dollars. The underlying asset has a price of ##S## dollars.

What is an expression for the payoff at maturity ##(f_T)## in dollars from owning (being long) the call option?

Acquirer firm plans to launch a takeover of Target firm. The deal is expected to create a present value of synergies totaling $2 million. A cash offer will be made that pays the fair price for the target's shares plus 70% of the total synergy value. The cash will be paid out of the firm's cash holdings, no new debt or equity will be raised.

| Firms Involved in the Takeover | ||

| Acquirer | Target | |

| Assets ($m) | 60 | 10 |

| Debt ($m) | 20 | 2 |

| Share price ($) | 10 | 8 |

| Number of shares (m) | 4 | 1 |

Ignore transaction costs and fees. Assume that the firms' debt and equity are fairly priced, and that each firms' debts' risk, yield and values remain constant. The acquisition is planned to occur immediately, so ignore the time value of money.

Calculate the merged firm's share price and total number of shares after the takeover has been completed.

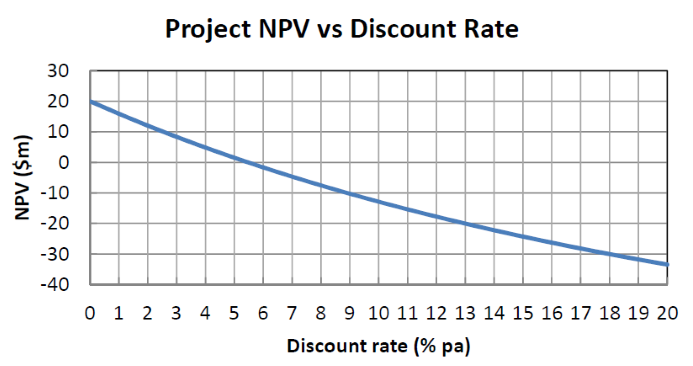

The below graph shows a project's net present value (NPV) against its annual discount rate.

Which of the following statements is NOT correct?

The standard deviation and variance of a stock's annual returns are calculated over a number of years. The units of the returns are percent per annum ##(\% pa)##.

What are the units of the standard deviation ##(\sigma)## and variance ##(\sigma^2)## of returns respectively?

Hint: Visit Wikipedia to understand the difference between percentage points ##(\text{pp})## and percent ##(\%)##.

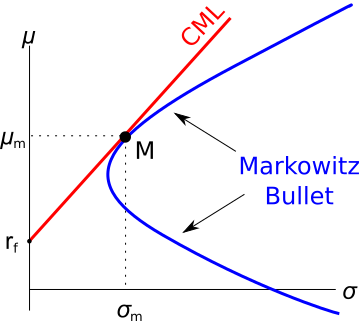

Question 778 CML, systematic and idiosyncratic risk, portfolio risk, CAPM

The capital market line (CML) is shown in the graph below. The total standard deviation is denoted by σ and the expected return is μ. Assume that markets are efficient so all assets are fairly priced.

Which of the below statements is NOT correct?

Question 785 fixed for floating interest rate swap, non-intermediated swap

The below table summarises the borrowing costs confronting two companies A and B.

| Bond Market Yields | ||||

| Fixed Yield to Maturity (%pa) | Floating Yield (%pa) | |||

| Firm A | 3 | L - 0.4 | ||

| Firm B | 5 | L + 1 | ||

Firm A wishes to borrow at a floating rate and Firm B wishes to borrow at a fixed rate. Design a non-intermediated swap that benefits firm A only. What will be the swap rate?