A company issues a large amount of bonds to raise money for new projects of similar risk to the company's existing projects. The net present value (NPV) of the new projects is positive but small. Assume a classical tax system. Which statement is NOT correct?

Calculate the effective annual rates of the following three APR's:

- A credit card offering an interest rate of 18% pa, compounding monthly.

- A bond offering a yield of 6% pa, compounding semi-annually.

- An annual dividend-paying stock offering a return of 10% pa compounding annually.

All answers are given in the same order:

##r_\text{credit card, eff yrly}##, ##r_\text{bond, eff yrly}##, ##r_\text{stock, eff yrly}##

Which of the following companies is most suitable for valuation using PE multiples techniques?

Acquirer firm plans to launch a takeover of Target firm. The deal is expected to create a present value of synergies totaling $105 million. A 40% scrip and 60% cash offer will be made that pays the fair price for the target's shares plus 75% of the total synergy value. The cash will be paid out of the firm's cash holdings, no new debt or equity will be raised.

| Firms Involved in the Takeover | ||

| Acquirer | Target | |

| Assets ($m) | 6,000 | 700 |

| Debt ($m) | 4,800 | 400 |

| Share price ($) | 40 | 20 |

| Number of shares (m) | 30 | 15 |

Ignore transaction costs and fees. Assume that the firms' debt and equity are fairly priced, and that each firms' debts' risk, yield and values remain constant. The acquisition is planned to occur immediately, so ignore the time value of money.

Calculate the merged firm's share price and total number of shares after the takeover has been completed.

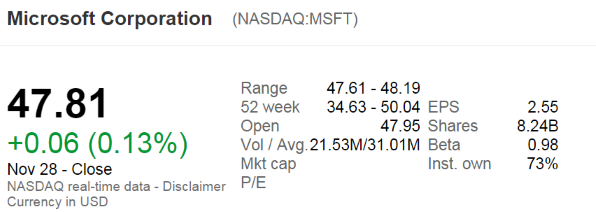

The below screenshot of Microsoft's (MSFT) details were taken from the Google Finance website on 28 Nov 2014. Some information has been deliberately blanked out.

What was MSFT's backwards-looking price-earnings ratio?

After doing extensive fundamental analysis of a company, you believe that their shares are overpriced and will soon fall significantly. The market believes that there will be no such fall.

Which of the following strategies is NOT a good idea, assuming that your prediction is true?

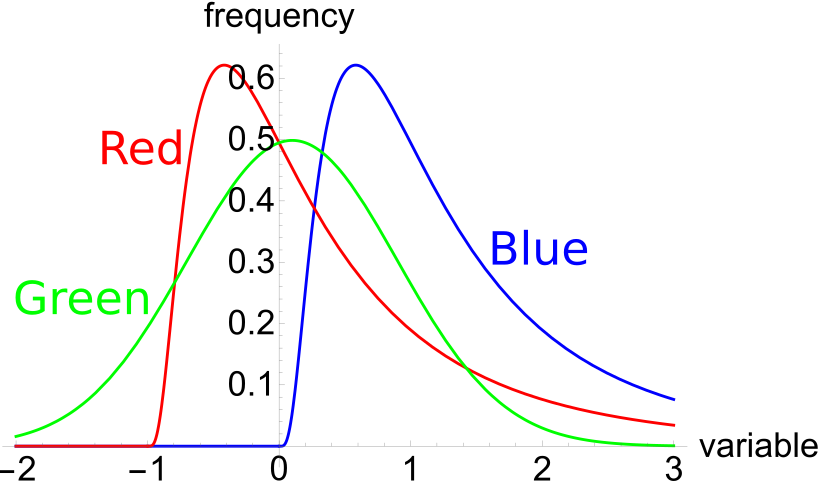

The below three graphs show probability density functions (PDF) of three different random variables Red, Green and Blue. Let ##P_1## be the unknown price of a stock in one year. ##P_1## is a random variable. Let ##P_0 = 1##, so the share price now is $1. This one dollar is a constant, it is not a variable.

Which of the below statements is NOT correct? Financial practitioners commonly assume that the shape of the PDF represented in the colour:

Below is the Australian federal government’s budget balance as a percent of GDP. Note that the columns to the right of the vertical black line were a forecast at the time. The x-axis shows financial years, so for example the 06/07 financial year represents the time period from 1 July 2006 to 30 June 2007.

Comparing the 2008/09 financial year to the previous one, the Australian federal government implemented:

Question 856 credit terms, no explanation

Your supplier’s credit terms are "1/10 net 30". Which of the following statements about these credit terms is NOT correct?

If you intend to buy an item from your supplier for a tag price of $100 and you:

Question 984 principal agent problem, moral hazard, asymmetric information, no explanation

When does the ‘principal-agent problem’ occur? Is it when:

I. The principal has conflicting incentives (moral hazard);

II. The agent has conflicting incentives (moral hazard);

III. The principal has incomplete information about the agent (asymmetric information); or

IV. The agent has incomplete information about the principal (asymmetric information)?

The principal-agent problem occurs when statements: