A company issues a large amount of bonds to raise money for new projects of similar risk to the company's existing projects. The net present value (NPV) of the new projects is positive but small. Assume a classical tax system. Which statement is NOT correct?

A share just paid its semi-annual dividend of $10. The dividend is expected to grow at 2% every 6 months forever. This 2% growth rate is an effective 6 month rate. Therefore the next dividend will be $10.20 in six months. The required return of the stock is 10% pa, given as an effective annual rate.

What is the price of the share now?

A 30-day Bank Accepted Bill has a face value of $1,000,000. The interest rate is 2.5% pa and there are 365 days in the year. What is its price now?

A 30 year Japanese government bond was just issued at par with a yield of 1.7% pa. The fixed coupon payments are semi-annual. The bond has a face value of $100.

Six months later, just after the first coupon is paid, the yield of the bond increases to 2% pa. What is the bond's new price?

Estimate the US bank JP Morgan's share price using a price earnings (PE) multiples approach with the following assumptions and figures only:

- The major US banks JP Morgan Chase (JPM), Citi Group (C) and Wells Fargo (WFC) are comparable companies;

- JP Morgan Chase's historical earnings per share (EPS) is $4.37;

- Citi Group's share price is $50.05 and historical EPS is $4.26;

- Wells Fargo's share price is $48.98 and historical EPS is $3.89.

Note: Figures sourced from Google Finance on 24 March 2014.

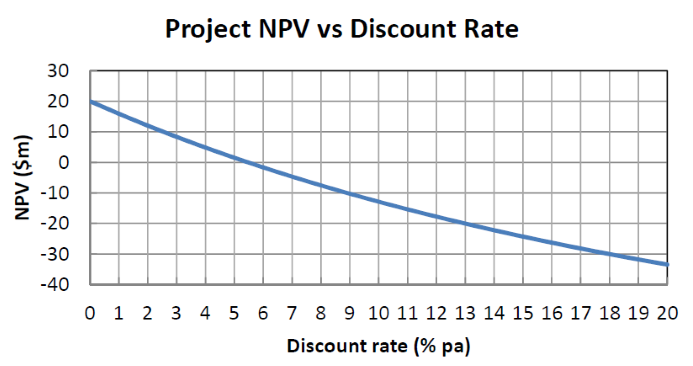

The below graph shows a project's net present value (NPV) against its annual discount rate.

Which of the following statements is NOT correct?

Question 543 price gains and returns over time, IRR, NPV, income and capital returns, effective return

For an asset price to triple every 5 years, what must be the expected future capital return, given as an effective annual rate?

Question 636 option, option payoff at maturity, no explanation

Which of the below formulas gives the payoff ##(f)## at maturity ##(T)## from being long a call option? Let the underlying asset price at maturity be ##S_T## and the exercise price be ##X_T##.

Question 833 option, delta, theta, standard deviation, no explanation

Which of the following statements about an option (either a call or put) and its underlying stock is NOT correct?

Question 851 labour force, no explanation

Below is a table showing some figures about the Australian labour force.

| Australian Labour Force and Employment Data | |

| April 2017 Seasonally Adjusted figures | |

| Employed persons ('000) | 12 061.9 |

| Unemployed persons ('000) | 751.4 |

| Unemployment rate (%) | 5.9 |

| Participation rate (%) | 64.8 |

Source: ABS 6202.0 Labour Force, Australia, Apr 2017

What do you estimate is the size of working age population in thousands (‘000)?