A firm is considering a new project of similar risk to the current risk of the firm. This project will expand its existing business. The cash flows of the project have been calculated assuming that there is no interest expense. In other words, the cash flows assume that the project is all-equity financed.

In fact the firm has a target debt-to-equity ratio of 1, so the project will be financed with 50% debt and 50% equity. To find the levered value of the firm's assets, what discount rate should be applied to the project's unlevered cash flows? Assume a classical tax system.

A managed fund charges fees based on the amount of money that you keep with them. The fee is 2% of the end-of-year amount, paid at the end of every year.

This fee is charged regardless of whether the fund makes gains or losses on your money.

The fund offers to invest your money in shares which have an expected return of 10% pa before fees.

You are thinking of investing $100,000 in the fund and keeping it there for 40 years when you plan to retire.

How much money do you expect to have in the fund in 40 years? Also, what is the future value of the fees that the fund expects to earn from you? Give both amounts as future values in 40 years. Assume that:

- The fund has no private information.

- Markets are weak and semi-strong form efficient.

- The fund's transaction costs are negligible.

- The cost and trouble of investing your money in shares by yourself, without the managed fund, is negligible.

- The fund invests its fees in the same companies as it invests your funds in, but with no fees.

The below answer choices list your expected wealth in 40 years and then the fund's expected wealth in 40 years.

The below graph shows a project's net present value (NPV) against its annual discount rate.

Which of the following statements is NOT correct?

Question 513 stock split, reverse stock split, stock dividend, bonus issue, rights issue

Which of the following statements is NOT correct?

The expression 'you have to spend money to make money' relates to which business decision?

An investor owns a whole level of an old office building which is currently worth $1 million. There are three mutually exclusive projects that can be started by the investor. The office building level can be:

- Rented out to a tenant for one year at $0.1m paid immediately, and then sold for $0.99m in one year.

- Refurbished into more modern commercial office rooms at a cost of $1m now, and then sold for $2.4m when the refurbishment is finished in one year.

- Converted into residential apartments at a cost of $2m now, and then sold for $3.4m when the conversion is finished in one year.

All of the development projects have the same risk so the required return of each is 10% pa. The table below shows the estimated cash flows and internal rates of returns (IRR's).

| Mutually Exclusive Projects | |||

| Project | Cash flow now ($) |

Cash flow in one year ($) |

IRR (% pa) |

| Rent then sell as is | -900,000 | 990,000 | 10 |

| Refurbishment into modern offices | -2,000,000 | 2,400,000 | 20 |

| Conversion into residential apartments | -3,000,000 | 3,400,000 | 13.33 |

Which project should the investor accept?

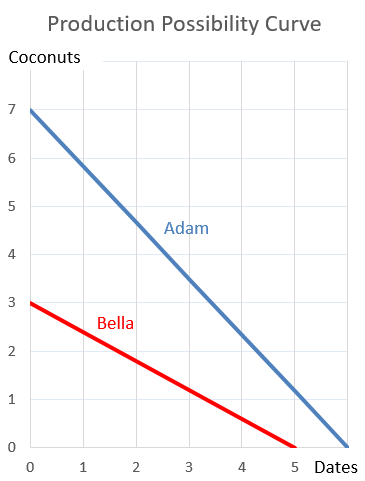

Question 897 comparative advantage in trade, production possibilities curve, no explanation

Adam and Bella are the only people on a remote island. Their production possibility curves are shown in the graph.

Which of the following statements is NOT correct?

Question 929 standard error, mean and median returns, mode return, return distribution, arithmetic and geometric averages, continuously compounding rate

The arithmetic average continuously compounded or log gross discrete return (AALGDR) on the ASX200 accumulation index over the 24 years from 31 Dec 1992 to 31 Dec 2016 is 9.49% pa.

The arithmetic standard deviation (SDLGDR) is 16.92 percentage points pa.

Assume that the data are sample statistics, not population statistics. Assume that the log gross discrete returns are normally distributed.

What is the standard error of your estimate of the sample ASX200 accumulation index arithmetic average log gross discrete return (AALGDR) over the 24 years from 1992 to 2016?

Question 948 VaR, expected shortfall

Below is a historical sample of returns on the S&P500 capital index.

| S&P500 Capital Index Daily Returns Ranked from Best to Worst |

||

| 10,000 trading days from 4th August 1977 to 24 March 2017 based on closing prices. |

||

| Rank | Date (DD-MM-YY) |

Continuously compounded daily return (% per day) |

| 1 | 21-10-87 | 9.23 |

| 2 | 08-03-83 | 8.97 |

| 3 | 13-11-08 | 8.3 |

| 4 | 30-09-08 | 8.09 |

| 5 | 28-10-08 | 8.01 |

| 6 | 29-10-87 | 7.28 |

| … | … | … |

| 9980 | 11-12-08 | -5.51 |

| 9981 | 22-10-08 | -5.51 |

| 9982 | 08-08-11 | -5.54 |

| 9983 | 22-09-08 | -5.64 |

| 9984 | 11-09-86 | -5.69 |

| 9985 | 30-11-87 | -5.88 |

| 9986 | 14-04-00 | -5.99 |

| 9987 | 07-10-98 | -6.06 |

| 9988 | 08-01-88 | -6.51 |

| 9989 | 27-10-97 | -6.55 |

| 9990 | 13-10-89 | -6.62 |

| 9991 | 15-10-08 | -6.71 |

| 9992 | 29-09-08 | -6.85 |

| 9993 | 07-10-08 | -6.91 |

| 9994 | 14-11-08 | -7.64 |

| 9995 | 01-12-08 | -7.79 |

| 9996 | 29-10-08 | -8.05 |

| 9997 | 26-10-87 | -8.4 |

| 9998 | 31-08-98 | -8.45 |

| 9999 | 09-10-08 | -12.9 |

| 10000 | 19-10-87 | -23.36 |

| Mean of all 10,000: | 0.0354 | |

| Sample standard deviation of all 10,000: | 1.2062 | |

| Sources: Bloomberg and S&P. | ||

Assume that the one-tail Z-statistic corresponding to a probability of 99.9% is exactly 3.09. Which of the following statements is NOT correct? Based on the historical data, the 99.9% daily: