A company has:

- 140 million shares outstanding.

- The market price of one share is currently $2.

- The company's debentures are publicly traded and their market price is equal to 93% of the face value.

- The debentures have a total face value of $50,000,000 and the current yield to maturity of corporate debentures is 12% per annum.

- The risk-free rate is 8.50% and the market return is 13.7%.

- Market analysts estimated that the company's stock has a beta of 0.90.

- The corporate tax rate is 30%.

What is the company's after-tax weighted average cost of capital (WACC) in a classical tax system?

You just signed up for a 30 year fully amortising mortgage with monthly payments of $1,000 per month. The interest rate is 6% pa which is not expected to change.

How much did you borrow? After 20 years, how much will be owing on the mortgage? The interest rate is still 6% and is not expected to change.

All things remaining equal, the higher the correlation of returns between two stocks:

A method commonly seen in textbooks for calculating a levered firm's free cash flow (FFCF, or CFFA) is the following:

###\begin{aligned} FFCF &= (Rev - COGS - Depr - FC - IntExp)(1-t_c) + \\ &\space\space\space+ Depr - CapEx -\Delta NWC + IntExp(1-t_c) \\ \end{aligned}###

The below screenshot of Microsoft's (MSFT) details were taken from the Google Finance website on 28 Nov 2014. Some information has been deliberately blanked out.

What was MSFT's market capitalisation of equity?

Question 524 risk, expected and historical returns, bankruptcy or insolvency, capital structure, corporate financial decision theory, limited liability

Which of the following statements is NOT correct?

Question 598 future, tailing the hedge, cross hedging

The standard deviation of monthly changes in the spot price of lamb is $0.015 per pound. The standard deviation of monthly changes in the futures price of live cattle is $0.012 per pound. The correlation between the spot price of lamb and the futures price of cattle is 0.4.

It is now January. A lamb producer is committed to selling 1,000,000 pounds of lamb in May. The spot price of live cattle is $0.30 per pound and the June futures price is $0.32 per pound. The spot price of lamb is $0.60 per pound.

The producer wants to use the June live cattle futures contracts to hedge his risk. Each futures contract is for the delivery of 50,000 pounds of cattle.

How many live cattle futures should the lamb farmer sell to hedge his risk? Round your answer to the nearest whole number of contracts.

Assets A, B, M and ##r_f## are shown on the graphs above. Asset M is the market portfolio and ##r_f## is the risk free yield on government bonds. Which of the below statements is NOT correct?

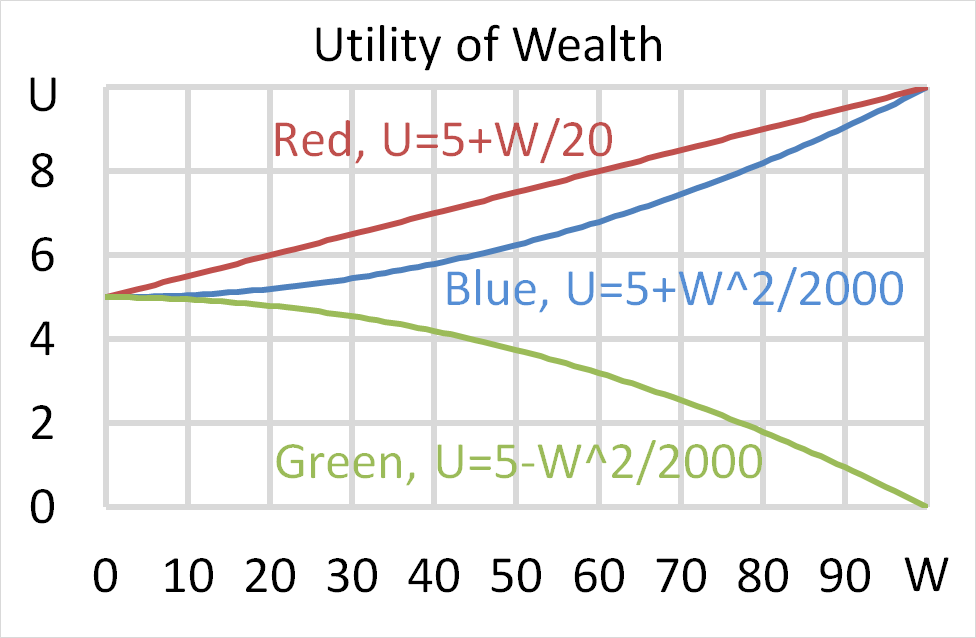

Mr Blue, Miss Red and Mrs Green are people with different utility functions. Which of the statements about the 3 utility functions is NOT correct?