You want to buy an apartment worth $500,000. You have saved a deposit of $50,000. The bank has agreed to lend you the $450,000 as a fully amortising mortgage loan with a term of 25 years. The interest rate is 6% pa and is not expected to change.

What will be your monthly payments?

A firm has a debt-to-assets ratio of 50%. The firm then issues a large amount of equity to raise money for new projects of similar systematic risk to the company's existing projects. Assume a classical tax system. Which statement is correct?

A firm can issue 5 year annual coupon bonds at a yield of 8% pa and a coupon rate of 12% pa.

The beta of its levered equity is 1. Five year government bonds yield 5% pa with a coupon rate of 6% pa. The market's expected dividend return is 4% pa and its expected capital return is 6% pa.

The firm's debt-to-equity ratio is 2:1. The corporate tax rate is 30%.

What is the firm's after-tax WACC? Assume a classical tax system.

Find Trademark Corporation's Cash Flow From Assets (CFFA), also known as Free Cash Flow to the Firm (FCFF), over the year ending 30th June 2013.

| Trademark Corp | ||

| Income Statement for | ||

| year ending 30th June 2013 | ||

| $m | ||

| Sales | 100 | |

| COGS | 25 | |

| Operating expense | 5 | |

| Depreciation | 20 | |

| Interest expense | 20 | |

| Income before tax | 30 | |

| Tax at 30% | 9 | |

| Net income | 21 | |

| Trademark Corp | ||

| Balance Sheet | ||

| as at 30th June | 2013 | 2012 |

| $m | $m | |

| Assets | ||

| Current assets | 120 | 80 |

| PPE | ||

| Cost | 150 | 140 |

| Accumul. depr. | 60 | 40 |

| Carrying amount | 90 | 100 |

| Total assets | 210 | 180 |

| Liabilities | ||

| Current liabilities | 75 | 65 |

| Non-current liabilities | 75 | 55 |

| Owners' equity | ||

| Retained earnings | 10 | 10 |

| Contributed equity | 50 | 50 |

| Total L and OE | 210 | 180 |

Note: all figures are given in millions of dollars ($m).

You have $100,000 in the bank. The bank pays interest at 10% pa, given as an effective annual rate.

You wish to consume twice as much now (t=0) as in one year (t=1) and have nothing left in the bank at the end.

How much can you consume at time zero and one? The answer choices are given in the same order.

Question 554 inflation, real and nominal returns and cash flows

On his 20th birthday, a man makes a resolution. He will put $30 cash under his bed at the end of every month starting from today. His birthday today is the first day of the month. So the first addition to his cash stash will be in one month. He will write in his will that when he dies the cash under the bed should be given to charity.

If the man lives for another 60 years, how much money will be under his bed if he dies just after making his last (720th) addition?

Also, what will be the real value of that cash in today's prices if inflation is expected to 2.5% pa? Assume that the inflation rate is an effective annual rate and is not expected to change.

The answers are given in the same order, the amount of money under his bed in 60 years, and the real value of that money in today's prices.

An equity index is currently at 5,200 points. The 6 month futures price is 5,300 points and the total required return is 6% pa with continuous compounding. Each index point is worth $25.

What is the implied dividend yield as a continuously compounded rate per annum?

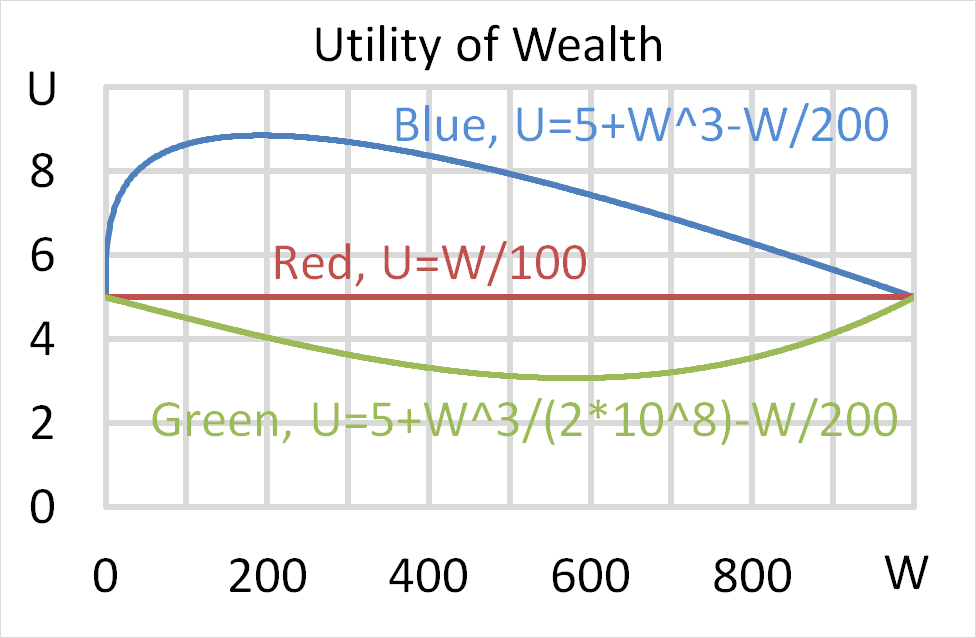

Mr Blue, Miss Red and Mrs Green are people with different utility functions.

Which of the following statements is NOT correct?

Telsa Motors advertises that its Model S electric car saves $570 per month in fuel costs. Assume that Tesla cars last for 10 years, fuel and electricity costs remain the same, and savings are made at the end of each month with the first saving of $570 in one month from now.

The effective annual interest rate is 15.8%, and the effective monthly interest rate is 1.23%. What is the present value of the savings?

A one year European-style put option has a strike price of $4.

The option's underlying stock currently trades at $5, pays no dividends and its standard deviation of continuously compounded returns is 47% pa.

The risk-free interest rate is 10% pa continuously compounded.

Use the Black-Scholes-Merton formula to calculate the option price. The put option price now is: