A firm can issue 3 year annual coupon bonds at a yield of 10% pa and a coupon rate of 8% pa.

The beta of its levered equity is 2. The market's expected return is 10% pa and 3 year government bonds yield 6% pa with a coupon rate of 4% pa.

The market value of equity is $1 million and the market value of debt is $1 million. The corporate tax rate is 30%.

What is the firm's after-tax WACC? Assume a classical tax system.

A project has an internal rate of return (IRR) which is greater than its required return. Select the most correct statement.

Question 381 Merton model of corporate debt, option, real option

In the Merton model of corporate debt, buying a levered company's debt is equivalent to buying risk free government bonds and:

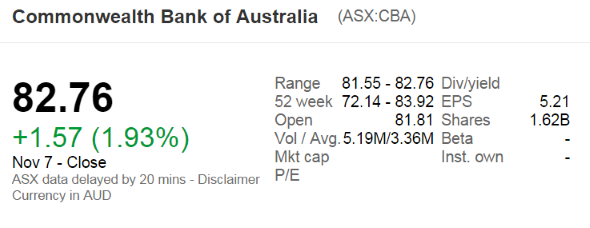

The below screenshot of Commonwealth Bank of Australia's (CBA) details were taken from the Google Finance website on 7 Nov 2014. Some information has been deliberately blanked out.

What was CBA's backwards-looking price-earnings ratio?

A man has taken a day off from his casual painting job to relax.

It's the end of the day and he's thinking about the hours that he could have spent working (in the past) which are now:

A company conducts a 2 for 3 rights issue at a subscription price of $8 when the pre-announcement stock price was $9. Assume that all investors use their rights to buy those extra shares.

What is the percentage increase in the stock price and the number of shares outstanding? The answers are given in the same order.

Question 738 financial statement, balance sheet, income statement

Where can a private firm's market value of equity be found? It can be sourced from the company's:

A common phrase heard in financial markets is that ‘high risk investments deserve high returns’. To make this statement consistent with the Capital Asset Pricing Model (CAPM), a high amount of what specific type of risk deserves a high return?

Investors deserve high returns when they buy assets with high:

Question 950 future, backwardation