For a price of $129, Joanne will sell you a share which is expected to pay a $30 dividend in one year, and a $10 dividend every year after that forever. So the stock's dividends will be $30 at t=1, $10 at t=2, $10 at t=3, and $10 forever onwards.

The required return of the stock is 10% pa.

According to the theory of the Capital Asset Pricing Model (CAPM), total variance can be broken into two components, systematic variance and idiosyncratic variance. Which of the following events would be considered the most diversifiable according to the theory of the CAPM?

Question 99 capital structure, interest tax shield, Miller and Modigliani, trade off theory of capital structure

A firm changes its capital structure by issuing a large amount of debt and using the funds to repurchase shares. Its assets are unchanged.

Assume that:

- The firm and individual investors can borrow at the same rate and have the same tax rates.

- The firm's debt and shares are fairly priced and the shares are repurchased at the market price, not at a premium.

- There are no market frictions relating to debt such as asymmetric information or transaction costs.

- Shareholders wealth is measured in terms of utiliity. Shareholders are wealth-maximising and risk-averse. They have a preferred level of overall leverage. Before the firm's capital restructure all shareholders were optimally levered.

According to Miller and Modigliani's theory, which statement is correct?

A stock is expected to pay a dividend of $15 in one year (t=1), then $25 for 9 years after that (payments at t=2 ,3,...10), and on the 11th year (t=11) the dividend will be 2% less than at t=10, and will continue to shrink at the same rate every year after that forever. The required return of the stock is 10%. All rates are effective annual rates.

What is the price of the stock now?

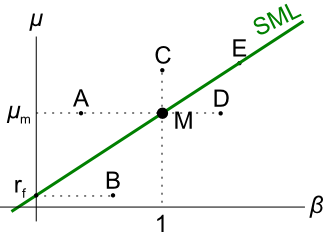

Question 244 CAPM, SML, NPV, risk

Examine the following graph which shows stocks' betas ##(\beta)## and expected returns ##(\mu)##:

Assume that the CAPM holds and that future expectations of stocks' returns and betas are correctly measured. Which statement is NOT correct?

Bonds X and Y are issued by the same company. Both bonds yield 10% pa, and they have the same face value ($100), maturity, seniority, and payment frequency.

The only difference is that bond X pays coupons of 6% pa and bond Y pays coupons of 8% pa. Which of the following statements is true?

The standard deviation of monthly changes in the spot price of corn is 50 cents per bushel. The standard deviation of monthly changes in the futures price of corn is 40 cents per bushel. The correlation between the spot price of corn and the futures price of corn is 0.9.

It is now March. A corn chip manufacturer is committed to buying 250,000 bushels of corn in May. The spot price of corn is 381 cents per bushel and the June futures price is 399 cents per bushel.

The corn chip manufacturer wants to use the June corn futures contracts to hedge his risk. Each futures contract is for the delivery of 5,000 bushels of corn. One bushel is about 127 metric tons.

How many corn futures should the corn chip manufacturer buy to hedge his risk? Round your answer to the nearest whole number of contracts. Remember to tail the hedge.

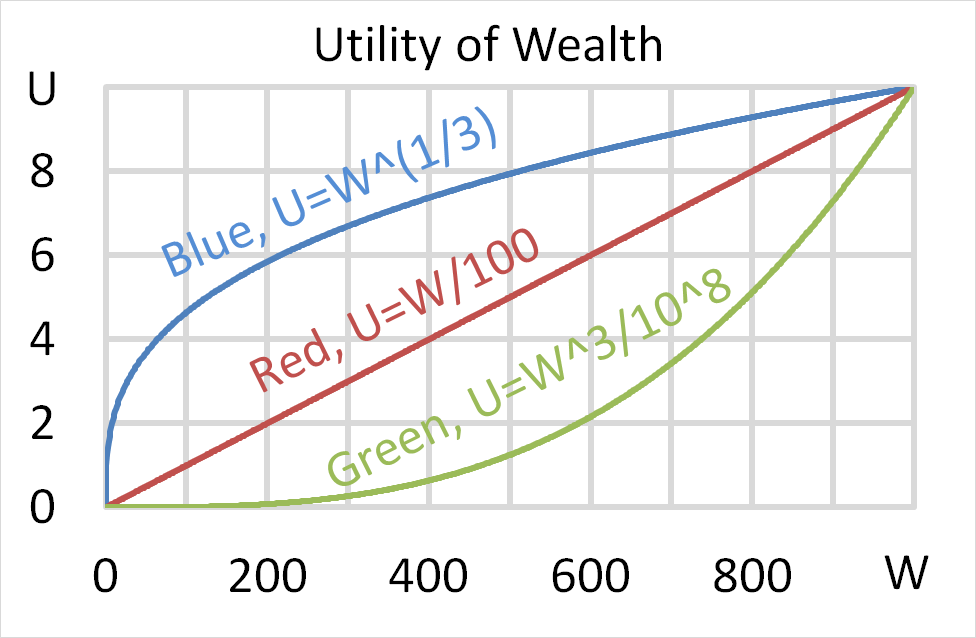

Mr Blue, Miss Red and Mrs Green are people with different utility functions.

Note that a fair gamble is a bet that has an expected value of zero, such as paying $0.50 to win $1 in a coin flip with heads or nothing if it lands tails. Fairly priced insurance is when the expected present value of the insurance premiums is equal to the expected loss from the disaster that the insurance protects against, such as the cost of rebuilding a home after a catastrophic fire.

Which of the following statements is NOT correct?

Question 821 option, option profit, option payoff at maturity, no explanation

You just paid $4 for a 3 month European style call option on a stock currently priced at $47 with a strike price of $50. The stock’s next dividend will be $1 in 4 months’ time. Note that the dividend is paid after the option matures. Which of the below statements is NOT correct?

Question 856 credit terms, no explanation

Your supplier’s credit terms are "1/10 net 30". Which of the following statements about these credit terms is NOT correct?

If you intend to buy an item from your supplier for a tag price of $100 and you: