According to the theory of the Capital Asset Pricing Model (CAPM), total variance can be broken into two components, systematic variance and idiosyncratic variance. Which of the following events would be considered the most diversifiable according to the theory of the CAPM?

Question 121 capital structure, leverage, financial distress, interest tax shield

Fill in the missing words in the following sentence:

All things remaining equal, as a firm's amount of debt funding falls, benefits of interest tax shields __________ and the costs of financial distress __________.

The following cash flows are expected:

- 10 yearly payments of $60, with the first payment in 3 years from now (first payment at t=3 and last at t=12).

- 1 payment of $400 in 5 years and 6 months (t=5.5) from now.

What is the NPV of the cash flows if the discount rate is 10% given as an effective annual rate?

Question 624 franking credit, personal tax on dividends, imputation tax system, no explanation

Which of the following statements about Australian franking credits is NOT correct? Franking credits:

Question 657 systematic and idiosyncratic risk, CAPM, no explanation

A stock's required total return will decrease when its:

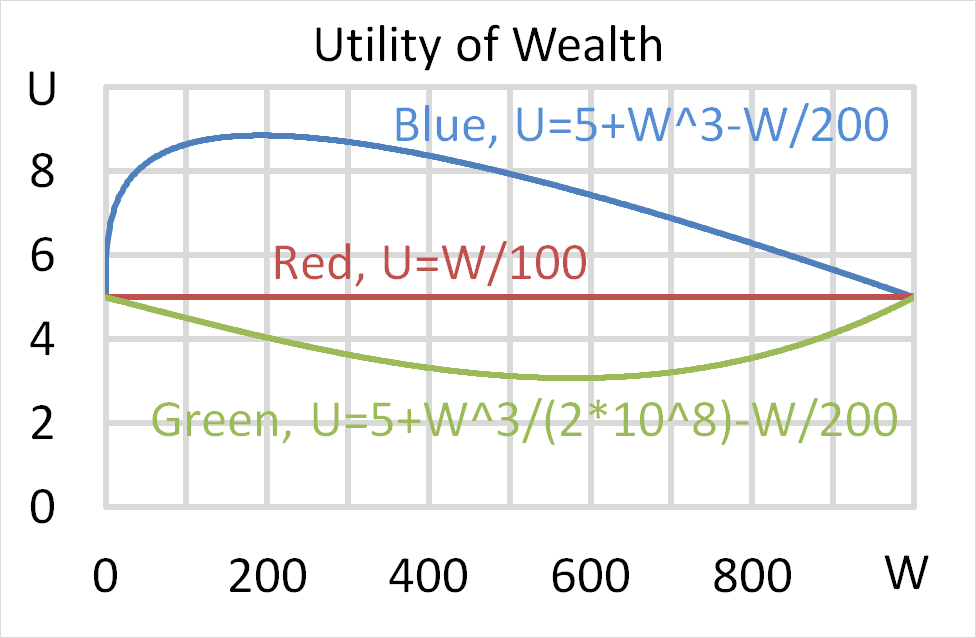

Mr Blue, Miss Red and Mrs Green are people with different utility functions.

Which of the following statements is NOT correct?

You deposit money into a bank. Which of the following statements is NOT correct? You:

Below are some statements about European-style options on non-dividend paying stocks. Assume that the risk free rate is always positive. Which of these statements is NOT correct?