According to the theory of the Capital Asset Pricing Model (CAPM), total variance can be broken into two components, systematic variance and idiosyncratic variance. Which of the following events would be considered the most diversifiable according to the theory of the CAPM?

A four year bond has a face value of $100, a yield of 6% and a fixed coupon rate of 12%, paid semi-annually. What is its price?

Question 382 Merton model of corporate debt, real option, option

In the Merton model of corporate debt, buying a levered company's shares is equivalent to:

Find the cash flow from assets (CFFA) of the following project.

| One Year Mining Project Data | ||

| Project life | 1 year | |

| Initial investment in building mine and equipment | $9m | |

| Depreciation of mine and equipment over the year | $8m | |

| Kilograms of gold mined at end of year | 1,000 | |

| Sale price per kilogram | $0.05m | |

| Variable cost per kilogram | $0.03m | |

| Before-tax cost of closing mine at end of year | $4m | |

| Tax rate | 30% | |

Note 1: Due to the project, the firm also anticipates finding some rare diamonds which will give before-tax revenues of $1m at the end of the year.

Note 2: The land that will be mined actually has thermal springs and a family of koalas that could be sold to an eco-tourist resort for an after-tax amount of $3m right now. However, if the mine goes ahead then this natural beauty will be destroyed.

Note 3: The mining equipment will have a book value of $1m at the end of the year for tax purposes. However, the equipment is expected to fetch $2.5m when it is sold.

Find the project's CFFA at time zero and one. Answers are given in millions of dollars ($m), with the first cash flow at time zero, and the second at time one.

Question 543 price gains and returns over time, IRR, NPV, income and capital returns, effective return

For an asset price to triple every 5 years, what must be the expected future capital return, given as an effective annual rate?

Question 639 option, option payoff at maturity, no explanation

Which of the below formulas gives the payoff ##(f)## at maturity ##(T)## from being short a put option? Let the underlying asset price at maturity be ##S_T## and the exercise price be ##X_T##.

Question 659 APR, effective rate, effective rate conversion, no explanation

A home loan company advertises an interest rate of 9% pa, payable monthly. Which of the following statements about the interest rate is NOT correct? All rates are given with an accuracy of 4 decimal places.

Question 662 APR, effective rate, effective rate conversion, no explanation

Which of the following interest rate labels does NOT make sense?

Question 993 inflation, real and nominal returns and cash flows

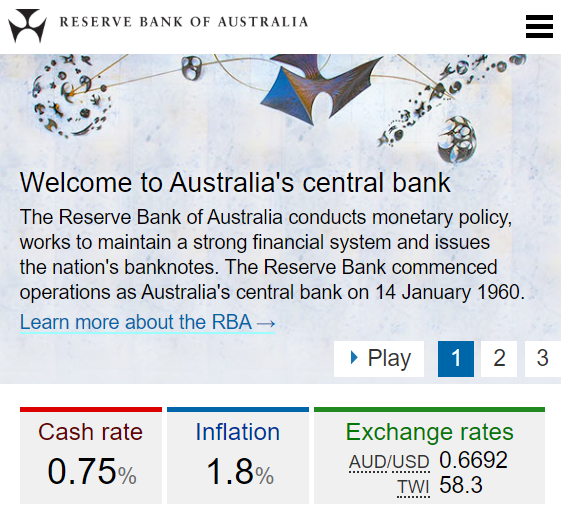

In February 2020, the RBA cash rate was 0.75% pa and the Australian CPI inflation rate was 1.8% pa.

You currently have $100 in the bank which pays a 0.75% pa interest rate.

Apples currently cost $1 each at the shop and inflation is 1.8% pa which is the expected growth rate in the apple price.

This information is summarised in the table below, with some parts missing that correspond to the answer options. All rates are given as effective annual rates. Note that when payments are not specified as real, as in this question, they're conventionally assumed to be nominal.

| Wealth in Dollars and Apples | ||||

| Time (year) | Bank account wealth ($) | Apple price ($) | Wealth in apples | |

| 0 | 100 | 1 | 100 | |

| 1 | 100.75 | 1.018 | (a) | |

| 2 | (b) | (c) | (d) | |

Which of the following statements is NOT correct? Your:

Use the below information to value a mature levered company with growing annual perpetual cash flows and a constant debt-to-assets ratio. The next cash flow will be generated in one year from now, so a perpetuity can be used to value this firm. The firm's debt funding comprises annual fixed coupon bonds that all have the same seniority and coupon rate. When these bonds mature, new bonds will be re-issued, and so on in perpetuity. The yield curve is flat.

| Data on a Levered Firm with Perpetual Cash Flows | ||

| Item abbreviation | Value | Item full name |

| ##\text{OFCF}_1## | $12.5m | Operating free cash flow at time 1 |

| ##\text{FFCF}_1 \text{ or }\text{CFFA}_1## | $14m | Firm free cash flow or cash flow from assets at time 1 |

| ##\text{EFCF}_1## | $11m | Equity free cash flow at time 1 |

| ##\text{BondCoupons}_1## | $1.2m | Bond coupons paid to debt holders at time 1 |

| ##g## | 2% pa | Growth rate of OFCF, FFCF, EFCF and Debt cash flow |

| ##\text{WACC}_\text{BeforeTax}## | 9% pa | Weighted average cost of capital before tax |

| ##\text{WACC}_\text{AfterTax}## | 8.25% pa | Weighted average cost of capital after tax |

| ##r_\text{D}## | 5% pa | Bond yield |

| ##r_\text{EL}## | 13% pa | Cost or required return of levered equity |

| ##D/V_L## | 50% pa | Debt to assets ratio, where the asset value includes tax shields |

| ##n_\text{shares}## | 1m | Number of shares |

| ##t_c## | 30% | Corporate tax rate |

Which of the following statements is NOT correct?