Which statement(s) are correct?

(i) All stocks that plot on the Security Market Line (SML) are fairly priced.

(ii) All stocks that plot above the Security Market Line (SML) are overpriced.

(iii) All fairly priced stocks that plot on the Capital Market Line (CML) have zero idiosyncratic risk.

Select the most correct response:

A company has:

- 10 million common shares outstanding, each trading at a price of $90.

- 1 million preferred shares which have a face (or par) value of $100 and pay a constant dividend of 9% of par. They currently trade at a price of $120 each.

- Debentures that have a total face value of $60,000,000 and a yield to maturity of 6% per annum. They are publicly traded and their market price is equal to 90% of their face value.

- The risk-free rate is 5% and the market return is 10%.

- Market analysts estimate that the company's common stock has a beta of 1.2. The corporate tax rate is 30%.

What is the company's after-tax Weighted Average Cost of Capital (WACC)? Assume a classical tax system.

Question 239 income and capital returns, inflation, real and nominal returns and cash flows, interest only loan

A bank grants a borrower an interest-only residential mortgage loan with a very large 50% deposit and a nominal interest rate of 6% that is not expected to change. Assume that inflation is expected to be a constant 2% pa over the life of the loan. Ignore credit risk.

From the bank's point of view, what is the long term expected nominal capital return of the loan asset?

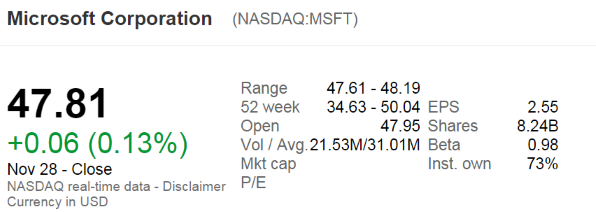

The below screenshot of Microsoft's (MSFT) details were taken from the Google Finance website on 28 Nov 2014. Some information has been deliberately blanked out.

What was MSFT's approximate payout ratio over the last year?

Note that MSFT's past four quarterly dividends were $0.31, $0.28, $0.28 and $0.28.

The current gold price is $700, gold storage costs are 2% pa and the risk free rate is 10% pa, both with continuous compounding.

What should be the 3 year gold futures price?

In 2014 the median starting salaries of male and female Australian bachelor degree accounting graduates aged less than 25 years in their first full-time industry job was $50,000 before tax, according to Graduate Careers Australia. See page 9 of this report. Personal income tax rates published by the Australian Tax Office are reproduced for the 2014-2015 financial year in the table below.

| Taxable income | Tax on this income |

|---|---|

| 0 – $18,200 | Nil |

| $18,201 – $37,000 | 19c for each $1 over $18,200 |

| $37,001 – $80,000 | $3,572 plus 32.5c for each $1 over $37,000 |

| $80,001 – $180,000 | $17,547 plus 37c for each $1 over $80,000 |

| $180,001 and over | $54,547 plus 45c for each $1 over $180,000 |

The above rates do not include the Medicare levy of 2%. Exclude the Medicare levy from your calculations

How much personal income tax would you have to pay per year if you earned $50,000 per annum before-tax?

Question 850 gross domestic product, gross domestic product per capita

Below is a table showing some countries’ GDP, population and GDP per capita.

| Countries' GDP and Population | |||

| GDP | Population | GDP per capita | |

| USD million | millions of people | USD | |

| United States | 18,036,648 | 325 | 55,492 |

| China | 11,158,457 | 1,383 | 8,066 |

| Japan | 4,383,076 | 127 | 34,586 |

| Germany | 3,363,600 | 83 | 40,623 |

| Norway | 500,519 | 5 | 95,027 |

Source: "GDP and its breakdown at current prices in US Dollars" United Nations Statistics Division. December 2016.

Using this data only, which one of these countries’ citizens have the highest living standards?

The risk-weight on "Margin lending against listed instruments on recognised exchanges" is 20% according to APRA's interpretation of the Basel 3 Accord in 'Prudential Standard APS 112 Capital Adequacy: Standardised Approach to Credit Risk, Attachment A: Risk-weights for on-balance sheet assets'.

A bank is considering lending a $100,000 margin loan secured by an ASX-listed stock. How much regulatory capital will the bank require to grant this loan under the Basel 3 Accord? Ignore the capital conservation buffer and the off-balance sheet exposure.

Question 880 gold standard, no explanation

Under the Gold Standard (1876 to 1913), currencies were priced relative to:

Question 888 foreign exchange rate, speculation, no explanation

The current Australian exchange rate is 0.8 USD per AUD.

If you think that the AUD will depreciate against the USD, contrary to the rest of the market, how could you profit? Right now you should: