A stock's correlation with the market portfolio increases while its total risk is unchanged. What will happen to the stock's expected return and systematic risk?

You just signed up for a 30 year fully amortising mortgage loan with monthly payments of $2,000 per month. The interest rate is 9% pa which is not expected to change.

How much did you borrow? After 5 years, how much will be owing on the mortgage? The interest rate is still 9% and is not expected to change.

Find UniBar Corp's Cash Flow From Assets (CFFA), also known as Free Cash Flow to the Firm (FCFF), over the year ending 30th June 2013.

| UniBar Corp | ||

| Income Statement for | ||

| year ending 30th June 2013 | ||

| $m | ||

| Sales | 80 | |

| COGS | 40 | |

| Operating expense | 15 | |

| Depreciation | 10 | |

| Interest expense | 5 | |

| Income before tax | 10 | |

| Tax at 30% | 3 | |

| Net income | 7 | |

| UniBar Corp | ||

| Balance Sheet | ||

| as at 30th June | 2013 | 2012 |

| $m | $m | |

| Assets | ||

| Current assets | 120 | 90 |

| PPE | ||

| Cost | 360 | 320 |

| Accumul. depr. | 40 | 30 |

| Carrying amount | 320 | 290 |

| Total assets | 440 | 380 |

| Liabilities | ||

| Current liabilities | 110 | 60 |

| Non-current liabilities | 190 | 180 |

| Owners' equity | ||

| Retained earnings | 95 | 95 |

| Contributed equity | 45 | 45 |

| Total L and OE | 440 | 380 |

Note: all figures are given in millions of dollars ($m).

In late 2003 the listed bank ANZ announced a 2-for-11 rights issue to fund the takeover of New Zealand bank NBNZ. Below is the chronology of events:

- 23/10/2003. Share price closes at $18.30.

- 24/10/2003. 2-for-11 rights issue announced at a subscription price of $13. The proceeds of the rights issue will be used to acquire New Zealand bank NBNZ. Trading halt announced in morning before market opens.

- 28/10/2003. Trading halt lifted. Last (and only) day that shares trade cum-rights. Share price opens at $18.00 and closes at $18.14.

- 29/10/2003. Shares trade ex-rights.

All things remaining equal, what would you expect ANZ's stock price to open at on the first day that it trades ex-rights (29/10/2003)? Ignore the time value of money since time is negligibly short. Also ignore taxes.

The hardest and most important aspect of business project valuation is the estimation of the:

A large proportion of a levered firm's assets is cash held at the bank. The firm is financed with half equity and half debt.

Which of the following statements about this firm's enterprise value (EV) and total asset value (V) is NOT correct?

The perpetuity with growth equation is:

###P_0=\dfrac{C_1}{r-g}###

Which of the following is NOT equal to the expected capital return as an effective annual rate?

A firm has a debt-to-equity ratio of 60%. What is its debt-to-assets ratio?

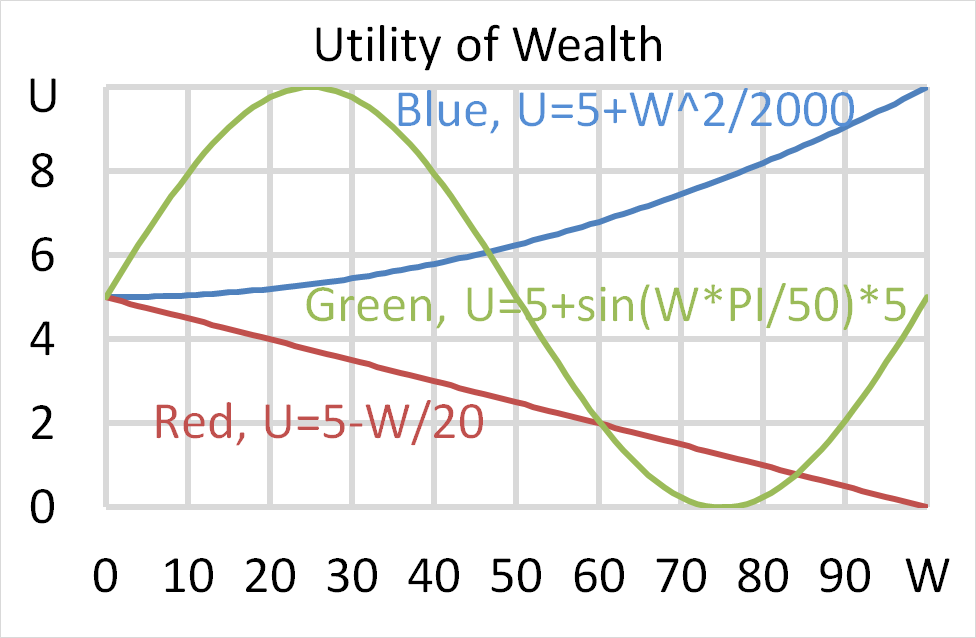

Mr Blue, Miss Red and Mrs Green are people with different utility functions. Which of the statements about the 3 utility functions is NOT correct?

Question 948 VaR, expected shortfall

Below is a historical sample of returns on the S&P500 capital index.

| S&P500 Capital Index Daily Returns Ranked from Best to Worst |

||

| 10,000 trading days from 4th August 1977 to 24 March 2017 based on closing prices. |

||

| Rank | Date (DD-MM-YY) |

Continuously compounded daily return (% per day) |

| 1 | 21-10-87 | 9.23 |

| 2 | 08-03-83 | 8.97 |

| 3 | 13-11-08 | 8.3 |

| 4 | 30-09-08 | 8.09 |

| 5 | 28-10-08 | 8.01 |

| 6 | 29-10-87 | 7.28 |

| … | … | … |

| 9980 | 11-12-08 | -5.51 |

| 9981 | 22-10-08 | -5.51 |

| 9982 | 08-08-11 | -5.54 |

| 9983 | 22-09-08 | -5.64 |

| 9984 | 11-09-86 | -5.69 |

| 9985 | 30-11-87 | -5.88 |

| 9986 | 14-04-00 | -5.99 |

| 9987 | 07-10-98 | -6.06 |

| 9988 | 08-01-88 | -6.51 |

| 9989 | 27-10-97 | -6.55 |

| 9990 | 13-10-89 | -6.62 |

| 9991 | 15-10-08 | -6.71 |

| 9992 | 29-09-08 | -6.85 |

| 9993 | 07-10-08 | -6.91 |

| 9994 | 14-11-08 | -7.64 |

| 9995 | 01-12-08 | -7.79 |

| 9996 | 29-10-08 | -8.05 |

| 9997 | 26-10-87 | -8.4 |

| 9998 | 31-08-98 | -8.45 |

| 9999 | 09-10-08 | -12.9 |

| 10000 | 19-10-87 | -23.36 |

| Mean of all 10,000: | 0.0354 | |

| Sample standard deviation of all 10,000: | 1.2062 | |

| Sources: Bloomberg and S&P. | ||

Assume that the one-tail Z-statistic corresponding to a probability of 99.9% is exactly 3.09. Which of the following statements is NOT correct? Based on the historical data, the 99.9% daily: