Question 96 bond pricing, zero coupon bond, term structure of interest rates, forward interest rate

An Australian company just issued two bonds paying semi-annual coupons:

- 1 year zero coupon bond at a yield of 8% pa, and a

- 2 year zero coupon bond at a yield of 10% pa.

What is the forward rate on the company's debt from years 1 to 2? Give your answer as an APR compounding every 6 months, which is how the above bond yields are quoted.

You're trying to save enough money to buy your first car which costs $2,500. You can save $100 at the end of each month starting from now. You currently have no money at all. You just opened a bank account with an interest rate of 6% pa payable monthly.

How many months will it take to save enough money to buy the car? Assume that the price of the car will stay the same over time.

Which one of the following bonds is trading at a premium?

Which one of the following is NOT usually considered an 'investable' asset for long-term wealth creation?

One of the reasons why firms may not begin projects with relatively small positive net present values (NPV's) is because they wish to maximise the value of their:

Question 526 real and nominal returns and cash flows, inflation, no explanation

How can a nominal cash flow be precisely converted into a real cash flow?

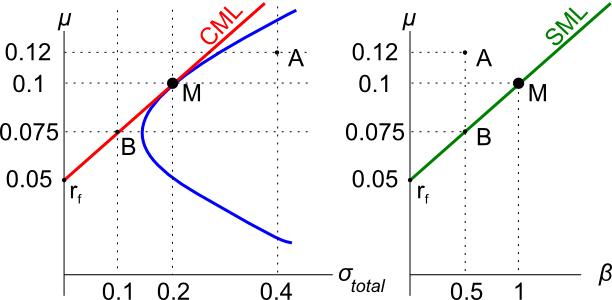

Assets A, B, M and ##r_f## are shown on the graphs above. Asset M is the market portfolio and ##r_f## is the risk free yield on government bonds. Assume that investors can borrow and lend at the risk free rate. Which of the below statements is NOT correct?

Which of the below formulas gives the payoff at maturity ##(f_T)## from being short a future? Let the underlying asset price at maturity be ##S_T## and the locked-in futures price be ##K_T##.

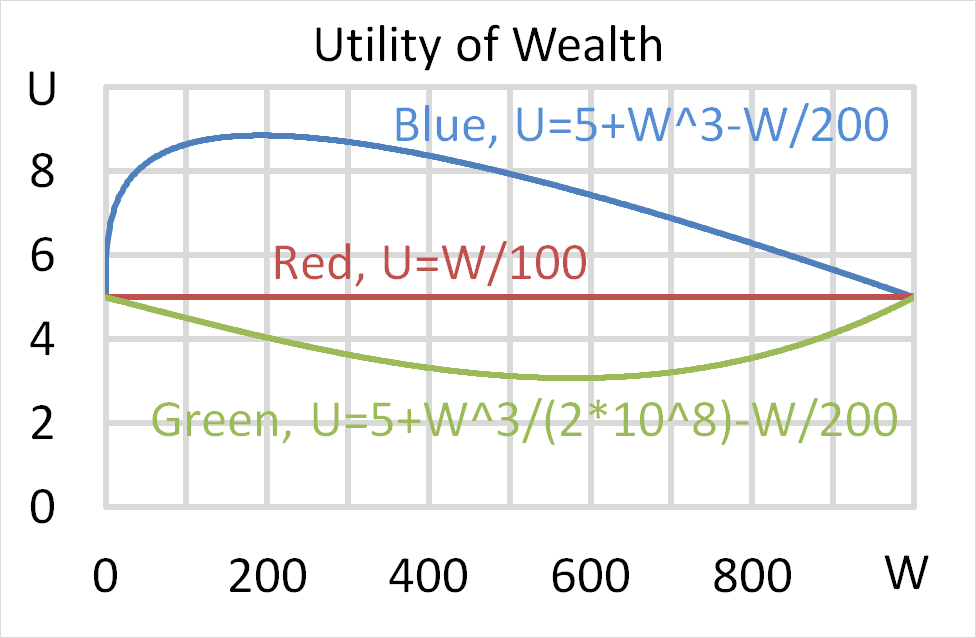

Mr Blue, Miss Red and Mrs Green are people with different utility functions.

Which of the following statements is NOT correct?

Which of the following is NOT the Australian central bank’s responsibility?