Question 96 bond pricing, zero coupon bond, term structure of interest rates, forward interest rate

An Australian company just issued two bonds paying semi-annual coupons:

- 1 year zero coupon bond at a yield of 8% pa, and a

- 2 year zero coupon bond at a yield of 10% pa.

What is the forward rate on the company's debt from years 1 to 2? Give your answer as an APR compounding every 6 months, which is how the above bond yields are quoted.

A project has the following cash flows. Normally cash flows are assumed to happen at the given time. But here, assume that the cash flows are received smoothly over the year. So the $250 at time 2 is actually earned smoothly from t=1 to t=2:

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -400 |

| 1 | 200 |

| 2 | 250 |

What is the payback period of the project in years?

You just started work at your new job which pays $48,000 per year.

The human resources department have given you the option of being paid at the end of every week or every month.

Assume that there are 4 weeks per month, 12 months per year and 48 weeks per year.

Bank interest rates are 12% pa given as an APR compounding per month.

What is the dollar gain over one year, as a net present value, of being paid every week rather than every month?

The CAPM can be used to find a business's expected opportunity cost of capital:

###r_i=r_f+β_i (r_m-r_f)###

What should be used as the risk free rate ##r_f##?

Question 443 corporate financial decision theory, investment decision, financing decision, working capital decision, payout policy

Business people make lots of important decisions. Which of the following is the most important long term decision?

What is the covariance of a variable X with a constant C?

The cov(X, C) or ##\sigma_{X,C}## equals:

The standard deviation of monthly changes in the spot price of corn is 50 cents per bushel. The standard deviation of monthly changes in the futures price of corn is 40 cents per bushel. The correlation between the spot price of corn and the futures price of corn is 0.9.

It is now March. A corn chip manufacturer is committed to buying 250,000 bushels of corn in May. The spot price of corn is 381 cents per bushel and the June futures price is 399 cents per bushel.

The corn chip manufacturer wants to use the June corn futures contracts to hedge his risk. Each futures contract is for the delivery of 5,000 bushels of corn. One bushel is about 127 metric tons.

How many corn futures should the corn chip manufacturer buy to hedge his risk? Round your answer to the nearest whole number of contracts. Remember to tail the hedge.

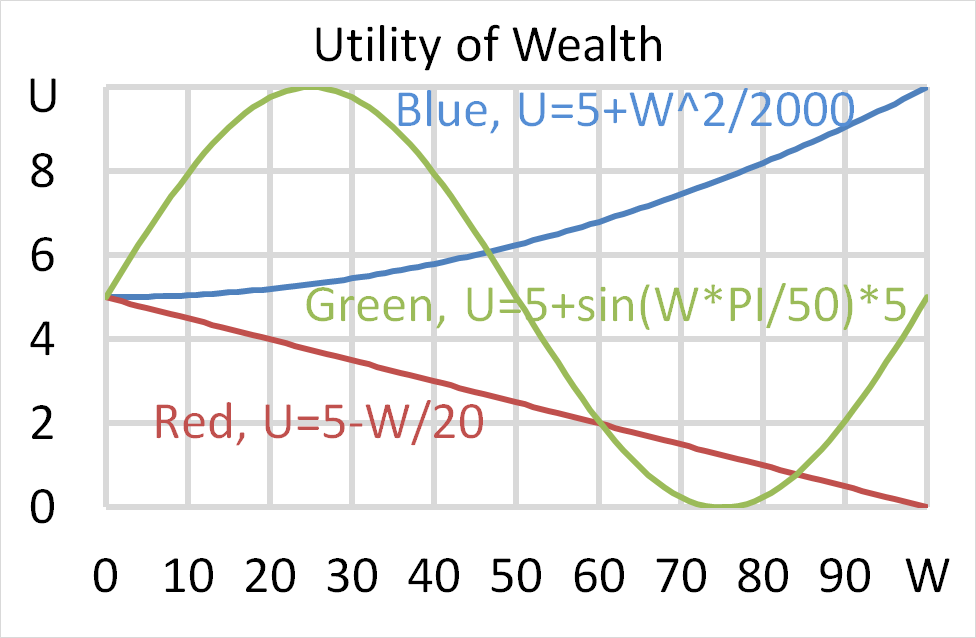

Question 702 utility, risk aversion, utility function, gamble

Mr Blue, Miss Red and Mrs Green are people with different utility functions.

Each person has $50 of initial wealth. A coin toss game is offered to each person at a casino where the player can win or lose $50. Each player can flip a coin and if they flip heads, they receive $50. If they flip tails then they will lose $50. Which of the following statements is NOT correct?

A firm wishes to raise $50 million now. They will issue 5% pa semi-annual coupon bonds that will mature in 10 years and have a face value of $100 each. Bond yields are 5% pa, given as an APR compounding every 6 months, and the yield curve is flat.

How many bonds should the firm issue?

Question 802 negative gearing, leverage, capital structure, no explanation

Which of the following statements about ‘negative gearing’ is NOT correct?