Question 385 Merton model of corporate debt, real option, option

A risky firm will last for one period only (t=0 to 1), then it will be liquidated. So it's assets will be sold and the debt holders and equity holders will be paid out in that order. The firm has the following quantities:

##V## = Market value of assets.

##E## = Market value of (levered) equity.

##D## = Market value of zero coupon bonds.

##F_1## = Total face value of zero coupon bonds which is promised to be paid in one year.

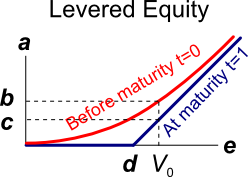

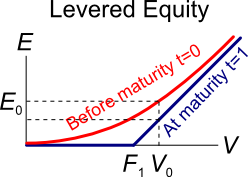

The levered equity graph above contains bold labels a to e. Which of the following statements about those labels is NOT correct?

Label e actually represents the value of assets ##(V)## at t=0 on the red curved line or t=1 on the blue crooked line. The graph below shows most of the quantities.

Question 386 Merton model of corporate debt, real option, option

A risky firm will last for one period only (t=0 to 1), then it will be liquidated. So it's assets will be sold and the debt holders and equity holders will be paid out in that order. The firm has the following quantities:

##V## = Market value of assets.

##E## = Market value of (levered) equity.

##D## = Market value of zero coupon bonds.

##F_1## = Total face value of zero coupon bonds which is promised to be paid in one year.

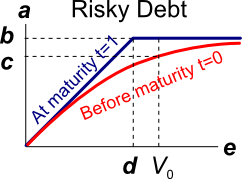

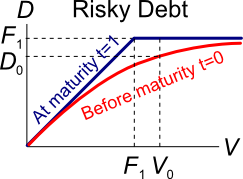

The risky corporate debt graph above contains bold labels a to e. Which of the following statements about those labels is NOT correct?

Label a represents the market value of debt ##(E)## at t=0 on the red curved line or t=1 on the blue crooked line. The market value of debt (y-axis) depends on the market value of assets (x-axis). The graph below shows most of the quantities.

Question 433 Merton model of corporate debt, real option, option, no explanation

A risky firm will last for one period only (t=0 to 1), then it will be liquidated. So it's assets will be sold and the debt holders and equity holders will be paid out in that order. The firm has the following quantities:

##V## = Market value of assets.

##E## = Market value of (levered) equity.

##D## = Market value of zero coupon bonds.

##F_1## = Total face value of zero coupon bonds which is promised to be paid in one year.

What is the payoff to equity holders at maturity, assuming that they keep their shares until maturity?

No explanation provided.

Question 434 Merton model of corporate debt, real option, option

A risky firm will last for one period only (t=0 to 1), then it will be liquidated. So it's assets will be sold and the debt holders and equity holders will be paid out in that order. The firm has the following quantities:

##V## = Market value of assets.

##E## = Market value of (levered) equity.

##D## = Market value of zero coupon bonds.

##F_1## = Total face value of zero coupon bonds which is promised to be paid in one year.

What is the payoff to debt holders at maturity, assuming that they keep their debt until maturity?

Debt holders are only paid what they are promised, not more. In this question, the maximum that the zero-coupon bond holders will be paid at maturity is the face value of the bonds, ##F_1##. This will occur if the firm does not go bankrupt and continues business. In the event that the firm goes bankrupt, the debt holders will be paid out first, before equity holders. But if the firm's assets are worth less than the face value of the debt, so ##V_1 < F_1##, then the debt holders will only be paid the remaining assets ##V_1##.

Therefore the debt holders receive the minimum of the face value of the zero coupon bonds or the remaining value of the firm's assets, ##D_1 = \min(F_1, V_1)##.

Question 381 Merton model of corporate debt, option, real option

In the Merton model of corporate debt, buying a levered company's debt is equivalent to buying risk free government bonds and:

Owning risky corporate debt is equivalent to owning risk free government bonds and selling a put option on the firm's assets with a strike price equal to the face value of the firm's debt. This is best seen by drawing the "long government bond" and "short put" payoff diagrams and adding the heights to get the "long risky debt" payoff diagram.

Question 382 Merton model of corporate debt, real option, option

In the Merton model of corporate debt, buying a levered company's shares is equivalent to:

Owning shares in a company has the benefit of limited liability.

If the company's debts are greater than its assets, equity holders can walk away and avoid paying the outstanding debt.

Owning equity in a levered company is equivalent to being long a call option on the company's assets, with a maturity equal to the debt's maturity, and a strike price equal to the debt's face value.

Question 383 Merton model of corporate debt, real option, option

In the Merton model of corporate debt, buying a levered company's debt is equivalent to buying the company's assets and:

Owning risky corporate debt is equivalent to owning the firm's assets and selling a call option on the firm's assets with a strike price equal to the face value of the firm's debt. The call option sold by debt holders is of course bought by equity holders.

This is best seen by drawing the "long assets" and "short call" payoff diagrams and adding the heights to get the "long risky debt" payoff diagram.