Which of the below statements about utility is NOT generally accepted by economists? Most people are thought to:

All statements are thought to be true for most people, except for the last. If utility ever falls as wealth rises, the person prefers less to more which is thought to be irrational. A person like this enjoys being poorer.

Note that some economists and psychologists believe that utility is bounded from above which means there is a maximum amount of happiness that a person can achieve no matter how much wealth they are given. But this is different to having a satiation point after which wealth falls. For example, a utility curve bounded from above is ##U(W) = -exp(-W)## which has a maximum utility at 0. Since the line U=0 is an asymptote, as the person gains more wealth they do have increasing happiness, but it increases at a decreasing rate and never quite reaches the maximum utility at 0.

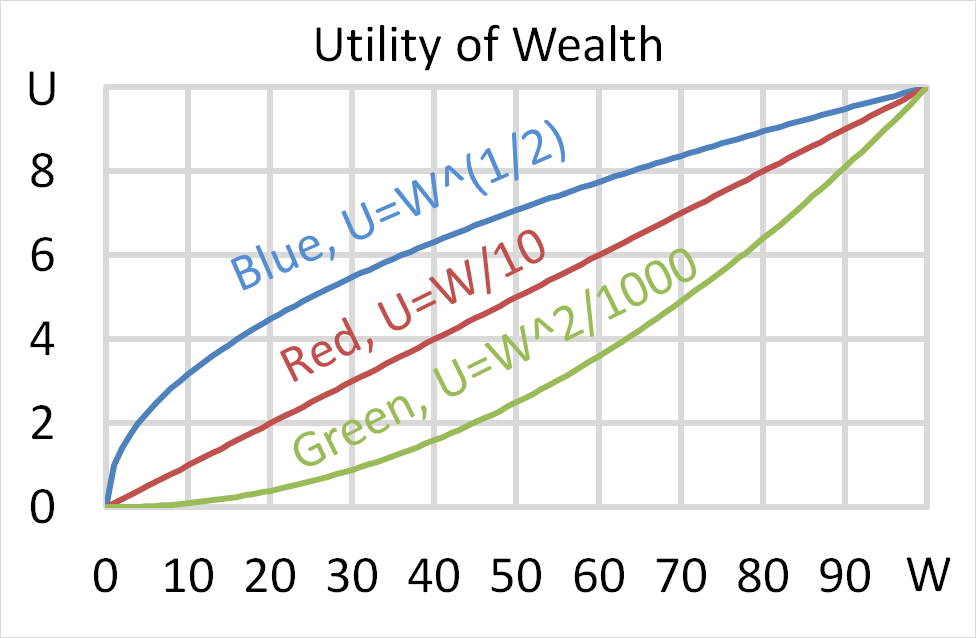

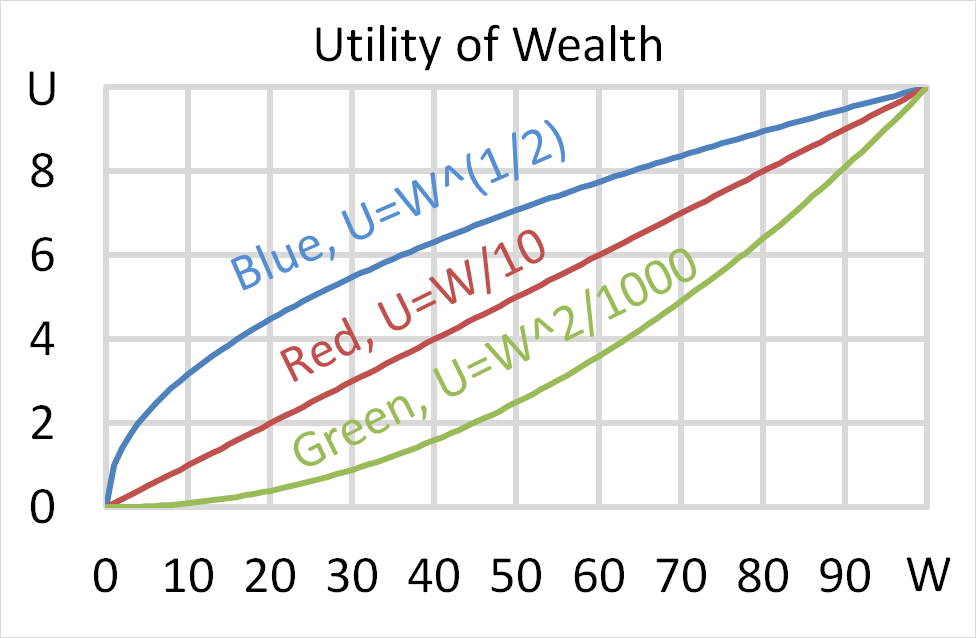

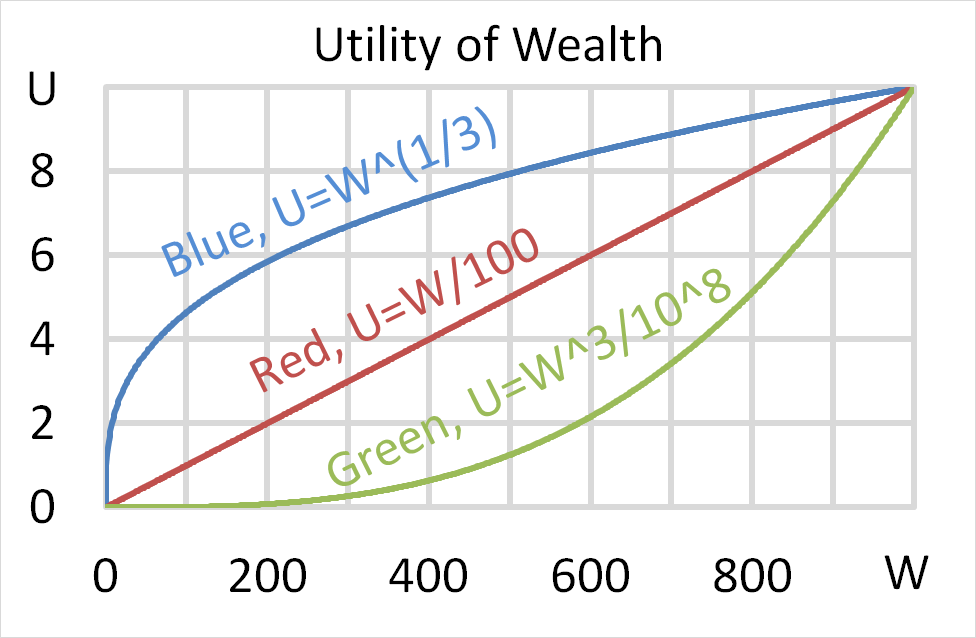

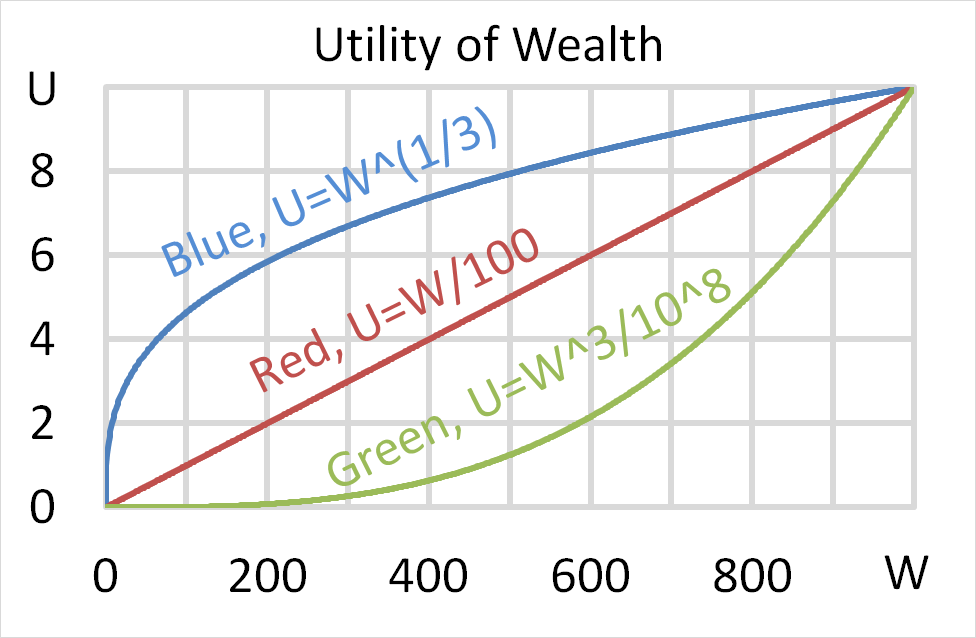

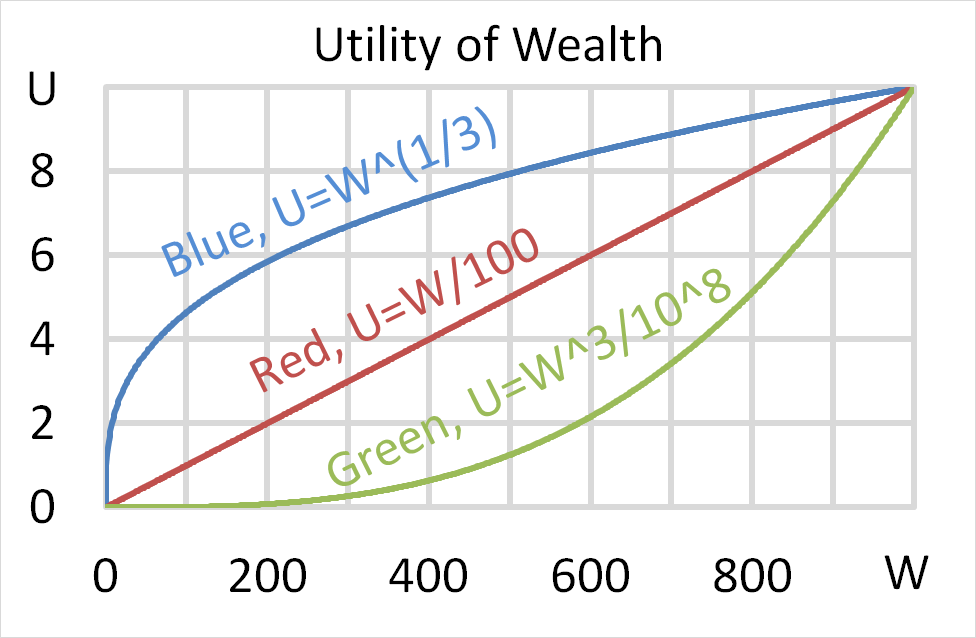

Mr Blue, Miss Red and Mrs Green are people with different utility functions. Which of the statements about the 3 utility functions is NOT correct?

Mrs Green is risk loving. She prefers more risk to less since her utility curve has a positive second derivative, it is concave up, it looks like a 'smile' rather than a frown. Mrs Green may therefore enjoy gambling if the expected loss is small compared to the risk which she enjoys.

Thanks to Shahzada to for the correction that changed "all people prefer more wealth to less" to "all rational people prefer more wealth to less", since not all people are rational!

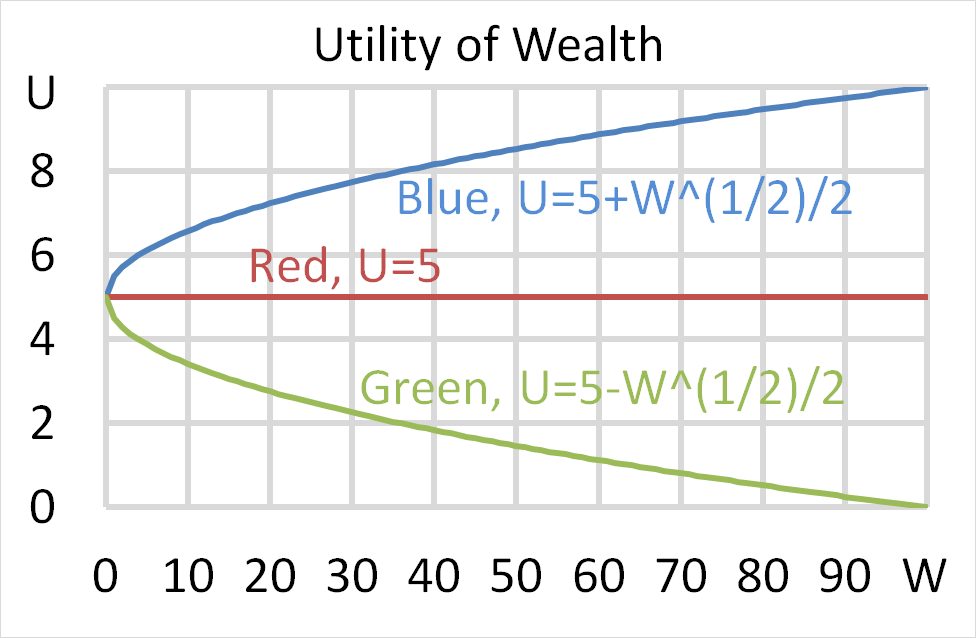

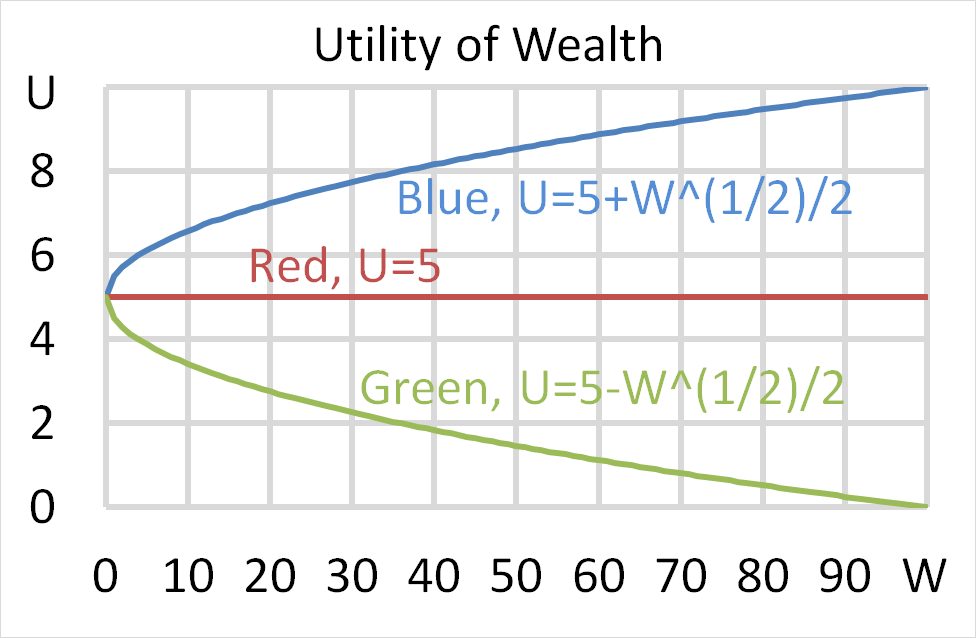

Mr Blue, Miss Red and Mrs Green are people with different utility functions. Which of the statements about the 3 utility functions is NOT correct?

Miss Red is risk neutral since her utility curve is a straight line. It has a zero second derivative, it is neither a 'frown' nor a 'smile'.

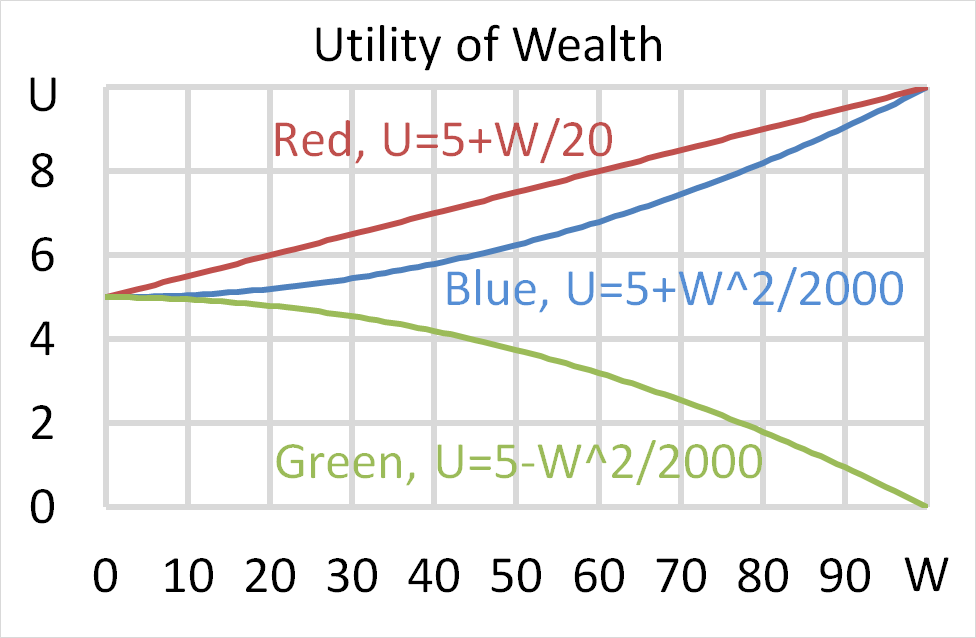

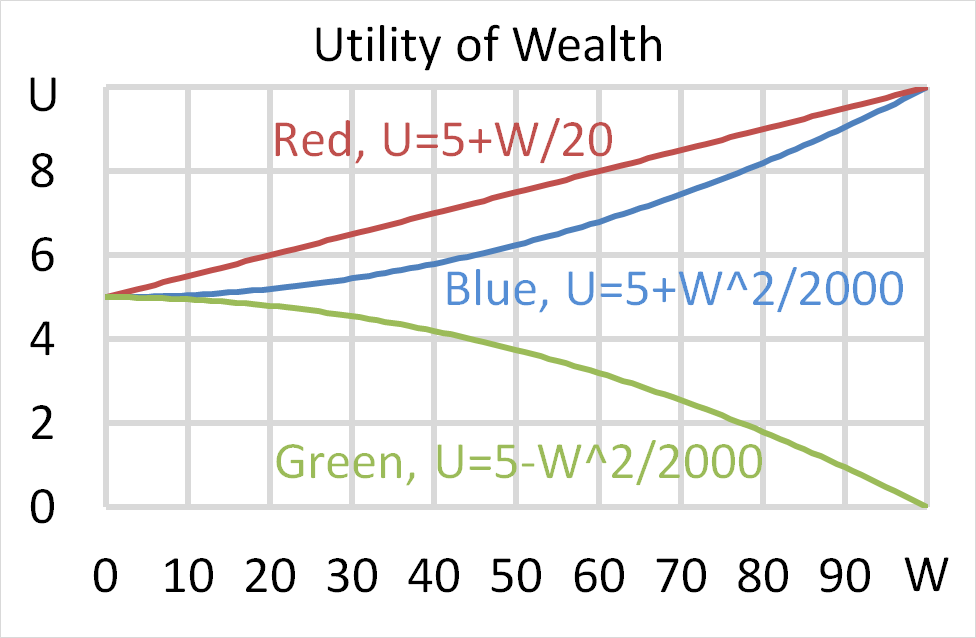

Mr Blue, Miss Red and Mrs Green are people with different utility functions. Which of the statements about the 3 utility functions is NOT correct?

Mr Blue is risk loving, not risk-averse, because his utility curve's second derivative is positive, it's concave up, it looks like a smile. Mr Blue may enjoy gambling.

Mrs Green is risk averse even though she prefers to be poor compared to being rich. She's risk averse because her utility curve's second derivative is negative, it's concave down, it looks like a frown. Mrs Green would not enjoy a fair gamble.

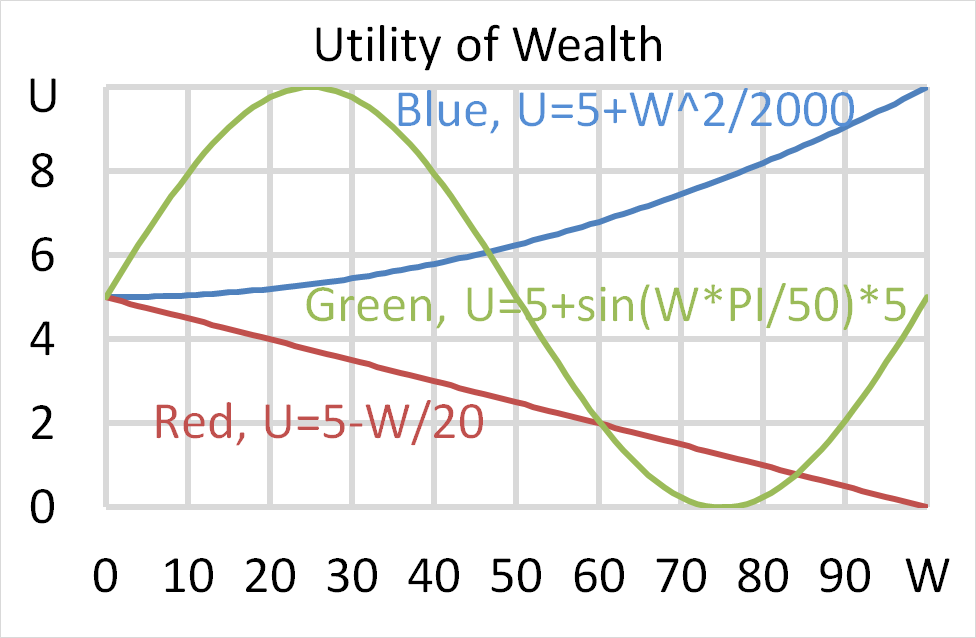

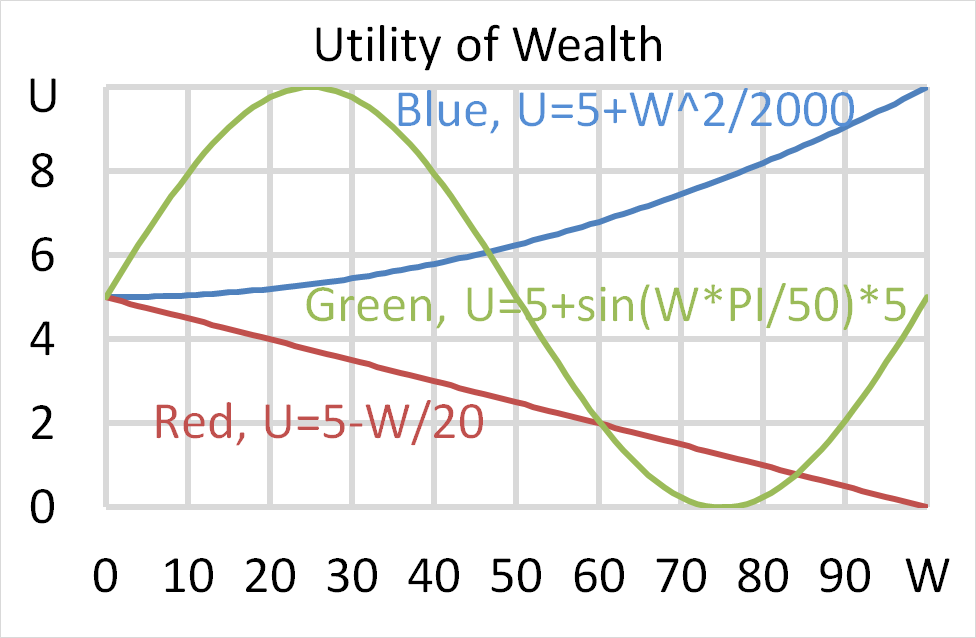

Mr Blue, Miss Red and Mrs Green are people with different utility functions. Which of the statements about the 3 utility functions is NOT correct?

Mrs Green is risk averse when she has between zero and $50 of wealth. This is because her utility curve's second derivative is negative over that span of wealth. It's concave down, it looks like a frown.

Mrs Green is risk-loving when she has between $50 and $100 of wealth. This is because her utility curve's second derivative is positive over that span of wealth. It's concave up, it looks like a smile. Mrs Green would enjoy gambling when she has between $50 and $100 of wealth.

Mr Blue is always risk loving. He would enjoy a fair gamble.

Miss Red and Mrs Green appear irrational from an economist's point of view. Miss Red always prefers less wealth to more, she likes being poor. Mrs Green prefers less wealth to more between $50 and $100. Mrs Green has a satiation or 'bliss' point at $25 which is the wealth at which she is most happy. Technically the bliss point happens repeatedly at 125, 225, 325 and so on since the sine wave repeats. Even at negative $125 wealth Mrs Green has a bliss point!

Question 699 utility, risk aversion, utility function, gamble

Mr Blue, Miss Red and Mrs Green are people with different utility functions.

Each person has $50 of initial wealth. A coin toss game is offered to each person at a casino where the player can win or lose $50. Each player can flip a coin and if they flip heads, they receive $50. If they flip tails then they will lose $50. Which of the following statements is NOT correct?

The gamble makes Mrs Green more happy but the numbers in answer b are wrong. Mrs Green's expected utility of wealth from gambling is 5 while refusing is 2.5.

Mrs Green

Mrs Green's expected utility of wealth from the risky gamble is:

###U(W) = \sum_{i=1}^{n} \left( p_i.U(W_i) \right) ### ###\begin{aligned} U(W_\text{Green, risky gamble}) &= 0.5 \times 100^2/1000+ 0.5 \times 0^2/1000 \\ &= 5 \\ \end{aligned}###To find the certainty equivalent of this risky gamble:

###U(W_\text{Green, certainty equiv}) = 5 ### ###(W_\text{Green, certainty equiv})^2/1000 = 5 ### ###\begin{aligned} W_\text{Green, certainty equiv} &= (5 \times 1000)^{0.5} \\ &= 70.71067812 \\ \end{aligned}###She would be indifferent to participating in the gamble or having $70.71 in wealth.

Mr Blue

The probability of flipping heads and winning is 0.5. The probability of flipping tails and losing is also 0.5. Mr Blue's expected utility of wealth from the risky gamble is:

###U(W) = \sum_{i=1}^{n} \left( p_i.U(W_i) \right) ### ###\begin{aligned} U(W_\text{Blue, risky gamble}) &= 0.5 \times 100^{0.5} + 0.5 \times 0^{0.5} \\ &= 5 \\ \end{aligned}###To find the certainty equivalent of the risky gamble:

###U(W_\text{Blue, certainty equiv}) = 5 ### ###(W_\text{Blue, certainty equiv})^{0.5} = 5 ### ###\begin{aligned} W_\text{Blue, certainty equiv} &= 5^2 \\ &= 25 \\ \end{aligned}###So he would be indifferent to participating in the gamble or having $25 in wealth, which is $25 less than his current wealth of $50. Therefore he'd try to avoid the gamble.

Question 700 utility, risk aversion, utility function, gamble

Mr Blue, Miss Red and Mrs Green are people with different utility functions.

Each person has $50 of initial wealth. A coin toss game is offered to each person at a casino where the player can win or lose $50. Each player can flip a coin and if they flip heads, they receive $50. If they flip tails then they will lose $50. Which of the following statements is NOT correct?

Mrs Green

Mrs Green is very unusual since she likes being poor (negative slope utility curve) and she enjoys risk (positive second derivative or 'smile'). So she would actually pay to take part in the gamble. She enjoys gambling since she's a risk-lover.

Note that Mrs Green's current utility of wealth is:

###\begin{aligned}U(W_\text{Green}) &= 5-W_\text{Green}^{0.5}/2 \\ &= 5-50^{0.5}/2 \\ &= 1.464466094 \\ \end{aligned}###Mrs Green's expected utility of wealth from the risky gamble is:

###U(W) = \sum_{i=1}^{n} \left( p_i.U(W_i) \right) ### ###\begin{aligned} U(W_\text{Green, risky gamble}) &= 0.5 \times (5-100^{0.5}/2)+ 0.5 \times (5-0^{0.5}/2) \\ &= 2.5 \\ \end{aligned}###Since the utility of the risky gamble ##(2.5)## is more than the utility of not taking part ##(1.464466094)##, then she obviously enjoys taking part and will be willing to pay for a ticket.

To find the certainty equivalent of this risky gamble:

###U(W_\text{Green, certainty equiv}) = 2.5 ### ###5-W_\text{Green, certainty equiv}^{0.5}/2 = 2.5 ### ###\begin{aligned} W_\text{Green, certainty equiv} &= ((5 - 2.5) \times 2)^2 \\ &= 25 \\ \end{aligned}###She would be indifferent to participating in the gamble or having $25 in wealth, which is $25 less than her current wealth of $50. But since she likes to lose wealth then the gamble makes her happy.

Mr Blue

The probability of flipping heads and winning is 0.5. The probability of flipping tails and losing is also 0.5. Mr Blue's expected utility of wealth from the risky gamble is:

###U(W) = \sum_{i=1}^{n} \left( p_i.U(W_i) \right) ### ###\begin{aligned} U(W_\text{Blue, risky gamble}) &= 0.5 \times (5+100^{0.5}/2) + 0.5 \times (5+0^{0.5}/2) \\ &= 7.5 \\ \end{aligned}###To find the certainty equivalent of the risky gamble:

###U(W_\text{Blue, certainty equiv}) = 7.5 ### ###(5+W_\text{Blue, certainty equiv})^{0.5}/2 = 7.5 ### ###\begin{aligned} W_\text{Blue, certainty equiv} &= ((7.5 - 5)*2)^2 \\ &= 25 \\ \end{aligned}###This is less than his current wealth of $50 so he'd dislike the gamble.

Question 701 utility, risk aversion, utility function, gamble

Mr Blue, Miss Red and Mrs Green are people with different utility functions.

Each person has $50 of initial wealth. A coin toss game is offered to each person at a casino where the player can win or lose $50. Each player can flip a coin and if they flip heads, they receive $50. If they flip tails then they will lose $50. Which of the following statements is NOT correct?

Mrs Green

The certainty equivalent of the gamble is $70.71, but since Mrs Green prefers to be poorer than richer, she would actually prefer to have her original $50 and therefore not take part in the risky gamble. Therefore answer d is wrong.

Mrs Green's expected utility of wealth from the risky gamble is:

###U(W) = \sum_{i=1}^{n} \left( p_i.U(W_i) \right) ### ###\begin{aligned} U(W_\text{Green, risky gamble}) &= 0.5 \times (5-100^2/2000) + 0.5 \times (5-0^2/2000) \\ &= 2.5 \\ \end{aligned}###To find the certainty equivalent of this risky gamble:

###U(W_\text{Green, certainty equiv}) = 2.5 ### ###5-(W_\text{Green, certainty equiv})^2/2000 = 2.5 ### ###\begin{aligned} W_\text{Green, certainty equiv} &= ((5 -2.5) \times 2000)^{0.5} \\ &= 70.71067812 \\ \end{aligned}###So she would be indifferent to participating in the gamble or having $70.71 in wealth. But since she dislikes wealth she would prefer to just have $50 and therefore not gamble.

Mr Blue

The certainty equivalent of the game for Mr Blue can be calculated. The probability of flipping heads is 0.5 and tails is 0.5. So Mr Blue's the expected utility of wealth from the risky gamble is:

###U(W) = \sum_{i=1}^{n} \left( p_i.U(W_i) \right) ### ###\begin{aligned} U(W_\text{Blue, risky gamble}) &= 0.5 \times (5+100^2/2000) + 0.5 \times (5+0^2/2000) \\ &= 7.5 \\ \end{aligned}###To find the certainty equivalent of this risky gamble:

###U(W_\text{Blue, certainty equiv}) = 7.5 ### ###5+(W_\text{Blue, certainty equiv})^2/2000 = 7.5 ### ###\begin{aligned} W_\text{Blue, certainty equiv} &= ((7.5-5) \times 2000)^{0.5} \\ &= 70.71067812 \\ \end{aligned}###This is more than his current wealth so he'd enjoy the gamble.

Question 702 utility, risk aversion, utility function, gamble

Mr Blue, Miss Red and Mrs Green are people with different utility functions.

Each person has $50 of initial wealth. A coin toss game is offered to each person at a casino where the player can win or lose $50. Each player can flip a coin and if they flip heads, they receive $50. If they flip tails then they will lose $50. Which of the following statements is NOT correct?

Mrs Green

Mrs Green would actually be indifferent to gambling or not. This is because her utility from having zero wealth or $100 is 5, which is also the utility of her initial $50 in wealth.

Mrs Green's expected utility of wealth from the risky gamble is:

###U(W) = \sum_{i=1}^{n} \left( p_i.U(W_i) \right) ### ###\begin{aligned} U(W_\text{Green, risky gamble}) &= 0.5 \times ((5+sin(100 \times \pi/50) \times 5)+ 0.5 \times ((5+sin(0 \times \pi/50) \times 5) \\ &= 5 \\ \end{aligned}###To find the certainty equivalent of this risky gamble, we can try to use equations but it will be messy and require use of the asin formula. Better to just look at the graph and see that when the utility is 5, the wealth is at 0, 50 and 100. These are her certainty equivalents.

Mr Blue

The probability of flipping heads and winning is 0.5. The probability of flipping tails and losing is also 0.5. Mr Blue's expected utility of wealth from the risky gamble is:

###U(W) = \sum_{i=1}^{n} \left( p_i.U(W_i) \right) ### ###\begin{aligned} U(W_\text{Blue, risky gamble}) &= 0.5 \times (5+100^2/2000) + 0.5 \times (5+0^2/2000) \\ &= 7.5 \\ \end{aligned}###To find the certainty equivalent of this risky gamble:

###U(W_\text{Blue, certainty equiv}) = 7.5 ### ###5+(W_\text{Blue, certainty equiv})^2/2000 = 7.5 ### ###\begin{aligned} W_\text{Blue, certainty equiv} &= ((7.5-5) \times 2000)^{0.5} \\ &= 70.71067812 \\ \end{aligned}###Since $70.71 is more than his initial $50 in wealth, he would like to gamble.

Question 703 utility, risk aversion, utility function, gamble

Mr Blue, Miss Red and Mrs Green are people with different utility functions.

Each person has $500 of initial wealth. A coin toss game is offered to each person at a casino where the player can win or lose $500. Each player can flip a coin and if they flip heads, they receive $500. If they flip tails then they will lose $500. Which of the following statements is NOT correct?

Mr Blue

Mr Blue would dislike the gamble but his certainty equivalent is $125, not $225. The probability of flipping heads is 0.5 and tails is 0.5. So Mr Blue's the expected utility of wealth from the risky gamble is:

###U(W) = \sum_{i=1}^{n} \left( p_i.U(W_i) \right) ### ###\begin{aligned} U(W_\text{Blue, risky gamble}) &= 0.5 \times 1000^{1/3} + 0.5 \times 0^{1/3} \\ &= 5 \\ \end{aligned}###To find the certainty equivalent of this risky gamble:

###U(W_\text{Blue, certainty equiv}) = 5 ### ###(W_\text{Blue, certainty equiv})^{1/3} = 5 ### ###\begin{aligned} W_\text{Blue, certainty equiv} &= 5^3 \\ &= 125 \\ \end{aligned}###So he would be indifferent to participating in the gamble or having $125 in wealth, which is $375 less than his current wealth of $500, so he'd dislike the gamble.

Mrs Green

The certainty equivalent of the game for Mrs Green can be calculated. Mrs Green's expected utility of wealth from the risky gamble is:

###U(W) = \sum_{i=1}^{n} \left( p_i.U(W_i) \right) ### ###\begin{aligned} U(W_\text{Green, risky gamble}) &= 0.5 \times 100^3/100,000,000+ 0.5 \times 0^3/100,000,000\\ &= 5 \\ \end{aligned}###To find the certainty equivalent of this risky gamble:

###U(W_\text{Green, certainty equiv}) = 5 ### ###(W_\text{Green, certainty equiv})^3/100,000,000 = 5 ### ###\begin{aligned} W_\text{Green, certainty equiv} &= (5 \times 100,000,000)^{1/3} \\ &= 793.700526 \\ \end{aligned}###So she would be indifferent to participating in the gamble or having $793.70 in wealth, which is $293.70 more than her current wealth of $500. Therefore she will enjoy the gamble.

Question 704 utility, risk aversion, utility function, gamble

Mr Blue, Miss Red and Mrs Green are people with different utility functions.

Each person has $256 of initial wealth. A coin toss game is offered to each person at a casino where the player can win or lose $256. Each player can flip a coin and if they flip heads, they receive $256. If they flip tails then they will lose $256. Which of the following statements is NOT correct?

Mrs Green

The certainty equivalent of wealth from gambling for Mrs Green is not $512. Mrs Green's expected utility of wealth from the risky gamble is:

###U(W) = \sum_{i=1}^{n} \left( p_i.U(W_i) \right) ### ###\begin{aligned} U(W_\text{Green, risky gamble}) &= 0.5 \times 512^3/100,000,000+ 0.5 \times 0^3/100,000,000\\ &= 0.67108864 \\ \end{aligned}###To find the certainty equivalent of this risky gamble:

###U(W_\text{Green, certainty equiv}) = 0.67108864 ### ###(W_\text{Green, certainty equiv})^3/100,000,000 = 0.67108864 ### ###\begin{aligned} W_\text{Green, certainty equiv} &= (0.67108864 \times 100,000,000)^{1/3} \\ &= 406.3746693 \\ \end{aligned}###So she would be indifferent to participating in the gamble or having $406.37 in wealth.

Mr Blue

The certainty equivalent of the game for Mr Blue can be calculated. The probability of flipping heads is 0.5 and tails is 0.5. So Mr Blue's the expected utility of wealth from the risky gamble is:

###U(W) = \sum_{i=1}^{n} \left( p_i.U(W_i) \right) ### ###\begin{aligned} U(W_\text{Blue, risky gamble}) &= 0.5 \times 512^{1/3} + 0.5 \times 0^{1/3} \\ &= 4 \\ \end{aligned}###To find the certainty equivalent of this risky gamble:

###U(W_\text{Blue, certainty equiv}) = 4 ### ###(W_\text{Blue, certainty equiv})^{1/3} = 4 ### ###\begin{aligned} W_\text{Blue, certainty equiv} &= 4^3 \\ &= 64 \\ \end{aligned}###So he would be indifferent to participating in the gamble or having $64 in wealth, which is $192 less than his current wealth of $256. Therefore he'd prefer not to gamble. In fact he would pay to avoid the gamble.

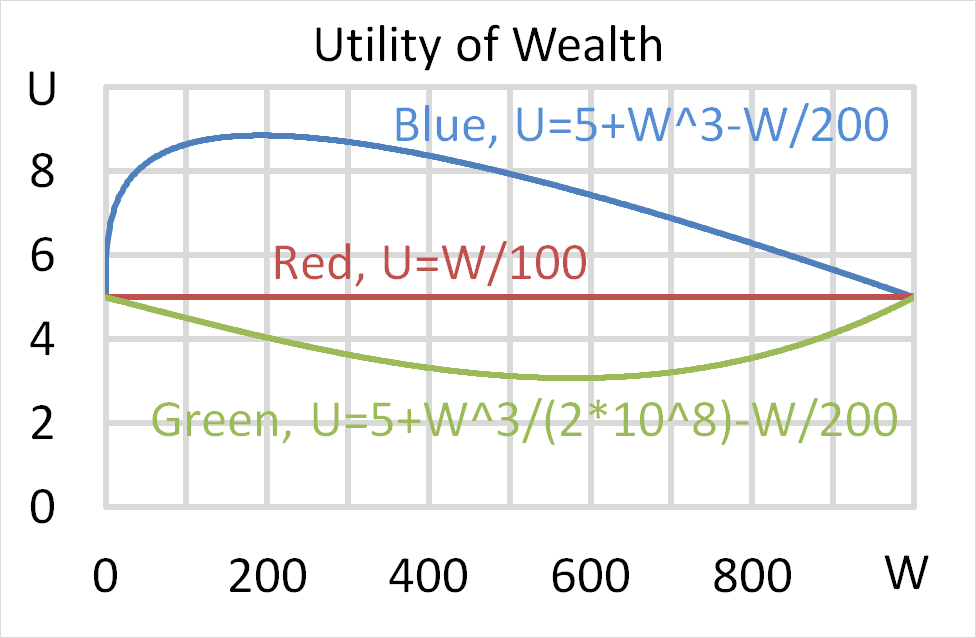

Mr Blue, Miss Red and Mrs Green are people with different utility functions.

Which of the following statements is NOT correct?

All of the people appear irrational to an economist but Mr Blue is rational when he has less than $192 in wealth, not more. This is because he prefers more to less wealth and is risk-averse, unlike the Miss Red and Mrs Green.

Mr Blue, Miss Red and Mrs Green are people with different utility functions.

Note that a fair gamble is a bet that has an expected value of zero, such as paying $0.50 to win $1 in a coin flip with heads or nothing if it lands tails. Fairly priced insurance is when the expected present value of the insurance premiums is equal to the expected loss from the disaster that the insurance protects against, such as the cost of rebuilding a home after a catastrophic fire.

Which of the following statements is NOT correct?

Mr Blue may like to buy insurance even if it is slightly over priced. Over priced insurance means that the expected present value of the insurance premiums is more than expected loss from the disaster that the insurance protects against, such as the cost of rebuilding a home after a catastrophic fire. While paying the insurance premium is expected to reduce Mr Blue's wealth over time, paying to reduce risk is often seen as a good idea by many people.

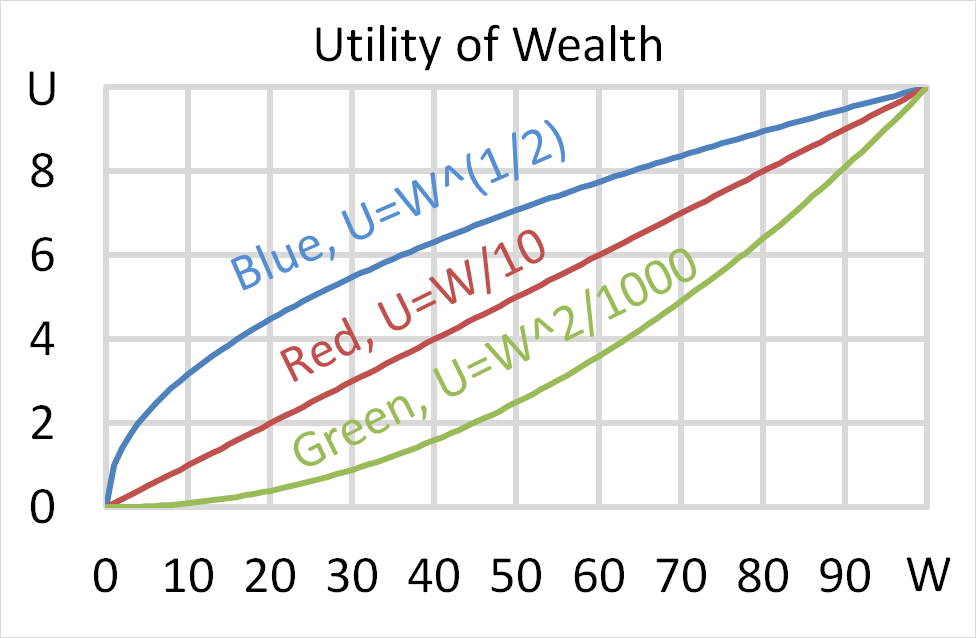

Below is a graph of 3 peoples’ utility functions, Mr Blue (U=W^(1/2) ), Miss Red (U=W/10) and Mrs Green (U=W^2/1000). Assume that each of them currently have $50 of wealth.

Which of the following statements about them is NOT correct?

(a) Mr Blue would prefer to invest his wealth in a well diversified portfolio of stocks rather than a single stock, assuming that all stocks had the same total risk and return.

The Capital Asset Pricing Model (CAPM) assumes that investors like return and dislike risk, similarly to Mr. Blue. If investors were the same as Miss Red, who is not afraid of risk, then all assets would have the same return regardless of their risk. So the security market line (SML) would be flat and everything would earn the risk free rate, making the CAPM invalid.