Question 574 inflation, real and nominal returns and cash flows, NPV

What is the present value of a nominal payment of $100 in 5 years? The real discount rate is 10% pa and the inflation rate is 3% pa.

A stock just paid its annual dividend of $9. The share price is $60. The required return of the stock is 10% pa as an effective annual rate.

What is the implied growth rate of the dividend per year?

The following is the Dividend Discount Model (DDM) used to price stocks:

### P_0 = \frac{d_1}{r-g} ###Assume that the assumptions of the DDM hold and that the time period is measured in years.

Which of the following is equal to the expected dividend in 3 years, ## d_3 ##?

You own an apartment which you rent out as an investment property.

What is the price of the apartment using discounted cash flow (DCF, same as NPV) valuation?

Assume that:

- You just signed a contract to rent the apartment out to a tenant for the next 12 months at $2,000 per month, payable in advance (at the start of the month, t=0). The tenant is just about to pay you the first $2,000 payment.

- The contract states that monthly rental payments are fixed for 12 months. After the contract ends, you plan to sign another contract but with rental payment increases of 3%. You intend to do this every year.

So rental payments will increase at the start of the 13th month (t=12) to be $2,060 (=2,000(1+0.03)), and then they will be constant for the next 12 months.

Rental payments will increase again at the start of the 25th month (t=24) to be $2,121.80 (=2,000(1+0.03)2), and then they will be constant for the next 12 months until the next year, and so on. - The required return of the apartment is 8.732% pa, given as an effective annual rate.

- Ignore all taxes, maintenance, real estate agent, council and strata fees, periods of vacancy and other costs. Assume that the apartment will last forever and so will the rental payments.

Which of the following investable assets are NOT suitable for valuation using PE multiples techniques?

Which firms tend to have low forward-looking price-earnings (PE) ratios? Only consider firms with positive PE ratios.

Which of the below statements about effective rates and annualised percentage rates (APR's) is NOT correct?

Question 49 inflation, real and nominal returns and cash flows, APR, effective rate

In Australia, nominal yields on semi-annual coupon paying Government Bonds with 2 years until maturity are currently 2.83% pa.

The inflation rate is currently 2.2% pa, given as an APR compounding per quarter. The inflation rate is not expected to change over the next 2 years.

What is the real yield on these bonds, given as an APR compounding every 6 months?

You just signed up for a 30 year fully amortising mortgage loan with monthly payments of $1,500 per month. The interest rate is 9% pa which is not expected to change.

To your surprise, you can actually afford to pay $2,000 per month and your mortgage allows early repayments without fees. If you maintain these higher monthly payments, how long will it take to pay off your mortgage?

A student won $1m in a lottery. Currently the money is in a bank account which pays interest at 6% pa, given as an APR compounding per month.

She plans to spend $20,000 at the beginning of every month from now on (so the first withdrawal will be at t=0). After each withdrawal, she will check how much money is left in the account. When there is less than $500,000 left, she will donate that remaining amount to charity.

In how many months will she make her last withdrawal and donate the remainder to charity?

An industrial chicken farmer grows chickens for their meat. Chickens:

- Cost $0.50 each to buy as chicks. They are bought on the day they’re born, at t=0.

- Grow at a rate of $0.70 worth of meat per chicken per week for the first 6 weeks (t=0 to t=6).

- Grow at a rate of $0.40 worth of meat per chicken per week for the next 4 weeks (t=6 to t=10) since they’re older and grow more slowly.

- Feed costs are $0.30 per chicken per week for their whole life. Chicken feed is bought and fed to the chickens once per week at the beginning of the week. So the first amount of feed bought for a chicken at t=0 costs $0.30, and so on.

- Can be slaughtered (killed for their meat) and sold at no cost at the end of the week. The price received for the chicken is their total value of meat (note that the chicken grows fast then slow, see above).

The required return of the chicken farm is 0.5% given as an effective weekly rate.

Ignore taxes and the fixed costs of the factory. Ignore the chicken’s welfare and other environmental and ethical concerns.

Find the equivalent weekly cash flow of slaughtering a chicken at 6 weeks and at 10 weeks so the farmer can figure out the best time to slaughter his chickens. The choices below are given in the same order, 6 and 10 weeks.

A person is thinking about borrowing $100 from the bank at 7% pa and investing it in shares with an expected return of 10% pa. One year later the person intends to sell the shares and pay back the loan in full. Both the loan and the shares are fairly priced.

What is the Net Present Value (NPV) of this one year investment? Note that you are asked to find the present value (##V_0##), not the value in one year (##V_1##).

A stock is expected to pay the following dividends:

| Cash Flows of a Stock | ||||||

| Time (yrs) | 0 | 1 | 2 | 3 | 4 | ... |

| Dividend ($) | 0.00 | 1.15 | 1.10 | 1.05 | 1.00 | ... |

After year 4, the annual dividend will grow in perpetuity at -5% pa. Note that this is a negative growth rate, so the dividend will actually shrink. So,

- the dividend at t=5 will be ##$1(1-0.05) = $0.95##,

- the dividend at t=6 will be ##$1(1-0.05)^2 = $0.9025##, and so on.

The required return on the stock is 10% pa. Both the growth rate and required return are given as effective annual rates.

What will be the price of the stock in four and a half years (t = 4.5)?

Your friend wants to borrow $1,000 and offers to pay you back $100 in 6 months, with more $100 payments at the end of every month for another 11 months. So there will be twelve $100 payments in total. She says that 12 payments of $100 equals $1,200 so she's being generous.

If interest rates are 12% pa, given as an APR compounding monthly, what is the Net Present Value (NPV) of your friend's deal?

Question 22 NPV, perpetuity with growth, effective rate, effective rate conversion

What is the NPV of the following series of cash flows when the discount rate is 10% given as an effective annual rate?

The first payment of $90 is in 3 years, followed by payments every 6 months in perpetuity after that which shrink by 3% every 6 months. That is, the growth rate every 6 months is actually negative 3%, given as an effective 6 month rate. So the payment at ## t=3.5 ## years will be ## 90(1-0.03)^1=87.3 ##, and so on.

The theory of fixed interest bond pricing is an application of the theory of Net Present Value (NPV). Also, a 'fairly priced' asset is not over- or under-priced. Buying or selling a fairly priced asset has an NPV of zero.

Considering this, which of the following statements is NOT correct?

A project has an internal rate of return (IRR) which is greater than its required return. Select the most correct statement.

A share currently worth $100 is expected to pay a constant dividend of $4 for the next 5 years with the first dividend in one year (t=1) and the last in 5 years (t=5).

The total required return is 10% pa.

What do you expected the share price to be in 5 years, just after the dividend at that time has been paid?

Question 56 income and capital returns, bond pricing, premium par and discount bonds

Which of the following statements about risk free government bonds is NOT correct?

Hint: Total return can be broken into income and capital returns as follows:

###\begin{aligned} r_\text{total} &= \frac{c_1}{p_0} + \frac{p_1-p_0}{p_0} \\ &= r_\text{income} + r_\text{capital} \end{aligned} ###

The capital return is the growth rate of the price.

The income return is the periodic cash flow. For a bond this is the coupon payment.

A company's shares just paid their annual dividend of $2 each.

The stock price is now $40 (just after the dividend payment). The annual dividend is expected to grow by 3% every year forever. The assumptions of the dividend discount model are valid for this company.

What do you expect the effective annual dividend yield to be in 3 years (dividend yield from t=3 to t=4)?

Question 218 NPV, IRR, profitability index, average accounting return

Which of the following statements is NOT correct?

A three year project's NPV is negative. The cash flows of the project include a negative cash flow at the very start and positive cash flows over its short life. The required return of the project is 10% pa. Select the most correct statement.

A highly levered risky firm is trying to raise more debt. The types of debt being considered, in no particular order, are senior bonds, junior bonds, bank accepted bills, promissory notes and bank loans.

Which of these forms of debt is the safest from the perspective of the debt investors who are thinking of investing in the firm's new debt?

Question 24 implicit interest rate in wholesale credit, effective rate

A bathroom and plumbing supplies shop offers credit to its customers. Customers are given 60 days to pay for their goods, but if they pay within 7 days they will get a 2% discount.

What is the effective interest rate implicit in the discount being offered? Assume 365 days in a year and that all customers pay on either the 7th day or the 60th day. All rates given in this question are effective annual rates.

A three year corporate bond yields 12% pa with a coupon rate of 10% pa, paid semi-annually.

Find the effective six month yield, effective annual yield and the effective daily yield. Assume that each month has 30 days and that there are 360 days in a year.

All answers are given in the same order:

##r_\text{eff semi-annual}##, ##r_\text{eff yearly}##, ##r_\text{eff daily}##.

A credit card company advertises an interest rate of 18% pa, payable monthly. Which of the following statements about the interest rate is NOT correct? All rates are given to four decimal places.

You're advising your superstar client 40-cent who is weighing up buying a private jet or a luxury yacht. 40-cent is just as happy with either, but he wants to go with the more cost-effective option. These are the cash flows of the two options:

- The private jet can be bought for $6m now, which will cost $12,000 per month in fuel, piloting and airport costs, payable at the end of each month. The jet will last for 12 years.

- Or the luxury yacht can be bought for $4m now, which will cost $20,000 per month in fuel, crew and berthing costs, payable at the end of each month. The yacht will last for 20 years.

What's unusual about 40-cent is that he is so famous that he will actually be able to sell his jet or yacht for the same price as it was bought since the next generation of superstar musicians will buy it from him as a status symbol.

Bank interest rates are 10% pa, given as an effective annual rate. You can assume that 40-cent will live for another 60 years and that when the jet or yacht's life is at an end, he will buy a new one with the same details as above.

Would you advise 40-cent to buy the or the ?

Note that the effective monthly rate is ##r_\text{eff monthly}=(1+0.1)^{1/12}-1=0.00797414##

Question 35 bond pricing, zero coupon bond, term structure of interest rates, forward interest rate

A European company just issued two bonds, a

- 1 year zero coupon bond at a yield of 8% pa, and a

- 2 year zero coupon bond at a yield of 10% pa.

What is the company's forward rate over the second year (from t=1 to t=2)? Give your answer as an effective annual rate, which is how the above bond yields are quoted.

Below are some statements about loans and bonds. The first descriptive sentence is correct. But one of the second sentences about the loans' or bonds' prices is not correct. Which statement is NOT correct? Assume that interest rates are positive.

Note that coupons or interest payments are the periodic payments made throughout a bond or loan's life. The face or par value of a bond or loan is the amount paid at the end when the debt matures.

In these tough economic times, central banks around the world have cut interest rates so low that they are practically zero. In some countries, government bond yields are also very close to zero.

A three year government bond with a face value of $100 and a coupon rate of 2% pa paid semi-annually was just issued at a yield of 0%. What is the price of the bond?

An investor bought two fixed-coupon bonds issued by the same company, a zero-coupon bond and a 7% pa semi-annual coupon bond. Both bonds have a face value of $1,000, mature in 10 years, and had a yield at the time of purchase of 8% pa.

A few years later, yields fell to 6% pa. Which of the following statements is correct? Note that a capital gain is an increase in price.

Which one of the following bonds is trading at a discount?

Question 545 income and capital returns, fully amortising loan, no explanation

Which of the following statements about the capital and income returns of a 25 year fully amortising loan asset is correct?

Assume that the yield curve (which shows total returns over different maturities) is flat and is not expected to change.

Over the 25 years from issuance to maturity, a fully amortising loan's expected annual effective:

Question 546 income and capital returns, interest only loan, no explanation

Which of the following statements about the capital and income returns of an interest-only loan is correct?

Assume that the yield curve (which shows total returns over different maturities) is flat and is not expected to change.

An interest-only loan's expected:

Bonds X and Y are issued by different companies, but they both pay a semi-annual coupon of 10% pa and they have the same face value ($100), maturity (3 years) and yield (10%) as each other.

Which of the following statements is true?

A man is thinking about taking a day off from his casual painting job to relax.

He just woke up early in the morning and he's about to call his boss to say that he won't be coming in to work.

But he's thinking about the hours that he could work today (in the future) which are:

Find Candys Corporation's Cash Flow From Assets (CFFA), also known as Free Cash Flow to the Firm (FCFF), over the year ending 30th June 2013.

| Candys Corp | ||

| Income Statement for | ||

| year ending 30th June 2013 | ||

| $m | ||

| Sales | 200 | |

| COGS | 50 | |

| Operating expense | 10 | |

| Depreciation | 20 | |

| Interest expense | 10 | |

| Income before tax | 110 | |

| Tax at 30% | 33 | |

| Net income | 77 | |

| Candys Corp | ||

| Balance Sheet | ||

| as at 30th June | 2013 | 2012 |

| $m | $m | |

| Assets | ||

| Current assets | 220 | 180 |

| PPE | ||

| Cost | 300 | 340 |

| Accumul. depr. | 60 | 40 |

| Carrying amount | 240 | 300 |

| Total assets | 460 | 480 |

| Liabilities | ||

| Current liabilities | 175 | 190 |

| Non-current liabilities | 135 | 130 |

| Owners' equity | ||

| Retained earnings | 50 | 60 |

| Contributed equity | 100 | 100 |

| Total L and OE | 460 | 480 |

Note: all figures are given in millions of dollars ($m).

Find Sidebar Corporation's Cash Flow From Assets (CFFA), also known as Free Cash Flow to the Firm (FCFF), over the year ending 30th June 2013.

| Sidebar Corp | ||

| Income Statement for | ||

| year ending 30th June 2013 | ||

| $m | ||

| Sales | 405 | |

| COGS | 100 | |

| Depreciation | 34 | |

| Rent expense | 22 | |

| Interest expense | 39 | |

| Taxable Income | 210 | |

| Taxes at 30% | 63 | |

| Net income | 147 | |

| Sidebar Corp | ||

| Balance Sheet | ||

| as at 30th June | 2013 | 2012 |

| $m | $m | |

| Cash | 0 | 0 |

| Inventory | 70 | 50 |

| Trade debtors | 11 | 16 |

| Rent paid in advance | 4 | 3 |

| PPE | 700 | 680 |

| Total assets | 785 | 749 |

| Trade creditors | 11 | 19 |

| Bond liabilities | 400 | 390 |

| Contributed equity | 220 | 220 |

| Retained profits | 154 | 120 |

| Total L and OE | 785 | 749 |

Note: All figures are given in millions of dollars ($m).

The cash flow from assets was:

Over the next year, the management of an unlevered company plans to:

- Make $5m in sales, $1.9m in net income and $2m in equity free cash flow (EFCF).

- Pay dividends of $1m.

- Complete a $1.3m share buy-back.

Assume that:

- All amounts are received and paid at the end of the year so you can ignore the time value of money.

- The firm has sufficient retained profits to legally pay the dividend and complete the buy back.

- The firm plans to run a very tight ship, with no excess cash above operating requirements currently or over the next year.

How much new equity financing will the company need? In other words, what is the value of new shares that will need to be issued?

Which one of the following will increase the Cash Flow From Assets in this year for a tax-paying firm, all else remaining constant?

Your friend is trying to find the net present value of an investment which:

- Costs $1 million initially (t=0); and

- Pays a single positive cash flow of $1.1 million in one year (t=1).

The investment has a total required return of 10% pa due to its moderate level of undiversifiable risk.

Your friend is aware of the importance of opportunity costs and the time value of money, but he is unsure of how to find the NPV of the project.

He knows that the opportunity cost of investing the $1m in the project is the expected gain from investing the money in shares instead. Like the project, shares also have an expected return of 10% since they have moderate undiversifiable risk. This opportunity cost is $0.1m ##(=1m \times 10\%)## which occurs in one year (t=1).

He knows that the time value of money should be accounted for, and this can be done by finding the present value of the cash flows in one year.

Your friend has listed a few different ways to find the NPV which are written down below.

Method 1: ##-1m + \dfrac{1.1m}{(1+0.1)^1} ##

Method 2: ##-1m + 1.1m - 1m \times 0.1 ##

Method 3: ##-1m + \dfrac{1.1m}{(1+0.1)^1} - 1m \times 0.1 ##

Which of the above calculations give the correct NPV? Select the most correct answer.

A firm has 2m shares and a market capitalisation of equity of $30m. The firm just announced earnings of $5m and paid an annual dividend of $0.75 per share.

What is the firm's (backward looking) price/earnings (PE) ratio?

Find the cash flow from assets (CFFA) of the following project.

| One Year Mining Project Data | ||

| Project life | 1 year | |

| Initial investment in building mine and equipment | $9m | |

| Depreciation of mine and equipment over the year | $8m | |

| Kilograms of gold mined at end of year | 1,000 | |

| Sale price per kilogram | $0.05m | |

| Variable cost per kilogram | $0.03m | |

| Before-tax cost of closing mine at end of year | $4m | |

| Tax rate | 30% | |

Note 1: Due to the project, the firm also anticipates finding some rare diamonds which will give before-tax revenues of $1m at the end of the year.

Note 2: The land that will be mined actually has thermal springs and a family of koalas that could be sold to an eco-tourist resort for an after-tax amount of $3m right now. However, if the mine goes ahead then this natural beauty will be destroyed.

Note 3: The mining equipment will have a book value of $1m at the end of the year for tax purposes. However, the equipment is expected to fetch $2.5m when it is sold.

Find the project's CFFA at time zero and one. Answers are given in millions of dollars ($m), with the first cash flow at time zero, and the second at time one.

There are a number of ways that assets can be depreciated. Generally the government's tax office stipulates a certain method.

But if it didn't, what would be the ideal way to depreciate an asset from the perspective of a businesses owner?

A firm has forecast its Cash Flow From Assets (CFFA) for this year and management is worried that it is too low. Which one of the following actions will lead to a higher CFFA for this year (t=0 to 1)? Only consider cash flows this year. Do not consider cash flows after one year, or the change in the NPV of the firm. Consider each action in isolation.

A company increases the proportion of debt funding it uses to finance its assets by issuing bonds and using the cash to repurchase stock, leaving assets unchanged.

Ignoring the costs of financial distress, which of the following statements is NOT correct:

Over the next year, the management of an unlevered company plans to:

- Achieve firm free cash flow (FFCF or CFFA) of $1m.

- Pay dividends of $1.8m

- Complete a $1.3m share buy-back.

- Spend $0.8m on new buildings without buying or selling any other fixed assets. This capital expenditure is included in the CFFA figure quoted above.

Assume that:

- All amounts are received and paid at the end of the year so you can ignore the time value of money.

- The firm has sufficient retained profits to pay the dividend and complete the buy back.

- The firm plans to run a very tight ship, with no excess cash above operating requirements currently or over the next year.

How much new equity financing will the company need? In other words, what is the value of new shares that will need to be issued?

A manufacturing company is considering a new project in the more risky services industry. The cash flows from assets (CFFA) are estimated for the new project, with interest expense excluded from the calculations. To get the levered value of the project, what should these unlevered cash flows be discounted by?

Assume that the manufacturing firm has a target debt-to-assets ratio that it sticks to.

The US firm Google operates in the online advertising business. In 2011 Google bought Motorola Mobility which manufactures mobile phones.

Assume the following:

- Google had a 10% after-tax weighted average cost of capital (WACC) before it bought Motorola.

- Motorola had a 20% after-tax WACC before it merged with Google.

- Google and Motorola have the same level of gearing.

- Both companies operate in a classical tax system.

You are a manager at Motorola. You must value a project for making mobile phones. Which method(s) will give the correct valuation of the mobile phone manufacturing project? Select the most correct answer.

The mobile phone manufacturing project's:

There are many ways to calculate a firm's free cash flow (FFCF), also called cash flow from assets (CFFA). Some include the annual interest tax shield in the cash flow and some do not.

Which of the below FFCF formulas include the interest tax shield in the cash flow?

###(1) \quad FFCF=NI + Depr - CapEx -ΔNWC + IntExp### ###(2) \quad FFCF=NI + Depr - CapEx -ΔNWC + IntExp.(1-t_c)### ###(3) \quad FFCF=EBIT.(1-t_c )+ Depr- CapEx -ΔNWC+IntExp.t_c### ###(4) \quad FFCF=EBIT.(1-t_c) + Depr- CapEx -ΔNWC### ###(5) \quad FFCF=EBITDA.(1-t_c )+Depr.t_c- CapEx -ΔNWC+IntExp.t_c### ###(6) \quad FFCF=EBITDA.(1-t_c )+Depr.t_c- CapEx -ΔNWC### ###(7) \quad FFCF=EBIT-Tax + Depr - CapEx -ΔNWC### ###(8) \quad FFCF=EBIT-Tax + Depr - CapEx -ΔNWC-IntExp.t_c### ###(9) \quad FFCF=EBITDA-Tax - CapEx -ΔNWC### ###(10) \quad FFCF=EBITDA-Tax - CapEx -ΔNWC-IntExp.t_c###The formulas for net income (NI also called earnings), EBIT and EBITDA are given below. Assume that depreciation and amortisation are both represented by 'Depr' and that 'FC' represents fixed costs such as rent.

###NI=(Rev - COGS - Depr - FC - IntExp).(1-t_c )### ###EBIT=Rev - COGS - FC-Depr### ###EBITDA=Rev - COGS - FC### ###Tax =(Rev - COGS - Depr - FC - IntExp).t_c= \dfrac{NI.t_c}{1-t_c}###A firm plans to issue equity and use the cash raised to pay off its debt. No assets will be bought or sold. Ignore the costs of financial distress.

Which of the following statements is NOT correct, all things remaining equal?

All things remaining equal, the variance of a portfolio of two positively-weighted stocks rises as:

| Portfolio Details | ||||||

| Stock | Expected return |

Standard deviation |

Correlation | Dollars invested |

||

| A | 0.1 | 0.4 | 0.5 | 60 | ||

| B | 0.2 | 0.6 | 140 | |||

What is the expected return of the above portfolio?

| Portfolio Details | ||||||

| Stock | Expected return |

Standard deviation |

Correlation ##(\rho_{A,B})## | Dollars invested |

||

| A | 0.1 | 0.4 | 0.5 | 60 | ||

| B | 0.2 | 0.6 | 140 | |||

What is the standard deviation (not variance) of returns of the above portfolio?

Question 282 expected and historical returns, income and capital returns

You're the boss of an investment bank's equities research team. Your five analysts are each trying to find the expected total return over the next year of shares in a mining company. The mining firm:

- Is regarded as a mature company since it's quite stable in size and was floated around 30 years ago. It is not a high-growth company;

- Share price is very sensitive to changes in the price of the market portfolio, economic growth, the exchange rate and commodities prices. Due to this, its standard deviation of total returns is much higher than that of the market index;

- Experienced tough times in the last 10 years due to unexpected falls in commodity prices.

- Shares are traded in an active liquid market.

- The analysts' source data is correct and true, but their inferences might be wrong;

- All returns and yields are given as effective annual nominal rates.

All things remaining equal, the higher the correlation of returns between two stocks:

Question 558 portfolio weights, portfolio return, short selling

An investor wants to make a portfolio of two stocks A and B with a target expected portfolio return of 16% pa.

- Stock A has an expected return of 8% pa.

- Stock B has an expected return of 12% pa.

What portfolio weights should the investor have in stocks A and B respectively?

Question 556 portfolio risk, portfolio return, standard deviation

An investor wants to make a portfolio of two stocks A and B with a target expected portfolio return of 12% pa.

- Stock A has an expected return of 10% pa and a standard deviation of 20% pa.

- Stock B has an expected return of 15% pa and a standard deviation of 30% pa.

The correlation coefficient between stock A and B's expected returns is 70%.

What will be the annual standard deviation of the portfolio with this 12% pa target return?

What is the covariance of a variable X with itself?

The cov(X, X) or ##\sigma_{X,X}## equals:

What is the covariance of a variable X with a constant C?

The cov(X, C) or ##\sigma_{X,C}## equals:

What is the correlation of a variable X with a constant C?

The corr(X, C) or ##\rho_{X,C}## equals:

The covariance and correlation of two stocks X and Y's annual returns are calculated over a number of years. The units of the returns are in percent per annum ##(\% pa)##.

What are the units of the covariance ##(\sigma_{X,Y})## and correlation ##(\rho_{X,Y})## of returns respectively?

Hint: Visit Wikipedia to understand the difference between percentage points ##(\text{pp})## and percent ##(\%)##.

Let the standard deviation of returns for a share per month be ##\sigma_\text{monthly}##.

What is the formula for the standard deviation of the share's returns per year ##(\sigma_\text{yearly})##?

Assume that returns are independently and identically distributed (iid) so they have zero auto correlation, meaning that if the return was higher than average today, it does not indicate that the return tomorrow will be higher or lower than average.

According to the theory of the Capital Asset Pricing Model (CAPM), total variance can be broken into two components, systematic variance and idiosyncratic variance. Which of the following events would be considered the most diversifiable according to the theory of the CAPM?

A firm changes its capital structure by issuing a large amount of debt and using the funds to repurchase shares. Its assets are unchanged. Ignore interest tax shields.

According to the Capital Asset Pricing Model (CAPM), which statement is correct?

A firm changes its capital structure by issuing a large amount of equity and using the funds to repay debt. Its assets are unchanged. Ignore interest tax shields.

According to the Capital Asset Pricing Model (CAPM), which statement is correct?

The total return of any asset can be broken down in different ways. One possible way is to use the dividend discount model (or Gordon growth model):

###p_0 = \frac{c_1}{r_\text{total}-r_\text{capital}}###

Which, since ##c_1/p_0## is the income return (##r_\text{income}##), can be expressed as:

###r_\text{total}=r_\text{income}+r_\text{capital}###

So the total return of an asset is the income component plus the capital or price growth component.

Another way to break up total return is to use the Capital Asset Pricing Model:

###r_\text{total}=r_\text{f}+β(r_\text{m}- r_\text{f})###

###r_\text{total}=r_\text{time value}+r_\text{risk premium}###

So the risk free rate is the time value of money and the term ##β(r_\text{m}- r_\text{f})## is the compensation for taking on systematic risk.

Using the above theory and your general knowledge, which of the below equations, if any, are correct?

(I) ##r_\text{income}=r_\text{time value}##

(II) ##r_\text{income}=r_\text{risk premium}##

(III) ##r_\text{capital}=r_\text{time value}##

(IV) ##r_\text{capital}=r_\text{risk premium}##

(V) ##r_\text{income}+r_\text{capital}=r_\text{time value}+r_\text{risk premium}##

Which of the equations are correct?

The CAPM can be used to find a business's expected opportunity cost of capital:

###r_i=r_f+β_i (r_m-r_f)###

What should be used as the risk free rate ##r_f##?

Question 339 bond pricing, inflation, market efficiency, income and capital returns

Economic statistics released this morning were a surprise: they show a strong chance of consumer price inflation (CPI) reaching 5% pa over the next 2 years.

This is much higher than the previous forecast of 3% pa.

A vanilla fixed-coupon 2-year risk-free government bond was issued at par this morning, just before the economic news was released.

What is the expected change in bond price after the economic news this morning, and in the next 2 years? Assume that:

- Inflation remains at 5% over the next 2 years.

- Investors demand a constant real bond yield.

- The bond price falls by the (after-tax) value of the coupon the night before the ex-coupon date, as in real life.

A managed fund charges fees based on the amount of money that you keep with them. The fee is 2% of the start-of-year amount, but it is paid at the end of every year.

This fee is charged regardless of whether the fund makes gains or losses on your money.

The fund offers to invest your money in shares which have an expected return of 10% pa before fees.

You are thinking of investing $100,000 in the fund and keeping it there for 40 years when you plan to retire.

What is the Net Present Value (NPV) of investing your money in the fund? Note that the question is not asking how much money you will have in 40 years, it is asking: what is the NPV of investing in the fund? Assume that:

- The fund has no private information.

- Markets are weak and semi-strong form efficient.

- The fund's transaction costs are negligible.

- The cost and trouble of investing your money in shares by yourself, without the managed fund, is negligible.

Question 416 real estate, market efficiency, income and capital returns, DDM, CAPM

A residential real estate investor believes that house prices will grow at a rate of 5% pa and that rents will grow by 2% pa forever.

All rates are given as nominal effective annual returns. Assume that:

- His forecast is true.

- Real estate is and always will be fairly priced and the capital asset pricing model (CAPM) is true.

- Ignore all costs such as taxes, agent fees, maintenance and so on.

- All rental income cash flow is paid out to the owner, so there is no re-investment and therefore no additions or improvements made to the property.

- The non-monetary benefits of owning real estate and renting remain constant.

Which one of the following statements is NOT correct? Over time:

Due to floods overseas, there is a cut in the supply of the mineral iron ore and its price increases dramatically. An Australian iron ore mining company therefore expects a large but temporary increase in its profit and cash flows. The mining company does not have any positive NPV projects to begin, so what should it do? Select the most correct answer.

Currently, a mining company has a share price of $6 and pays constant annual dividends of $0.50. The next dividend will be paid in 1 year. Suddenly and unexpectedly the mining company announces that due to higher than expected profits, all of these windfall profits will be paid as a special dividend of $0.30 in 1 year.

If investors believe that the windfall profits and dividend is a one-off event, what will be the new share price? If investors believe that the additional dividend is actually permanent and will continue to be paid, what will be the new share price? Assume that the required return on equity is unchanged. Choose from the following, where the first share price includes the one-off increase in earnings and dividends for the first year only ##(P_\text{0 one-off})## , and the second assumes that the increase is permanent ##(P_\text{0 permanent})##:

Note: When a firm makes excess profits they sometimes pay them out as special dividends. Special dividends are just like ordinary dividends but they are one-off and investors do not expect them to continue, unlike ordinary dividends which are expected to persist.

A company conducts a 4 for 3 stock split. What is the percentage change in the stock price and the number of shares outstanding? The answers are given in the same order.

Question 455 income and capital returns, payout policy, DDM, market efficiency

A fairly priced unlevered firm plans to pay a dividend of $1 next year (t=1) which is expected to grow by 3% pa every year after that. The firm's required return on equity is 8% pa.

The firm is thinking about reducing its future dividend payments by 10% so that it can use the extra cash to invest in more projects which are expected to return 8% pa, and have the same risk as the existing projects. Therefore, next year's dividend will be $0.90. No new equity or debt will be issued to fund the new projects, they'll all be funded by the cut in dividends.

What will be the stock's new annual capital return (proportional increase in price per year) if the change in payout policy goes ahead?

Assume that payout policy is irrelevant to firm value (so there's no signalling effects) and that all rates are effective annual rates.

When someone says that they're "buying American dollars" (USD), what type of asset are they probably buying? They're probably buying:

Question 319 foreign exchange rate, monetary policy, American and European terms

Investors expect the Reserve Bank of Australia (RBA) to keep the policy rate steady at their next meeting.

Then unexpectedly, the RBA announce that they will increase the policy rate by 25 basis points due to fears that the economy is growing too fast and that inflation will be above their target rate of 2 to 3 per cent.

What do you expect to happen to Australia's exchange rate in the short term? The Australian dollar is likely to:

Question 320 foreign exchange rate, monetary policy, American and European terms

Investors expect the Reserve Bank of Australia (RBA) to decrease the overnight cash rate at their next meeting.

Then unexpectedly, the RBA announce that they will keep the policy rate unchanged.

What do you expect to happen to Australia's exchange rate in the short term? The Australian dollar is likely to:

Question 246 foreign exchange rate, forward foreign exchange rate, cross currency interest rate parity

Suppose the Australian cash rate is expected to be 8.15% pa and the US federal funds rate is expected to be 3.00% pa over the next 2 years, both given as nominal effective annual rates. The current exchange rate is at parity, so 1 USD = 1 AUD.

What is the implied 2 year forward foreign exchange rate?

Below is a graph of the USD against the JPY and EUR from 1980 to 2015, compiled by the RBA. Select the correct statement about what occurred between 1980 and 2015. Note that in 1980 the euro was around 1.3 USD per EUR and the Yen was around 250 JPY per USD.

Find the cash flow from assets (CFFA) of the following project.

| Project Data | |

| Project life | 2 years |

| Initial investment in equipment | $8m |

| Depreciation of equipment per year for tax purposes | $3m |

| Unit sales per year | 10m |

| Sale price per unit | $9 |

| Variable cost per unit | $4 |

| Fixed costs per year, paid at the end of each year | $2m |

| Tax rate | 30% |

Note 1: Due to the project, the firm will have to purchase $40m of inventory initially (at t=0). Half of this inventory will be sold at t=1 and the other half at t=2.

Note 2: The equipment will have a book value of $2m at the end of the project for tax purposes. However, the equipment is expected to fetch $1m when it is sold. Assume that the full capital loss is tax-deductible and taxed at the full corporate tax rate.

Note 3: The project will be fully funded by equity which investors will expect to pay dividends totaling $10m at the end of each year.

Find the project's CFFA at time zero, one and two. Answers are given in millions of dollars ($m).

A firm's weighted average cost of capital before tax (##r_\text{WACC before tax}##) would increase due to:

A company has:

- 50 million shares outstanding.

- The market price of one share is currently $6.

- The risk-free rate is 5% and the market return is 10%.

- Market analysts believe that the company's ordinary shares have a beta of 2.

- The company has 1 million preferred stock which have a face (or par) value of $100 and pay a constant dividend of 10% of par. They currently trade for $80 each.

- The company's debentures are publicly traded and their market price is equal to 90% of their face value.

- The debentures have a total face value of $60,000,000 and the current yield to maturity of corporate debentures is 10% per annum. The corporate tax rate is 30%.

What is the company's after-tax weighted average cost of capital (WACC)? Assume a classical tax system.

Question 104 CAPM, payout policy, capital structure, Miller and Modigliani, risk

Assume that there exists a perfect world with no transaction costs, no asymmetric information, no taxes, no agency costs, equal borrowing rates for corporations and individual investors, the ability to short the risk free asset, semi-strong form efficient markets, the CAPM holds, investors are rational and risk-averse and there are no other market frictions.

For a firm operating in this perfect world, which statement(s) are correct?

(i) When a firm changes its capital structure and/or payout policy, share holders' wealth is unaffected.

(ii) When the idiosyncratic risk of a firm's assets increases, share holders do not expect higher returns.

(iii) When the systematic risk of a firm's assets increases, share holders do not expect higher returns.

Select the most correct response:

Question 271 CAPM, option, risk, systematic risk, systematic and idiosyncratic risk

All things remaining equal, according to the capital asset pricing model, if the systematic variance of an asset increases, its required return will increase and its price will decrease.

If the idiosyncratic variance of an asset increases, its price will be unchanged.

What is the relationship between the price of a call or put option and the total, systematic and idiosyncratic variance of the underlying asset that the option is based on? Select the most correct answer.

Call and put option prices increase when the:

Assets A, B, M and ##r_f## are shown on the graphs above. Asset M is the market portfolio and ##r_f## is the risk free yield on government bonds. Assume that investors can borrow and lend at the risk free rate. Which of the below statements is NOT correct?

Assets A, B, M and ##r_f## are shown on the graphs above. Asset M is the market portfolio and ##r_f## is the risk free yield on government bonds. Which of the below statements is NOT correct?

A stock's required total return will increase when its:

The accounting identity states that the book value of a company's assets (A) equals its liabilities (L) plus owners equity (OE), so A = L + OE.

The finance version states that the market value of a company's assets (V) equals the market value of its debt (D) plus equity (E), so V = D + E.

Therefore a business's assets can be seen as a portfolio of the debt and equity that fund the assets.

Let ##\sigma_\text{V total}^2## be the total variance of returns on assets, ##\sigma_\text{V syst}^2## be the systematic variance of returns on assets, and ##\sigma_\text{V idio}^2## be the idiosyncratic variance of returns on assets, and ##\rho_\text{D idio, E idio}## be the correlation between the idiosyncratic returns on debt and equity.

Which of the following equations is NOT correct?

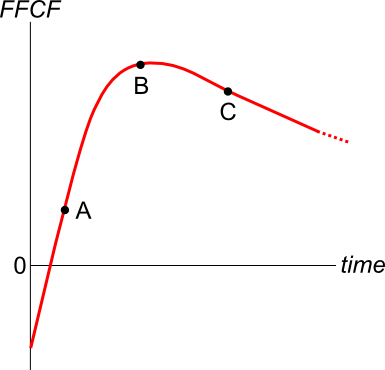

An old company's Firm Free Cash Flow (FFCF, same as CFFA) is forecast in the graph below.

To value the firm's assets, the terminal value needs to be calculated using the perpetuity with growth formula:

###V_{\text{terminal, }t-1} = \dfrac{FFCF_{\text{terminal, }t}}{r-g}###

Which point corresponds to the best time to calculate the terminal value?

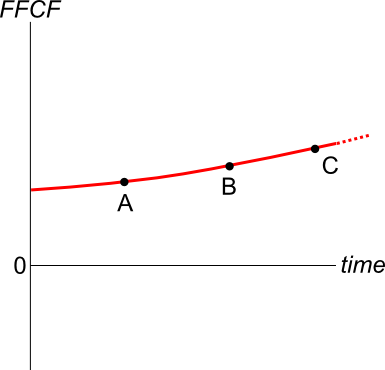

A new company's Firm Free Cash Flow (FFCF, same as CFFA) is forecast in the graph below.

To value the firm's assets, the terminal value needs to be calculated using the perpetuity with growth formula:

###V_{\text{terminal, }t-1} = \dfrac{FFCF_{\text{terminal, }t}}{r-g}###

Which point corresponds to the best time to calculate the terminal value?

Question 237 WACC, Miller and Modigliani, interest tax shield

Which of the following discount rates should be the highest for a levered company? Ignore the costs of financial distress.

Question 308 risk, standard deviation, variance, no explanation

A stock's standard deviation of returns is expected to be:

- 0.09 per month for the first 5 months;

- 0.14 per month for the next 7 months.

What is the expected standard deviation of the stock per year ##(\sigma_\text{annual})##?

Assume that returns are independently and identically distributed (iid) and therefore have zero auto-correlation.

Three important classes of investable risky assets are:

- Corporate debt which has low total risk,

- Real estate which has medium total risk,

- Equity which has high total risk.

Assume that the correlation between total returns on:

- Corporate debt and real estate is 0.1,

- Corporate debt and equity is 0.1,

- Real estate and equity is 0.5.

You are considering investing all of your wealth in one or more of these asset classes. Which portfolio will give the lowest total risk? You are restricted from shorting any of these assets. Disregard returns and the risk-return trade-off, pretend that you are only concerned with minimising risk.

Question 65 annuity with growth, needs refinement

Which of the below formulas gives the present value of an annuity with growth?

Hint: The equation of a perpetuity without growth is: ###V_\text{0, perp without growth} = \frac{C_\text{1}}{r}###

The formula for the present value of an annuity without growth is derived from the formula for a perpetuity without growth.

The idea is than an annuity with T payments from t=1 to T inclusive is equivalent to a perpetuity starting at t=1 with fixed positive cash flows, plus a perpetuity starting T periods later (t=T+1) with fixed negative cash flows. The positive and negative cash flows after time period T cancel each other out, leaving the positive cash flows between t=1 to T, which is the annuity.

###\begin{aligned} V_\text{0, annuity} &= V_\text{0, perp without growth from t=1} - V_\text{0, perp without growth from t=T+1} \\ &= \dfrac{C_\text{1}}{r} - \dfrac{ \left( \dfrac{C_\text{T+1}}{r} \right) }{(1+r)^T} \\ &= \dfrac{C_\text{1}}{r} - \dfrac{ \left( \dfrac{C_\text{1}}{r} \right) }{(1+r)^T} \\ &= \dfrac{C_\text{1}}{r}\left(1 - \dfrac{1}{(1+r)^T}\right) \\ \end{aligned}###

The equation of a perpetuity with growth is:

###V_\text{0, perp with growth} = \dfrac{C_\text{1}}{r-g}###