A share just paid its semi-annual dividend of $10. The dividend is expected to grow at 2% every 6 months forever. This 2% growth rate is an effective 6 month rate. Therefore the next dividend will be $10.20 in six months. The required return of the stock 10% pa, given as an effective annual rate.

What is the price of the share now?

A stock is expected to pay the following dividends:

| Cash Flows of a Stock | ||||||

| Time (yrs) | 0 | 1 | 2 | 3 | 4 | ... |

| Dividend ($) | 0 | 6 | 12 | 18 | 20 | ... |

After year 4, the dividend will grow in perpetuity at 5% pa. The required return of the stock is 10% pa. Both the growth rate and required return are given as effective annual rates.

What will be the price of the stock in 7 years (t = 7), just after the dividend at that time has been paid?

In the dividend discount model:

### P_0= \frac{d_1}{r-g} ###

The pronumeral ##g## is supposed to be the:

Question 447 payout policy, corporate financial decision theory

Payout policy is most closely related to which part of a business?

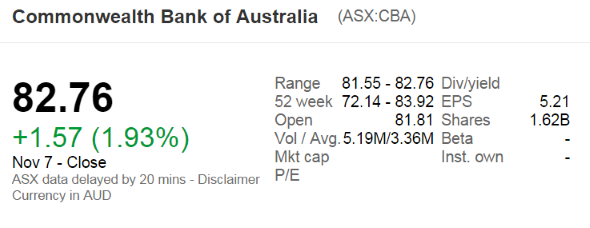

The below screenshot of Commonwealth Bank of Australia's (CBA) details were taken from the Google Finance website on 7 Nov 2014. Some information has been deliberately blanked out.

What was CBA's market capitalisation of equity?

Question 524 risk, expected and historical returns, bankruptcy or insolvency, capital structure, corporate financial decision theory, limited liability

Which of the following statements is NOT correct?

You have $100,000 in the bank. The bank pays interest at 10% pa, given as an effective annual rate.

You wish to consume twice as much now (t=0) as in one year (t=1) and have nothing left in the bank at the end.

How much can you consume at time zero and one? The answer choices are given in the same order.

Question 693 boot strapping zero coupon yield, forward interest rate, term structure of interest rates

Information about three risk free Government bonds is given in the table below.

| Federal Treasury Bond Data | ||||

| Maturity | Yield to maturity | Coupon rate | Face value | Price |

| (years) | (pa, compounding semi-annually) | (pa, paid semi-annually) | ($) | ($) |

| 0.5 | 3% | 4% | 100 | 100.4926 |

| 1 | 4% | 4% | 100 | 100.0000 |

| 1.5 | 5% | 4% | 100 | 98.5720 |

Based on the above government bonds' yields to maturity, which of the below statements about the spot zero rates and forward zero rates is NOT correct?

A stock is expected to pay a dividend of $1 in one year. Its future annual dividends are expected to grow by 10% pa. So the first dividend of $1 is in one year, and the year after that the dividend will be $1.1 (=1*(1+0.1)^1), and a year later $1.21 (=1*(1+0.1)^2) and so on forever.

Its required total return is 30% pa. The total required return and growth rate of dividends are given as effective annual rates. The stock is fairly priced.

Calculate the pay back period of buying the stock and holding onto it forever, assuming that the dividends are received as at each time, not smoothly over each year.

The market's expected total return is 10% pa and the risk free rate is 5% pa, both given as effective annual rates.

A stock has a beta of 0.7.

What do you think will be the stock's expected return over the next year, given as an effective annual rate?