A project's NPV is positive. Select the most correct statement:

A four year bond has a face value of $100, a yield of 9% and a fixed coupon rate of 6%, paid semi-annually. What is its price?

A company announces that it will pay a dividend, as the market expected. The company's shares trade on the stock exchange which is open from 10am in the morning to 4pm in the afternoon each weekday. When would the share price be expected to fall by the amount of the dividend? Ignore taxes.

The share price is expected to fall during the:

What is the covariance of a variable X with a constant C?

The cov(X, C) or ##\sigma_{X,C}## equals:

A stock's required total return will increase when its:

Question 784 boot strapping zero coupon yield, forward interest rate, term structure of interest rates

Information about three risk free Government bonds is given in the table below.

| Federal Treasury Bond Data | ||||

| Maturity | Yield to maturity | Coupon rate | Face value | Price |

| (years) | (pa, compounding annually) | (pa, paid annually) | ($) | ($) |

| 1 | 0% | 2% | 100 | 102 |

| 2 | 1% | 2% | 100 | 101.9703951 |

| 3 | 2% | 2% | 100 | 100 |

Based on the above government bonds' yields to maturity, which of the below statements about the spot zero rates and forward zero rates is NOT correct?

A put option written on a risky non-dividend paying stock will mature in one month. As is normal, assume that the option's exercise price is non-zero and positive ##(K>0)## and the stock has limited liability ##(S>0)##.

Which of the following statements is NOT correct? The put option's:

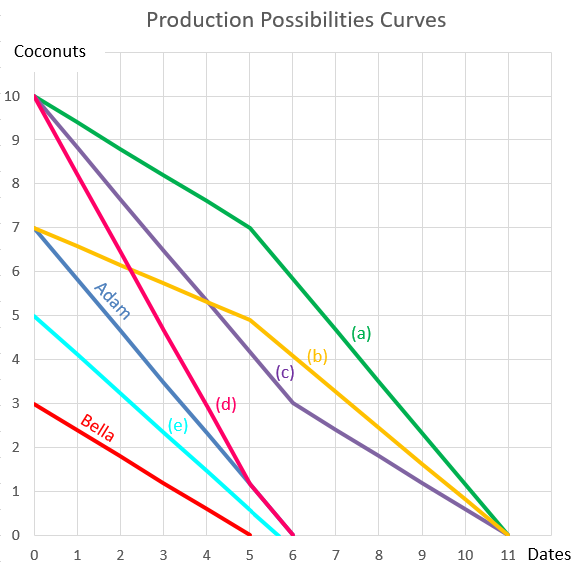

Question 898 comparative advantage in trade, production possibilities curve, no explanation

Adam and Bella are the only people on a remote island. Their production possibility curves are shown in the graph.

Assuming that Adam and Bella cooperate according to the principles of comparative advantage, what will be their combined production possibilities curve?

Question 921 utility, return distribution, log-normal distribution, arithmetic and geometric averages, no explanation

Who was the first theorist to propose the idea of ‘expected utility’?