Question 24 implicit interest rate in wholesale credit, effective rate

A bathroom and plumbing supplies shop offers credit to its customers. Customers are given 60 days to pay for their goods, but if they pay within 7 days they will get a 2% discount.

What is the effective interest rate implicit in the discount being offered? Assume 365 days in a year and that all customers pay on either the 7th day or the 60th day. All rates given in this question are effective annual rates.

Question 96 bond pricing, zero coupon bond, term structure of interest rates, forward interest rate

An Australian company just issued two bonds paying semi-annual coupons:

- 1 year zero coupon bond at a yield of 8% pa, and a

- 2 year zero coupon bond at a yield of 10% pa.

What is the forward rate on the company's debt from years 1 to 2? Give your answer as an APR compounding every 6 months, which is how the above bond yields are quoted.

A text book publisher is thinking of asking some teachers to write a new textbook at a cost of $100,000, payable now. The book would be written, printed and ready to sell to students in 2 years. It will be ready just before semester begins.

A cash flow of $100 would be made from each book sold, after all costs such as printing and delivery. There are 600 students per semester. Assume that every student buys a new text book. Remember that there are 2 semesters per year and students buy text books at the beginning of the semester.

Assume that text book publishers will sell the books at the same price forever and that the number of students is constant.

If the discount rate is 8% pa, given as an effective annual rate, what is the NPV of the project?

A share was bought for $10 (at t=0) and paid its annual dividend of $0.50 one year later (at t=1). Just after the dividend was paid, the share price was $11 (at t=1).

What was the total return, capital return and income return? Calculate your answers as effective annual rates. The choices are given in the same order:

##r_\text{total}##, ##r_\text{capital}##, ##r_\text{dividend}##.

You just signed up for a 30 year fully amortising mortgage loan with monthly payments of $2,000 per month. The interest rate is 9% pa which is not expected to change.

How much did you borrow? After 5 years, how much will be owing on the mortgage? The interest rate is still 9% and is not expected to change.

What is the net present value (NPV) of undertaking a full-time Australian undergraduate business degree as an Australian citizen? Only include the cash flows over the duration of the degree, ignore any benefits or costs of the degree after it's completed.

Assume the following:

- The degree takes 3 years to complete and all students pass all subjects.

- There are 2 semesters per year and 4 subjects per semester.

- University fees per subject per semester are $1,277, paid at the start of each semester. Fees are expected to remain constant in real terms for the next 3 years.

- There are 52 weeks per year.

- The first semester is just about to start (t=0). The first semester lasts for 19 weeks (t=0 to 19).

- The second semester starts immediately afterwards (t=19) and lasts for another 19 weeks (t=19 to 38).

- The summer holidays begin after the second semester ends and last for 14 weeks (t=38 to 52). Then the first semester begins the next year, and so on.

- Working full time at the grocery store instead of studying full-time pays $20/hr and you can work 35 hours per week. Wages are paid at the end of each week and are expected to remain constant in real terms.

- Full-time students can work full-time during the summer holiday at the grocery store for the same rate of $20/hr for 35 hours per week.

- The discount rate is 9.8% pa. All rates and cash flows are real. Inflation is expected to be 3% pa. All rates are effective annual.

The NPV of costs from undertaking the university degree is:

Let the variance of returns for a share per month be ##\sigma_\text{monthly}^2##.

What is the formula for the variance of the share's returns per year ##(\sigma_\text{yearly}^2)##?

Assume that returns are independently and identically distributed (iid) so they have zero auto correlation, meaning that if the return was higher than average today, it does not indicate that the return tomorrow will be higher or lower than average.

Over the next year, the management of an unlevered company plans to:

- Achieve firm free cash flow (FFCF or CFFA) of $1m.

- Pay dividends of $1.8m

- Complete a $1.3m share buy-back.

- Spend $0.8m on new buildings without buying or selling any other fixed assets. This capital expenditure is included in the CFFA figure quoted above.

Assume that:

- All amounts are received and paid at the end of the year so you can ignore the time value of money.

- The firm has sufficient retained profits to pay the dividend and complete the buy back.

- The firm plans to run a very tight ship, with no excess cash above operating requirements currently or over the next year.

How much new equity financing will the company need? In other words, what is the value of new shares that will need to be issued?

You have $100,000 in the bank. The bank pays interest at 10% pa, given as an effective annual rate.

You wish to consume twice as much now (t=0) as in one year (t=1) and have nothing left in the bank at the end.

How much can you consume at time zero and one? The answer choices are given in the same order.

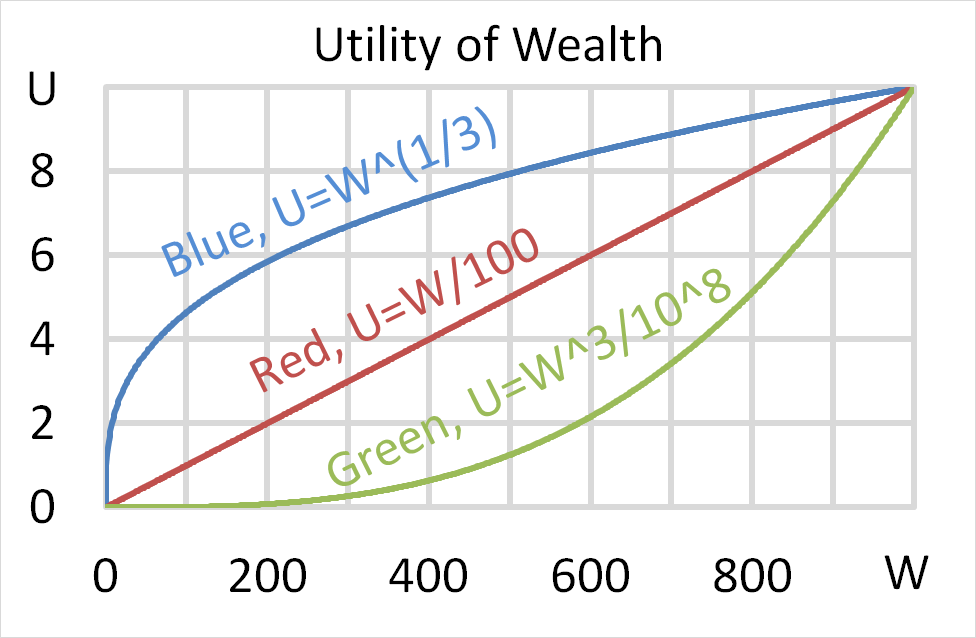

Question 704 utility, risk aversion, utility function, gamble

Mr Blue, Miss Red and Mrs Green are people with different utility functions.

Each person has $256 of initial wealth. A coin toss game is offered to each person at a casino where the player can win or lose $256. Each player can flip a coin and if they flip heads, they receive $256. If they flip tails then they will lose $256. Which of the following statements is NOT correct?