What is the net present value (NPV) of undertaking a full-time Australian undergraduate business degree as an Australian citizen? Only include the cash flows over the duration of the degree, ignore any benefits or costs of the degree after it's completed.

Assume the following:

- The degree takes 3 years to complete and all students pass all subjects.

- There are 2 semesters per year and 4 subjects per semester.

- University fees per subject per semester are $1,277, paid at the start of each semester. Fees are expected to remain constant in real terms for the next 3 years.

- There are 52 weeks per year.

- The first semester is just about to start (t=0). The first semester lasts for 19 weeks (t=0 to 19).

- The second semester starts immediately afterwards (t=19) and lasts for another 19 weeks (t=19 to 38).

- The summer holidays begin after the second semester ends and last for 14 weeks (t=38 to 52). Then the first semester begins the next year, and so on.

- Working full time at the grocery store instead of studying full-time pays $20/hr and you can work 35 hours per week. Wages are paid at the end of each week and are expected to remain constant in real terms.

- Full-time students can work full-time during the summer holiday at the grocery store for the same rate of $20/hr for 35 hours per week.

- The discount rate is 9.8% pa. All rates and cash flows are real. Inflation is expected to be 3% pa. All rates are effective annual.

The NPV of costs from undertaking the university degree is:

Question 525 income and capital returns, real and nominal returns and cash flows, inflation

Which of the following statements about cash in the form of notes and coins is NOT correct? Assume that inflation is positive.

Notes and coins:

A firm has a debt-to-assets ratio of 20%. What is its debt-to-equity ratio?

Question 734 real and nominal returns and cash flows, inflation, DDM, no explanation

An equities analyst is using the dividend discount model to price a company's shares. The company operates domestically and has no plans to expand overseas. It is part of a mature industry with stable positive growth prospects.

The analyst has estimated the real required return (r) of the stock and the value of the dividend that the stock just paid a moment before ##(C_\text{0 before})##.

What is the highest perpetual real growth rate of dividends (g) that can be justified? Select the most correct statement from the following choices. The highest perpetual real expected growth rate of dividends that can be justified is the country's expected:

Question 809 Markowitz portfolio theory, CAPM, Jensens alpha, CML, systematic and idiosyncratic risk

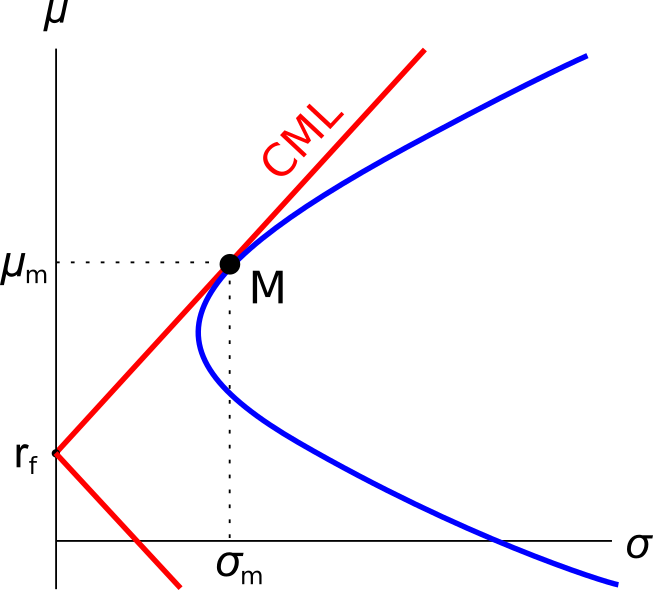

A graph of assets’ expected returns ##(\mu)## versus standard deviations ##(\sigma)## is given in the graph below. The CML is the capital market line.

Which of the following statements about this graph, Markowitz portfolio theory and the Capital Asset Pricing Model (CAPM) theory is NOT correct?

Question 924 foreign exchange rate, forward foreign exchange rate, arbitrage, forward interest rate, no explanation

Suppose that the yield curve in the United States of America and Australia is flat and that the current:

- USD federal funds rate is 1% pa;

- AUD cash rate is 1.5% pa;

- Spot AUD exchange rate is 1 USD per AUD;

- One year forward AUD exchange rate is 0.97 USD per AUD.

You suspect that there’s an arbitrage opportunity.

Which one of the following statements about the potential arbitrage opportunity is NOT correct?

Question 979 balance of payments, current account, no explanation

This question is about the Balance of Payments.

Assume that all foreign and domestic assets are either debt which makes interest income or equity which makes dividend income, and vice versa for liabilities which cost interest and dividend payments, respectively.

Which of the following statements is NOT correct?

Question 981 margin loan, Basel accord, credit conversion factor

Margin loans secured by listed stock have a Basel III risk weight of 20%.

For margin loans that cannot be immediately cancelled by banks and asked to be repaid, the credit conversion factor (CCF) is 20%.

Suppose you have a stock portfolio worth $500,000, financed by:

- $300,000 of your own money; and

- $200,000 of the bank’s funds in the form of a margin loan which can only be cancelled by the bank after 5 days notice. The margin loan’s maximum LVR is 70%.

How much regulatory capital must the bank hold due to your margin loan? Assume that the bank wishes to pay dividends to its shareholders, so include the 2.5% capital conservation buffer in your calculations.