Question 407 income and capital returns, inflation, real and nominal returns and cash flows

A stock has a real expected total return of 7% pa and a real expected capital return of 2% pa.

Inflation is expected to be 2% pa. All rates are given as effective annual rates.

What is the nominal expected total return, capital return and dividend yield? The answers below are given in the same order.

Calculate the price of a newly issued ten year bond with a face value of $100, a yield of 8% pa and a fixed coupon rate of 6% pa, paid semi-annually. So there are two coupons per year, paid in arrears every six months.

Question 572 bond pricing, zero coupon bond, term structure of interest rates, expectations hypothesis, forward interest rate, yield curve

In the below term structure of interest rates equation, all rates are effective annual yields and the numbers in subscript represent the years that the yields are measured over:

###(1+r_{0-3})^3 = (1+r_{0-1})(1+r_{1-2})(1+r_{2-3}) ###

Which of the following statements is NOT correct?

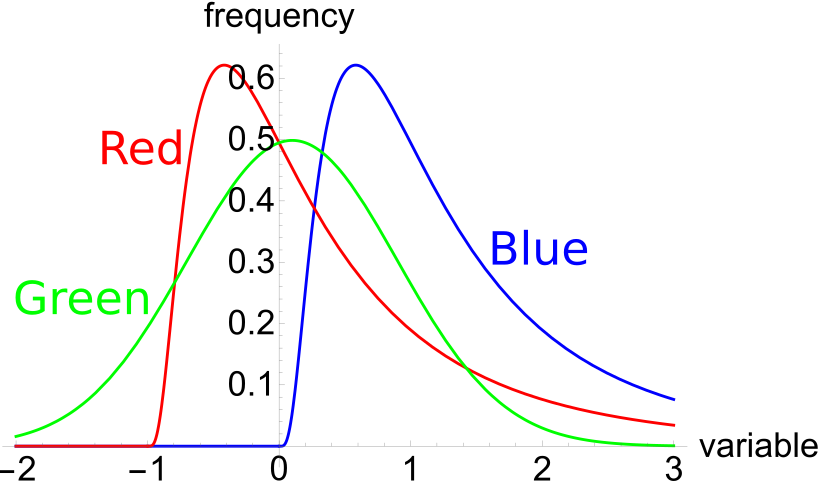

The below three graphs show probability density functions (PDF) of three different random variables Red, Green and Blue. Let ##P_1## be the unknown price of a stock in one year. ##P_1## is a random variable. Let ##P_0 = 1##, so the share price now is $1. This one dollar is a constant, it is not a variable.

Which of the below statements is NOT correct? Financial practitioners commonly assume that the shape of the PDF represented in the colour:

Question 787 fixed for floating interest rate swap, intermediated swap

The below table summarises the borrowing costs confronting two companies A and B.

| Bond Market Yields | ||||

| Fixed Yield to Maturity (%pa) | Floating Yield (%pa) | |||

| Firm A | 2 | L - 0.1 | ||

| Firm B | 2.5 | L | ||

Firm A wishes to borrow at a floating rate and Firm B wishes to borrow at a fixed rate. Design an intermediated swap (which means there will actually be two swaps) that nets a bank 0.15% and grants the remaining swap benefits to Firm A only. Which of the following statements about the swap is NOT correct?

Question 798 idiom, diversification, market efficiency, sunk cost, no explanation

The following quotes are most closely related to which financial concept?

- “Opportunity is missed by most people because it is dressed in overalls and looks like work” -Thomas Edison

- “The only place where success comes before work is in the dictionary” -Vidal Sassoon

- “The safest way to double your money is to fold it over and put it in your pocket” - Kin Hubbard

Question 860 idiom, hedging, speculation, arbitrage, market making, insider trading, no explanation

Which class of derivatives market trader is NOT principally focused on ‘buying low and selling high’?

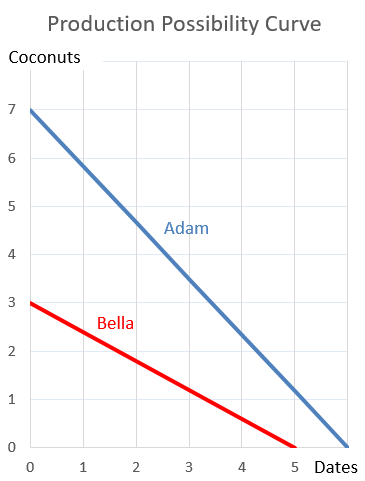

Question 896 comparative advantage in trade, production possibilities curve, no explanation

Adam and Bella are the only people on a remote island. Their production possibility curves are shown in the graph.

Which of the following statements is NOT correct?