Diversification is achieved by investing in a large amount of stocks. What type of risk is reduced by diversification?

A bond maturing in 10 years has a coupon rate of 4% pa, paid semi-annually. The bond's yield is currently 6% pa. The face value of the bond is $100. What is its price?

Question 235 SML, NPV, CAPM, risk

The security market line (SML) shows the relationship between beta and expected return.

Investment projects that plot on the SML would have:

A young lady is trying to decide if she should attend university or begin working straight away in her home town.

The young lady's grandma says that she should not go to university because she is less likely to marry the local village boy whom she likes because she will spend less time with him if she attends university.

What's the correct way to classify this item from a capital budgeting perspective when trying to decide whether to attend university?

The cost of not marrying the local village boy should be classified as:

Total cash flows can be broken into income and capital cash flows.

What is the name given to the cash flow generated from selling shares at a higher price than they were bought?

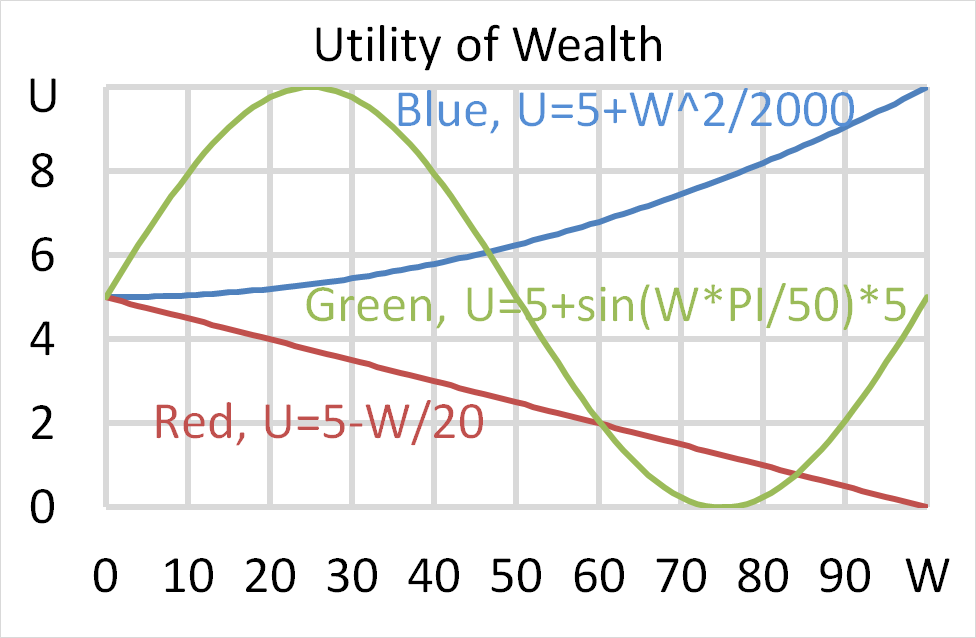

Question 702 utility, risk aversion, utility function, gamble

Mr Blue, Miss Red and Mrs Green are people with different utility functions.

Each person has $50 of initial wealth. A coin toss game is offered to each person at a casino where the player can win or lose $50. Each player can flip a coin and if they flip heads, they receive $50. If they flip tails then they will lose $50. Which of the following statements is NOT correct?

A stock, a call, a put and a bond are available to trade. The call and put options' underlying asset is the stock they and have the same strike prices, ##K_T##.

You are currently long the stock. You want to hedge your long stock position without actually trading the stock. How would you do this?

Question 858 indirect security, intermediated finance, no explanation

Which of the following transactions involves an ‘indirect security’ using a ‘financial intermediary’?

Question 906 effective rate, return types, net discrete return, return distribution, price gains and returns over time

For an asset's price to double from say $1 to $2 in one year, what must its effective annual return be? Note that an effective annual return is also called a net discrete return per annum. If the price now is ##P_0## and the price in one year is ##P_1## then the effective annul return over the next year is:

###r_\text{effective annual} = \dfrac{P_1 - P_0}{P_0} = \text{NDR}_\text{annual}###