The option price, also known as the option premium, is paid at the start when the option contract is first agreed to. The buyer (who is long the option) pays the option price to the seller (who is short the option).

The strike price of the option is paid at the end when the option contract matures, assuming that the option ends up being in the money in which case the buyer will exercise. The buyer (who is long the option) pays the option strike price to the seller (who is short the option) at maturity in exchange for the underlying asset if the contract is physically settled. If the contract is cash-settled then the seller will pay the difference between the underlying asset's value and the strike price.

You believe that the price of a share will fall significantly very soon, but the rest of the market does not. The market thinks that the share price will remain the same. Assuming that your prediction will soon be true, which of the following trades is a bad idea? In other words, which trade will NOT make money or prevent losses?

All of the above trades will result in gains or the avoidance of losses except selling put options on the stock. Selling (shorting) put options will result in a positive premium payment at the start, but there will be a negative payoff at maturity if the stock price falls. The long put trader counterparty will exercise her put option to sell the low-value stock at the high exercise price. So the short put trader will be obliged to buy the low-value stock for the high price at maturity, losing money.

Note that shorting futures or forwards will also result in gains from falling prices.

Which option position has the possibility of unlimited potential losses?

The short call option position has potentially unlimited losses since the writer of these options loses money if the underlying share price rises, and the share price can theoretically rise infinitely high. There is a lower bound on the underlying stock price (zero) due to the limited liability of equity, but there is no upper bound on share prices.

A man just sold a call option to his counterparty, a lady. The man has just now:

The man selling the call option is 'short' the option. His counterparty, the lady, is 'long' the call option.

The man has sold the right that allows her to buy the underlying asset from him at maturity if she wants.

This is also equivalent to him selling a contract that obliges him to sell the underlying asset to her at maturity if she wants.

A European call option will mature in ##T## years with a strike price of ##K## dollars. The underlying asset has a price of ##S## dollars.

What is an expression for the payoff at maturity ##(f_T)## in dollars from owning (being long) the call option?

No explanation provided.

A European put option will mature in ##T## years with a strike price of ##K## dollars. The underlying asset has a price of ##S## dollars.

What is an expression for the payoff at maturity ##(f_T)## in dollars from owning (being long) the put option?

No explanation provided.

A European call option will mature in ##T## years with a strike price of ##K## dollars. The underlying asset has a price of ##S## dollars.

What is an expression for the payoff at maturity ##(f_T)## in dollars from having written (being short) the call option?

No explanation provided.

A European put option will mature in ##T## years with a strike price of ##K## dollars. The underlying asset has a price of ##S## dollars.

What is an expression for the payoff at maturity ##(f_T)## in dollars from having written (being short) the put option?

No explanation provided.

Question 432 option, option intrinsic value, no explanation

An American style call option with a strike price of ##K## dollars will mature in ##T## years. The underlying asset has a price of ##S## dollars.

What is an expression for the current intrinsic value in dollars from owning (being long) the American style call option? Note that the intrinsic value of an option does not subtract the premium paid to buy the option.

No explanation provided.

Which one of the following statements about option contracts is NOT correct?

An option's strike or exercise price is fixed for the life of the option. It is written in the option contract and does not change.

Which of the following statements about option contracts is NOT correct? For every:

For every call option there does not necessarily have to be a put option.

The other statements are true.

If trader A has sold the right that allows counterparty B to buy the underlying asset from him at maturity if counterparty B wants then trader A is:

Since trader A has sold an option, he is short. Because trader B can buy the underlying asset at maturity, trader B has a call option. Therefore trader A has sold a call option (and trader B has bought a call option).

Note that the long or short aspect is about what happens at the start (t=0).

The call or put aspect is about what happens at maturity (t=T).

After doing extensive fundamental analysis of a company, you believe that their shares are overpriced and will soon fall significantly. The market believes that there will be no such fall.

Which of the following strategies is NOT a good idea, assuming that your prediction is true?

Buying call options will not be profitable because you will pay the premium or option price at the start, and then after the stock price falls, the call option will end out-of-the-money so there will be no pay out at maturity.

However, selling call options would be a good idea since the option premium will be received at the start, and when the the stock price falls the call option will be out-of-the-money so there will be no cost at maturity.

Question 636 option, option payoff at maturity, no explanation

Which of the below formulas gives the payoff ##(f)## at maturity ##(T)## from being long a call option? Let the underlying asset price at maturity be ##S_T## and the exercise price be ##X_T##.

No explanation provided.

Question 637 option, option payoff at maturity, no explanation

Which of the below formulas gives the payoff ##(f)## at maturity ##(T)## from being short a call option? Let the underlying asset price at maturity be ##S_T## and the exercise price be ##X_T##.

No explanation provided.

Question 638 option, option payoff at maturity, no explanation

Which of the below formulas gives the payoff ##(f)## at maturity ##(T)## from being long a put option? Let the underlying asset price at maturity be ##S_T## and the exercise price be ##X_T##.

No explanation provided.

Question 639 option, option payoff at maturity, no explanation

Which of the below formulas gives the payoff ##(f)## at maturity ##(T)## from being short a put option? Let the underlying asset price at maturity be ##S_T## and the exercise price be ##X_T##.

No explanation provided.

Which one of the below option and futures contracts gives the possibility of potentially unlimited gains?

No explanation provided.

A trader buys one crude oil European style call option contract on the CME expiring in one year with an exercise price of $44 per barrel for a price of $6.64. The crude oil spot price is $40.33. If the trader doesn’t close out her contract before maturity, then at maturity she will have the:

No explanation provided.

Which of the below formulas gives the profit ##(\pi)## from being long a call option? Let the underlying asset price at maturity be ##S_T##, the exercise price be ##X_T## and the option price be ##f_{LC,0}##. Note that ##S_T##, ##X_T## and ##f_{LC,0}## are all positive numbers.

No explanation provided.

Which of the below formulas gives the profit ##(\pi)## from being short a call option? Let the underlying asset price at maturity be ##S_T##, the exercise price be ##X_T## and the option price be ##f_{LC,0}##. Note that ##S_T##, ##X_T## and ##f_{LC,0}## are all positive numbers.

No explanation provided.

Which of the below formulas gives the profit ##(\pi)## from being long a put option? Let the underlying asset price at maturity be ##S_T##, the exercise price be ##X_T## and the option price be ##f_{LP,0}##. Note that ##S_T##, ##X_T## and ##f_{LP,0}## are all positive numbers.

No explanation provided.

Which of the below formulas gives the profit ##(\pi)## from being short a put option? Let the underlying asset price at maturity be ##S_T##, the exercise price be ##X_T## and the option price be ##f_{LP,0}##. Note that ##S_T##, ##X_T## and ##f_{LP,0}## are all positive numbers.

No explanation provided.

A trader sells one crude oil European style call option contract on the CME expiring in one year with an exercise price of $44 per barrel for a price of $6.64. The crude oil spot price is $40.33. If the trader doesn’t close out her contract before maturity, then at maturity she will have the:

No explanation provided.

A trader buys one crude oil European style put option contract on the CME expiring in one year with an exercise price of $44 per barrel for a price of $6.64. The crude oil spot price is $40.33. If the trader doesn’t close out her contract before maturity, then at maturity she will have the:

No explanation provided.

Which of the following statements about call options is NOT correct?

No explanation provided.

A trader just bought a European style put option on CBA stock. The current option premium is $2, the exercise price is $75, the option matures in one year and the spot CBA stock price is $74.

Which of the following statements is NOT correct?

The put option is currently 'in-the-money' since the current stock price ##(S_0 = 74)## is less than the strike price ##(K_T = 75)##.

If the put option could be exercised now then it would be worth $1 to the buyer. ###f_\text{LP,T}=max(K_T-S_T,0)=max(75-74,0)=max(1,0)=1### Note that this European style option cannot actually be exercised now, it can only be exericed at expiry (T, also called maturity). American style options can be exercised before expiry.

No explanation provided.

No explanation provided.

No explanation provided.

No explanation provided.

No explanation provided.

No explanation provided.

Question 584 option, option payoff at maturity, option profit

Which of the following statements about European call options on non-dividend paying stocks is NOT correct?

Call options on non-dividend paying stocks should be exercised when the stock price is above the exercise price, not the break-even price. This is because the exercise price is less than the break even price. Even if the profit from exercising the option is negative, so long as exercising still provides a positive cash flow at maturity then it is in the option holders' interest to exercise. After all, the original cost of the option is a sunk cost by the time that the option matures. Therefore subtracting the original cost of the option to calculate profit is a little silly after the option matures, so the break-even price is also irrelevant after maturity.

All other statements are true.

A company runs a number of slaughterhouses which supply hamburger meat to McDonalds. The company is afraid that live cattle prices will increase over the next year, even though there is widespread belief in the market that they will be stable. What can the company do to hedge against the risk of increasing live cattle prices? Which statement(s) are correct?

(i) buy call options on live cattle.

(ii) buy put options on live cattle.

(iii) sell call options on live cattle.

Select the most correct response:

If live cattle prices increase, the slaughterhouse will lose money since it will have higher costs from buying more expensive cattle in the future. Therefore if cattle prices rise, the losses from the business should be offset by gains on options.

Buying call options will result in positive payoffs at maturity if the underlying asset (cattle prices) rise above the exercise price. Buying these options will require the payment of the option price (also called premium) at the start, but since the market believes that cattle prices will remain stable, the price of these call options should be small.

Note that selling put options can also be used to gain from increasing live cattle prices. But this would be a less effective hedge since the gain from selling a put option is only from the premium payment at the start which is fixed. The gain doesn't scale up with the increase in cattle prices, unlike buying calls where the payoff at maturity increases in line with cattle prices.

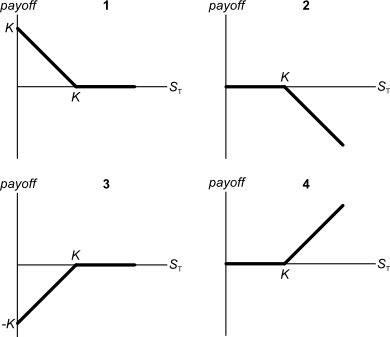

Below are 4 option graphs. Note that the y-axis is payoff at maturity (T). What options do they depict? List them in the order that they are numbered.

Some rules to help remember the way the graphs look:

- Long calls (graph 4) and long puts (graph 1) have a zero or positive payoff at maturity, so their graphs are always above the x-axis (the axis representing the underlying asset's spot price at maturity, ##S_T##). The short option graphs are the symmetric opposite, the graphs are reflected in the x-axis. The payoff is always zero or negative. This makes sense since options, like all derivatives, are a zero sum game: one trader's win is her counterparty's loss.

- The long call graph has a positive payoff if the underlying asset price goes up. It has a positive slope. The long put graph has a positive payoff if the underlying asset price goes down. It has a negative slope.

You have just sold an 'in the money' 6 month European put option on the mining company BHP at an exercise price of $40 for a premium of $3.

Which of the following statements best describes your situation?

You have sold a put option. Therefore you have sold the right for the put option buyer (your counterparty) to sell the underlying BHP share to you at maturity.

This also means that you are have the obligation to buy the underlying BHP share at maturity if the put option buyer exercises and wishes to sell the BHP share to you.

At maturity the put option's underlying asset (the BHP share) can be sold by the long put option trader (your counter-party) from the short put option trader (you). The long option trader will exercise the option if the BHP share price is below the $40 exercise price at maturity. If this happens, you will have to buy a BHP share from the long put option trader.

You operate a cattle farm that supplies hamburger meat to the big fast food chains. You buy a lot of grain to feed your cattle, and you sell the fully grown cattle on the livestock market.

You're afraid of adverse movements in grain and livestock prices. What options should you buy to hedge your exposures in the grain and cattle livestock markets?

Select the most correct response:

The cattle farmer has to buy grain and sell cattle. So he is afraid of grain prices going up in the future because then he'll have higher costs. And he is afraid of cattle prices going down in the future since then he will have less revenue.

If grain prices go up, he will lose money and be upset. To make up for this, he should buy call options on grain because they have a positive payoff when grain prices rise. In the event of a grain price increase, the positive cash flow of the long calls will make up for the negative cash flow from the farmer's business, so he will be hedged.

If cattle livestock prices go down, he will lose money and be upset. To make up for this, he should buy put options on cattle because they have a positive payoff when cattle prices fall. In the event of a cattle livestock price decline, the positive cash flow of the long puts will make up for the negative cash flow from the farmer's business, so he will be hedged.

Question 271 CAPM, option, risk, systematic risk, systematic and idiosyncratic risk

All things remaining equal, according to the capital asset pricing model, if the systematic variance of an asset increases, its required return will increase and its price will decrease.

If the idiosyncratic variance of an asset increases, its price will be unchanged.

What is the relationship between the price of a call or put option and the total, systematic and idiosyncratic variance of the underlying asset that the option is based on? Select the most correct answer.

Call and put option prices increase when the:

Option price variance is not the same thing as the option's underlying asset's variance

Shares, bonds, property and other asset prices including option prices decrease when the asset's systematic variance increases, according to the CAPM. But the systematic risk of an option itself is not the same thing as the systematic risk of the asset underlying the option, they are completely different.

In fact, call and put option prices increase when the total variance of the underlying asset increases. This is because call and put options have a minimum payoff of zero, so higher variance means more chance of ending up in the money. Therefore an increase in the underlying asset's total, systematic or idiosyncratic variance will increase the value of the call or put option.

Asset prices and their variance

The capital asset pricing model (CAPM) breaks total variance into systematic and idiosyncratic variances, and only systematic variance affects required returns and prices.

Assets' required returns increase with systematic variance since it is undiversifiable. If required returns increase and income payments (dividends, coupons or rent) stay the same, prices will decrease. Therefore systematic variance increases required returns and decreases prices of assets.

On the other hand, idiosyncratic variance is specific to the asset and can be diversified away in a portfolio and is therefore irrelevant. Idiosyncratic risk does not affect required returns or prices.