Question 278 inflation, real and nominal returns and cash flows

Imagine that the interest rate on your savings account was 1% per year and inflation was 2% per year.

Inflation is the proportional increase in price levels. An inflation rate of 2% means that a product that costs $10 now will cost $10.20 (=10(1+0.02)1) in one year.

If you have $1,000 in the bank right now, you can buy 100 (=1,000/10) products.

The bank interest rate is 1% so $1,000 in the bank will grow to be $1,010 (=1,000(1+0.01)1) in one year. Product prices are $10.20 at this time, so we can only buy 99 (or 99.02 =1,010/10.20) products rather than 100 products before.

Economist's method

An economist would say that the higher inflation rate has eroded our buying power.

A short cut to doing the calculations above is to find the real return using the Fisher equation,

###\begin{aligned} 1+r_\text{real} &= \frac{1+r_\text{nominal}}{1+r_\text{inflation}} \\ &= \frac{1+0.01}{1+0.02} \\ \end{aligned}###

###\begin{aligned} r_\text{real} &= \frac{1+0.01}{1+0.02} -1 \\ &= 0.990196078 -1 \\ &= -0.009803922 = -0.9803922\% \\ \end{aligned}###

This says that our real return is negative, so our wealth buys 0.98% less after one year, so instead of buying 100 products we can only buy 99.02 (=100(1-0.0098)) products in one year.

Note that the exact Fisher equation can be approximated:

###\begin{aligned} r_\text{real} &\approx r_\text{nominal} - r_\text{inflation} \\ &= 0.01 -0.02 \\ &= -0.01 = -1\%\\ \end{aligned}###

Commentary

This question was used in the '2004 Health and Retirement Survey' of Americans over the age of 50. The survey results were as follows:

- 75.2% of respondents answered it correctly,

- 13.4% were incorrect,

- 9.9% answered "don't know" and

- 1.5% refused to answer.

This question tests knowledge of inflation and was used in the research paper 'Financial Literacy and Planning: Implications for Retirement Wellbeing' by Annamaria Lusardi and Olivia S. Mitchell in 2011.

Question 992 inflation, real and nominal returns and cash flows

You currently have $100 in the bank which pays a 10% pa interest rate.

Oranges currently cost $1 each at the shop and inflation is 5% pa which is the expected growth rate in the orange price.

This information is summarised in the table below, with some parts missing that correspond to the answer options. All rates are given as effective annual rates. Note that when payments are not specified as real, as in this question, they're conventionally assumed to be nominal.

| Wealth in Dollars and Oranges | ||||

| Time (year) | Bank account wealth ($) | Orange price ($) | Wealth in oranges | |

| 0 | 100 | 1 | 100 | |

| 1 | 110 | 1.05 | (a) | |

| 2 | (b) | (c) | (d) | |

Which of the following statements is NOT correct? Your:

The real interest rate is exactly equal to 4.7619048% pa using the Fisher formula:

###\begin{aligned} 1+r_\text{real} &= \dfrac{1+r_\text{nominal}}{1+r_\text{inflation}} \\ &= \dfrac{1+0.1}{1+0.05} \\ \end{aligned}### ###r_\text{real} = 0.047619048###You can see that this is the rate at which your wealth grows by in real terms in oranges.

The real interest rate is approximately equal to 5% pa:

###\begin{aligned} r_\text{real} &\approx r_\text{nominal} - r_\text{inflation} \\ &\approx 0.1 - 0.05 \\ &\approx 0.05 \\ \end{aligned}###But this is just a rough approximation.

The below table shows all missing values:

| Wealth in Dollars and Oranges | ||||

| Time (year) | Bank account wealth ($) | Orange price ($) | Wealth in oranges | |

| 0 | 100 | 1 | 100 | |

| 1 | 110 | 1.05 | 104.7619048 | |

| 2 | 121 | 1.1025 | 109.7505669 | |

Question 993 inflation, real and nominal returns and cash flows

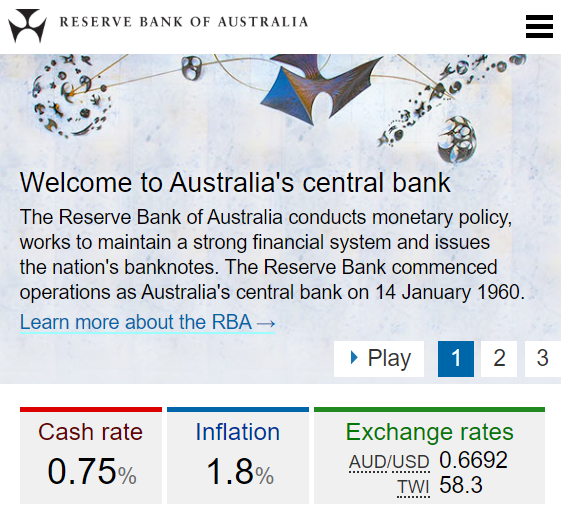

In February 2020, the RBA cash rate was 0.75% pa and the Australian CPI inflation rate was 1.8% pa.

You currently have $100 in the bank which pays a 0.75% pa interest rate.

Apples currently cost $1 each at the shop and inflation is 1.8% pa which is the expected growth rate in the apple price.

This information is summarised in the table below, with some parts missing that correspond to the answer options. All rates are given as effective annual rates. Note that when payments are not specified as real, as in this question, they're conventionally assumed to be nominal.

| Wealth in Dollars and Apples | ||||

| Time (year) | Bank account wealth ($) | Apple price ($) | Wealth in apples | |

| 0 | 100 | 1 | 100 | |

| 1 | 100.75 | 1.018 | (a) | |

| 2 | (b) | (c) | (d) | |

Which of the following statements is NOT correct? Your:

Real wealth at t=2 is $97.9477702 or 97.9477702 apples. To calculate this, we can find the real interest rate and grow current wealth by that real rate to find the real wealth at time 2.

The real interest rate is exactly equal to -1.0314342% pa using the Fisher formula:

###\begin{aligned} 1+r_\text{real} &= \dfrac{1+r_\text{nominal}}{1+r_\text{inflation}} \\ &= \dfrac{1+0.0075}{1+0.018} \\ \end{aligned}### ###r_\text{real} = -0.010314342###Real wealth at t=2 is then the current (t=0) wealth grown by the real interest rate over 2 years:

###\begin{aligned} \text{RealWealth}_2 &= \text{Wealth}_0(1+r_\text{real})^2 \\ &= \text{100}(1+-0.010314342)^2 \\ &= 97.9477702 \text{ apples or dollars}\\ \end{aligned}###Alternatively, real wealth at t=2 can be found by finding how many apples you can buy at this time, so divide nominal wealth by the nominal price of apples at time 2:

###\begin{aligned} \text{RealWealth}_2 &= \dfrac{\text{NominalWealth}_2}{\text{ApplePrice}_2} \\ &= \dfrac{\text{Wealth}_0(1+r_\text{nominal})^2}{\text{ApplePrice}_0(1+r_\text{inflation})^2} \\ &= \dfrac{100(1+0.0075)^2}{1(1+0.018)^2} \\ &= \dfrac{101.505625}{1.036324} \\ &= 97.9477702 \text{ apples or dollars}\\ \end{aligned}###The below table shows all missing values:

| Wealth in Dollars and Apples | ||||

| Time (year) | Bank account wealth ($) | Apple price ($) | Wealth in apples | |

| 0 | 100 | 1 | 100 | |

| 1 | 100.75 | 1.018 | 98.96856582 | |

| 2 | 101.505625 | 1.036324 | 97.9477702 | |

Commentary

Note that the negative real interest rate in early 2020 is unusual. When the economy is growing well and inflation is high within the RBA's 2 to 3% pa target band, real rates are usually positive to entice investors to save (lend or buy debt) rather than borrow (sell debt). However, in early 2020, the Australian central bank was afraid of a recession so they kept the overnight money market rate very low at 0.75% pa to encourage consumers to borrow and spend rather than save. The central bank is implementing expansionary monetary policy by keeping the interest rate so low since it encourages higher consumption and higher economic growth.

Question 295 inflation, real and nominal returns and cash flows, NPV

When valuing assets using discounted cash flow (net present value) methods, it is important to consider inflation. To properly deal with inflation:

(I) Discount nominal cash flows by nominal discount rates.

(II) Discount nominal cash flows by real discount rates.

(III) Discount real cash flows by nominal discount rates.

(IV) Discount real cash flows by real discount rates.

Which of the above statements is or are correct?

Nominal cash flows can be discounted using nominal discount rates. Also, real cash flows can be discounted using real discount rates. Both will give the same asset price.

###C_\text{0} = \dfrac{C_\text{t, nominal}}{(1+r_\text{nominal})^t} = \dfrac{C_\text{t, real}}{(1+r_\text{real})^t}###If the cash flows are nominal and the discount rate is real or vice-versa, it's usually easier to convert the discount rate to a nominal or real rate using the Fisher equation, and then discount the cash flows to arrive at the correct price.

###1+r_\text{real} = \dfrac{1+r_\text{nominal}}{1+r_\text{inflation}}###Cash flows can also be converted from nominal to real or vice versa using the inflation rate.

###C_\text{t, real} = \dfrac{C_\text{t, nominal}}{(1+r_\text{inflation})^t}###Question 353 income and capital returns, inflation, real and nominal returns and cash flows, real estate

A residential investment property has an expected nominal total return of 6% pa and nominal capital return of 3% pa.

Inflation is expected to be 2% pa. All rates are given as effective annual rates.

What are the property's expected real total, capital and income returns? The answer choices below are given in the same order.

The nominal total return and capital return are given, therefore the nominal income return can be calculated.

###r_\text{nominal, total} = r_\text{nominal, income} + r_\text{nominal, capital} ### ###0.06 = r_\text{nominal, income} + 0.03 ### ###\begin{aligned} r_\text{nominal, income} &= 0.06 - 0.03\\ &= 0.03 \\ \end{aligned}###The Fisher equation can be used to convert nominal rates to real rates. The exact version is:

###1+r_\text{real} = \dfrac{1+r_\text{nominal}}{1+r_\text{inflation}}###The approximation is:

###r_\text{real} \approx r_\text{nominal} - r_\text{inflation}###But the Fisher equation only applies to the total and capital returns, not the income return. This is obvious when considering the approximation of the Fisher equation. If inflation is subtracted from both the nominal capital and income returns, then since the total return is the sum of these two, inflation will be subtracted twice from the total return which is wrong.

Method 1: Fisher equation on total and capital returns

Work out the total and capital returns using the Fisher equation, then calculate the difference which is the income return.

To find the real total return:

###1+r_\text{real, total} = \dfrac{1+r_\text{nominal, total}}{1+r_\text{inflation}}### ###1+r_\text{real, total} = \dfrac{1+0.06}{1+0.02}### ###r_\text{real, total} = \dfrac{1+0.06}{1+0.02}-1 = 0.039215686 ###To find the real capital return:

###1+r_\text{real, capital} = \dfrac{1+r_\text{nominal, capital}}{1+r_\text{inflation}}### ###1+r_\text{real, capital} = \dfrac{1+0.03}{1+0.02}### ###r_\text{real, capital} = \dfrac{1+0.03}{1+0.02}-1 = 0.009803922 ###To find the real income return:

###r_\text{real, total} = r_\text{real, income} + r_\text{real, capital} ### ###0.039215686 = r_\text{real, income} + 0.009803922 ### ###\begin{aligned} r_\text{real, income} &= 0.039215686 - 0.009803922 \\ &= 0.029411765 \\ \end{aligned}###Method 2: Convert nominal cash flows to real cash flows

Discount all future nominal cash flows by inflation to get the real cash flows then calculate the real rates of return.

###\begin{aligned} r_\text{nominal, total} &= r_\text{nominal, income} + r_\text{nominal, capital} \\ &= \dfrac{C_\text{1, nominal}}{P_0} + \dfrac{P_\text{1, nominal}-P_0}{P_0} \\ \end{aligned}\\ \begin{aligned} r_\text{real, total} &= r_\text{real, income} + r_\text{real, capital} \\ &= \dfrac{C_\text{1, real}}{P_0} + \dfrac{P_\text{1, real}-P_0}{P_0} \\ &= \dfrac{ \left( \dfrac{C_\text{1, nominal}}{(1+r_\text{inflation})^1} \right) }{P_0} + \dfrac{\left( \dfrac{P_\text{1, nominal}}{(1+r_\text{inflation})^1} \right)-P_0}{P_0} \\ \end{aligned}\\###If the price now were, say, $1 then the nominal income cash flow in one period would be $0.03 which is the nominal income return times the price now. The nominal price in one period would be $1.03 ##(=1(1+0.03)^1)## which is the price now grown by the nominal capital return. Note that the price now ##(P_0)## is not affected by inflation. Substituting these and inflation into the above equation, the real returns can be calculated:

###\begin{aligned} r_\text{real, total} &= \dfrac{ \left( \dfrac{0.03}{(1+0.02)^1} \right) }{1} + \dfrac{\left( \dfrac{1.03}{(1+0.02)^1} \right)-1}{1} \\ &= 0.029411765 + 0.009803922 \\ &= 0.039215686 \\ \end{aligned}###So the real total return is 3.92%, the real capital return is 0.98% and the real income return is 2.94%.

Question 363 income and capital returns, inflation, real and nominal returns and cash flows, real estate

A residential investment property has an expected nominal total return of 8% pa and nominal capital return of 3% pa.

Inflation is expected to be 2% pa. All rates are given as effective annual rates.

What are the property's expected real total, capital and income returns? The answer choices below are given in the same order.

The Fisher equation can be used to calculate nominal and real rates. The exact version is:

###1+r_\text{real} = \dfrac{1+r_\text{nominal}}{1+r_\text{inflation}}###The approximation is:

###r_\text{real} \approx r_\text{nominal} - r_\text{inflation}###The only problem is that the Fisher equation above only applies to the total and capital returns, not the income return. This is obvious when considering the approximation of the Fisher equation. If inflation is subtracted from the capital return and the income return, then since the total return is the sum of the capital and income return, inflation will be subtracted twice from the total return which is wrong.

Method 1: Fisher equation on total and capital returns

Work out the total and capital returns using the Fisher equation, then calculate the difference which is the income return.

To find the real total return:

###1+r_\text{real, total} = \dfrac{1+r_\text{nominal, total}}{1+r_\text{inflation}}### ###1+r_\text{real, total} = \dfrac{1+0.08}{1+0.02}### ###r_\text{real, total} = \dfrac{1+0.08}{1+0.02}-1 = 0.058823529 ###To find the real capital return:

###1+r_\text{real, capital} = \dfrac{1+r_\text{nominal, capital}}{1+r_\text{inflation}}### ###1+r_\text{real, capital} = \dfrac{1+0.03}{1+0.02}### ###r_\text{real, capital} = \dfrac{1+0.03}{1+0.02}-1 = 0.009803922###To find the real income return:

###\begin{aligned} r_\text{real, total} &= r_\text{real, income} + r_\text{real, capital} \\ 0.058823529&= r_\text{real, income} + 0.009803922 \\ \end{aligned}### ###\begin{aligned} r_\text{real, income} &= 0.058823529 - 0.009803922 \\ &= 0.049019608\\ \end{aligned}###Method 2: Convert nominal cash flows to real cash flows

Discount all future nominal cash flows by inflation to get the real cash flows then calculate the real rates of return.

###\begin{aligned} r_\text{nominal, total} &= r_\text{nominal, income} + r_\text{nominal, capital} \\ &= \dfrac{C_\text{1, nominal}}{P_0} + \dfrac{P_\text{1, nominal}-P_0}{P_0} \\ \end{aligned}\\ \begin{aligned} r_\text{real, total} &= r_\text{real, income} + r_\text{real, capital} \\ &= \dfrac{C_\text{1, real}}{P_0} + \dfrac{P_\text{1, real}-P_0}{P_0} \\ &= \dfrac{ \left( \dfrac{C_\text{1, nominal}}{(1+r_\text{inflation})^1} \right) }{P_0} + \dfrac{\left( \dfrac{P_\text{1, nominal}}{(1+r_\text{inflation})^1} \right)-P_0}{P_0} \\ \end{aligned}\\###If the price now were, say, $1 then the nominal income cash flow in one period would be $0.05 (nominal income return times price now) and the nominal price in one period would be $1.03 (nominal capital return times price now). Note that the price now is not affected by inflation. Substituting these and inflation into the above equation, the real returns can be calculated:

###\begin{aligned} r_\text{real, total} &= \dfrac{ \left( \dfrac{0.05}{(1+0.02)^1} \right) }{1} + \dfrac{\left( \dfrac{1.03}{(1+0.02)^1} \right)-1}{1} \\ &= 0.049019608 + 0.009803922 \\ &= 0.058823529\\ \end{aligned}###So the real total return is 5.88%, the real capital return is 0.98% and the real income return is 4.90%.

Question 407 income and capital returns, inflation, real and nominal returns and cash flows

A stock has a real expected total return of 7% pa and a real expected capital return of 2% pa.

Inflation is expected to be 2% pa. All rates are given as effective annual rates.

What is the nominal expected total return, capital return and dividend yield? The answers below are given in the same order.

The Fisher equation can be used to calculate nominal and real rates. The exact version is:

###1+r_\text{real} = \dfrac{1+r_\text{nominal}}{1+r_\text{inflation}}###The approximation is:

###r_\text{real} \approx r_\text{nominal} - r_\text{inflation}###The only problem is that the Fisher equation only applies to the total and capital returns, not the income return. This is obvious when considering the approximation of the Fisher equation. If inflation is added to the real capital and income returns, then since the real total return is the sum of these two, inflation will be added twice to the total return which is wrong.

Method 1: Fisher equation on total and capital returns

Work out the total and capital returns using the Fisher equation, then calculate the difference which is the income return.

To find the nominal total return:

###1+r_\text{real, total} = \dfrac{1+r_\text{nominal, total}}{1+r_\text{inflation}}### ###1+0.07 = \dfrac{1+r_\text{nominal, total}}{1+0.02} ### ###r_\text{nominal, total} = (1+0.07)(1+0.02)-1 = 0.0914 ###To find the nominal capital return:

###1+r_\text{real, capital} = \dfrac{1+r_\text{nominal, capital}}{1+r_\text{inflation}}### ###1+0.02 = \dfrac{1+r_\text{nominal, capital}}{1+0.02} ### ###r_\text{nominal, capital} = (1+0.02)(1+0.02)-1 = 0.0404 ###To find the real income return:

###\begin{aligned} r_\text{nominal, total} &= r_\text{nominal, income} + r_\text{nominal, capital} \\ 0.0914 &= r_\text{nominal, income} + 0.0404 \\ \end{aligned}### ###\begin{aligned} r_\text{nominal, income} &= 0.0914 - 0.0404 \\ &= 0.051 \\ \end{aligned}###Method 2: Convert nominal cash flows to real cash flows

Grow all future real cash flows by inflation to get the nominal cash flows then calculate the nominal rates of return.

###\begin{aligned} r_\text{nominal, total} &= r_\text{nominal, income} + r_\text{nominal, capital} \\ &= \dfrac{C_\text{1, nominal}}{P_0} + \dfrac{P_\text{1, nominal}-P_0}{P_0} \\ &= \dfrac{C_\text{1, real}.(1+r_\text{inflation})^1}{P_0} + \dfrac{P_\text{1, real}.(1+r_\text{inflation})^1-P_0}{P_0} \\ \end{aligned}###If the price now were, say, $1 then the nominal income cash flow in one period would be $0.05 which is the nominal income return times the price now. The nominal price in one period would be $1.02 ##(=1(1+0.02)^1)## which is the price now grown by the nominal capital return. Note that the price now ##(P_0)## is not affected by inflation. Substituting these and inflation into the above equation, the real returns can be calculated:

###\begin{aligned} r_\text{nominal, total} &= \dfrac{C_\text{1, real}.(1+r_\text{inflation})^1}{P_0} + \dfrac{P_\text{1, real}.(1+r_\text{inflation})^1-P_0}{P_0} \\ &= \dfrac{0.05 \times (1+0.02)^1}{1} + \dfrac{1.02 \times (1+0.02)^1-1}{1} \\ &= 0.051 + 0.0404 \\ &= 0.0914 \\ \end{aligned}###So the real total return is 9.14%, the real capital return is 4.04% and the real income return is 5.1%.

In the 'Austin Powers' series of movies, the character Dr. Evil threatens to destroy the world unless the United Nations pays him a ransom (video 1, video 2). Dr. Evil makes the threat on two separate occasions:

- In 1969 he demands a ransom of $1 million (=10^6), and again;

- In 1997 he demands a ransom of $100 billion (=10^11).

If Dr. Evil's demands are equivalent in real terms, in other words $1 million will buy the same basket of goods in 1969 as $100 billion would in 1997, what was the implied inflation rate over the 28 years from 1969 to 1997?

The answer choices below are given as effective annual rates:

To find the inflation rate that makes $1 million grow into $100 billion in 28 years, use the 'present value of a single cash flow' equation:

###V_{0} = \dfrac{V_{t}}{(1+r_\text{inflation})^t} ### ###V_{1969} = \dfrac{V_{1997}}{(1+r_\text{inflation})^{28}} ### ###1,000,000 = \dfrac{100,000,000,000}{(1+r_\text{inflation})^{28}} ### ###(1+r_\text{inflation})^{28} = \dfrac{100,000,000,000}{1,000,000}### ###1+r_\text{inflation} = \left( \dfrac{100,000,000,000}{1,000,000} \right)^{1/28}### ###\begin{aligned} r_\text{inflation} &= (100,000)^{1/28} - 1 \\ &= 0.508591 \\ \end{aligned}###That's an unreasonably high inflation rate of more than 50% pa! This may indicate that in real terms, Dr. Evil's demands were much higher in 1997 compared to 1969.

Question 522 income and capital returns, real and nominal returns and cash flows, inflation, real estate

A residential investment property has an expected nominal total return of 6% pa and nominal capital return of 2.5% pa. Inflation is expected to be 2.5% pa.

All of the above are effective nominal rates and investors believe that they will stay the same in perpetuity.

What are the property's expected real total, capital and income returns?

The answer choices below are given in the same order.

The nominal total return and capital return are given, therefore the nominal income return can be calculated.

###r_\text{nominal, total} = r_\text{nominal, income} + r_\text{nominal, capital} ### ###0.06 = r_\text{nominal, income} + 0.025 ### ###\begin{aligned} r_\text{nominal, income} &= 0.06 - 0.025\\ &= 0.035 \\ \end{aligned}###The Fisher equation can be used to convert nominal rates to real rates. The exact version is:

###1+r_\text{real} = \dfrac{1+r_\text{nominal}}{1+r_\text{inflation}}###The approximation is:

###r_\text{real} \approx r_\text{nominal} - r_\text{inflation}###But the Fisher equation only applies to the total and capital returns, not the income return. This is obvious when considering the approximation of the Fisher equation. If inflation is subtracted from both the nominal capital and income returns, then since the total return is the sum of these two, inflation will be subtracted twice from the total return which is wrong.

Method 1: Fisher equation on total and capital returns

Work out the total and capital returns using the Fisher equation, then calculate the difference which is the income return.

To find the real total return:

###1+r_\text{real, total} = \dfrac{1+r_\text{nominal, total}}{1+r_\text{inflation}}### ###1+r_\text{real, total} = \dfrac{1+0.06}{1+0.025}### ###r_\text{real, total} = \dfrac{1+0.06}{1+0.025}-1 = 0.034146341###To find the real capital return:

###1+r_\text{real, capital} = \dfrac{1+r_\text{nominal, capital}}{1+r_\text{inflation}}### ###1+r_\text{real, capital} = \dfrac{1+0.025}{1+0.025}### ###r_\text{real, capital} = \dfrac{1+0.025}{1+0.025}-1 = 0###To find the real income return:

###r_\text{real, total} = r_\text{real, income} + r_\text{real, capital} ### ###0.034146341= r_\text{real, income} + 0### ###\begin{aligned} r_\text{real, income} &= 0.034146341\\ \end{aligned}###Method 2: Convert nominal cash flows to real cash flows

Discount all future nominal cash flows by inflation to get the real cash flows then calculate the real rates of return.

###\begin{aligned} r_\text{nominal, total} &= r_\text{nominal, income} + r_\text{nominal, capital} \\ &= \dfrac{C_\text{1, nominal}}{P_0} + \dfrac{P_\text{1, nominal}-P_0}{P_0} \\ \end{aligned}\\ \begin{aligned} r_\text{real, total} &= r_\text{real, income} + r_\text{real, capital} \\ &= \dfrac{C_\text{1, real}}{P_0} + \dfrac{P_\text{1, real}-P_0}{P_0} \\ &= \dfrac{ \left( \dfrac{C_\text{1, nominal}}{(1+r_\text{inflation})^1} \right) }{P_0} + \dfrac{\left( \dfrac{P_\text{1, nominal}}{(1+r_\text{inflation})^1} \right)-P_0}{P_0} \\ \end{aligned}\\###If the price now were, say, $1 then the nominal income cash flow in one period would be $0.035 which is the nominal income return times the price now. The nominal price in one period would be $1.025 ##(=1(1+0.025)^1)## which is the price now grown by the nominal capital return. Note that the price now ##(P_0)## is not affected by inflation. Substituting these and inflation into the above equation, the real returns can be calculated:

###\begin{aligned} r_\text{real, total} &= \dfrac{ \left( \dfrac{0.035}{(1+0.025)^1} \right) }{1} + \dfrac{\left( \dfrac{1.025}{(1+0.025)^1} \right)-1}{1} \\ &= 0.03414634146 + 0 \\ &= 0.03414634146 \\ \end{aligned}###So the real total return is 3.41%, the real capital return is 0% and the real income return is 3.41%.

Thanks to Shahzada for his corrections to this solution.

Question 523 income and capital returns, real and nominal returns and cash flows, inflation

A low-growth mature stock has an expected nominal total return of 6% pa and nominal capital return of 2% pa. Inflation is expected to be 3% pa.

All of the above are effective nominal rates and investors believe that they will stay the same in perpetuity.

What are the stock's expected real total, capital and income returns?

The answer choices below are given in the same order.

The nominal total return and capital return are given, therefore the nominal income return can be calculated.

###r_\text{nominal, total} = r_\text{nominal, income} + r_\text{nominal, capital} ### ###0.06 = r_\text{nominal, income} + 0.02 ### ###\begin{aligned} r_\text{nominal, income} &= 0.06 - 0.02\\ &= 0.04 \\ \end{aligned}###The Fisher equation can be used to convert nominal rates to real rates. The exact version is:

###1+r_\text{real} = \dfrac{1+r_\text{nominal}}{1+r_\text{inflation}}###The approximation is:

###r_\text{real} \approx r_\text{nominal} - r_\text{inflation}###But the Fisher equation only applies to the total and capital returns, not the income return. This is obvious when considering the approximation of the Fisher equation. If inflation is subtracted from both the nominal capital and income returns, then since the total return is the sum of these two, inflation will be subtracted twice from the total return which is wrong.

Method 1: Fisher equation on total and capital returns

Work out the total and capital returns using the Fisher equation, then calculate the difference which is the income return.

To find the real total return:

###1+r_\text{real, total} = \dfrac{1+r_\text{nominal, total}}{1+r_\text{inflation}}### ###1+r_\text{real, total} = \dfrac{1+0.06}{1+0.03}### ###r_\text{real, total} = \dfrac{1+0.06}{1+0.03}-1 = 0.029126214###To find the real capital return:

###1+r_\text{real, capital} = \dfrac{1+r_\text{nominal, capital}}{1+r_\text{inflation}}### ###1+r_\text{real, capital} = \dfrac{1+0.02}{1+0.03}### ###r_\text{real, capital} = \dfrac{1+0.02}{1+0.03}-1 = -0.009708738###To find the real income return:

###r_\text{real, total} = r_\text{real, income} + r_\text{real, capital} ### ###0.029126214= r_\text{real, income} - 0.009708738### ###\begin{aligned} r_\text{real, income} &= 0.029126214 + 0.009708738\\ &= 0.038834951 \\ \end{aligned}###Method 2: Convert nominal cash flows to real cash flows

Discount all future nominal cash flows by inflation to get the real cash flows then calculate the real rates of return.

###\begin{aligned} r_\text{nominal, total} &= r_\text{nominal, income} + r_\text{nominal, capital} \\ &= \dfrac{C_\text{1, nominal}}{P_0} + \dfrac{P_\text{1, nominal}-P_0}{P_0} \\ \end{aligned}\\ \begin{aligned} r_\text{real, total} &= r_\text{real, income} + r_\text{real, capital} \\ &= \dfrac{C_\text{1, real}}{P_0} + \dfrac{P_\text{1, real}-P_0}{P_0} \\ &= \dfrac{ \left( \dfrac{C_\text{1, nominal}}{(1+r_\text{inflation})^1} \right) }{P_0} + \dfrac{\left( \dfrac{P_\text{1, nominal}}{(1+r_\text{inflation})^1} \right)-P_0}{P_0} \\ \end{aligned}\\###If the price now were, say, $1 then the nominal income cash flow in one period would be $0.04 which is the nominal income return times the price now. The nominal price in one period would be $1.02 ##(=1(1+0.02)^1)## which is the price now grown by the nominal capital return. Note that the price now ##(P_0)## is not affected by inflation. Substituting these and inflation into the above equation, the real returns can be calculated:

###\begin{aligned} r_\text{real, total} &= \dfrac{ \left( \dfrac{0.04}{(1+0.03)^1} \right) }{1} + \dfrac{\left( \dfrac{1.02}{(1+0.03)^1} \right)-1}{1} \\ &= 0.038834951 - 0.009708738 \\ &= 0.029126214 \\ \end{aligned}###So the real total return is 2.91%, the real capital return is -0.97% and the real income return is 3.88%.

Question 525 income and capital returns, real and nominal returns and cash flows, inflation

Which of the following statements about cash in the form of notes and coins is NOT correct? Assume that inflation is positive.

Notes and coins:

Notes and coins pay no income and therefore have zero nominal and real income returns. Since $100 of notes and coins are worth $100 now and will still be worth $100 in one year, the nominal capital return is zero. The nominal total return is the sum of the nominal income and capital return therefore it's also zero.

However, $100 of notes and coins will buy less goods and services in one year than it will now if inflation is positive because the price of things will increase. Therefore the real capital return and real total returns of notes and coins are negative.

Question 526 real and nominal returns and cash flows, inflation, no explanation

How can a nominal cash flow be precisely converted into a real cash flow?

No explanation provided.

Question 574 inflation, real and nominal returns and cash flows, NPV

What is the present value of a nominal payment of $100 in 5 years? The real discount rate is 10% pa and the inflation rate is 3% pa.

The nominal cash flow cannot be discounted by a real discount rate.

Method 1: Discount the nominal cash flow by the nominal discount rate

The real discount rate can be converted into a nominal rate using the Fisher equation.

###1+r_\text{real} = \dfrac{1+r_\text{nominal}}{1+r_\text{inflation}}### ###1+0.1 = \dfrac{1+r_\text{nominal}}{1+0.03}### ###\begin{aligned} r_\text{nominal} &= (1+0.1)(1+0.03) -1 \\ &= 0.133333 \\ \end{aligned}###Now discount the nominal payment by the nominal discount rate.

###\begin{aligned} V_0 &= \dfrac{V_\text{5, nominal}}{(1+r_\text{nominal})^5} \\ &= \dfrac{100}{(1+0.133333)^5} \\ &= 53.56121877 \end{aligned}###Method 2: Discount the real cash flow by the real discount rate

The nominal cash flow can be converted into a real cash flow by discounting using the inflation rate.

###\begin{aligned} V_\text{5, real} &= \dfrac{V_\text{5, nominal}}{(1+r_\mathbf{inflation})^5} \\ &= \dfrac{100}{(1+0.03)^5} \\ &= 86.26087844 \end{aligned}###Now discount the real payment by the real discount rate.

###\begin{aligned} V_0 &= \dfrac{V_\text{5, real}}{(1+r_\text{real})^5} \\ &= \dfrac{86.26087844}{(1+0.1)^5} \\ &= 53.56121877 \end{aligned}###Question 575 inflation, real and nominal returns and cash flows

You expect a nominal payment of $100 in 5 years. The real discount rate is 10% pa and the inflation rate is 3% pa. Which of the following statements is NOT correct?

If all goods and services' nominal prices grow by the same inflation rate, then their real prices will be unchanged or constant.

For example, say apples and oranges originally cost $1 each, so one apple is worth one orange. Then a year later, they cost $1.03 each since inflation was 3% pa. Since one apple is still worth one orange, the real price of apples and oranges is the same. It's only the nominal price (in dollars) that has changed.

Therefore only nominal prices increase by inflation. Real prices are unaffected.

Question 576 inflation, real and nominal returns and cash flows

What is the present value of a nominal payment of $1,000 in 4 years? The nominal discount rate is 8% pa and the inflation rate is 2% pa.

The nominal cash flow can be discounted by the nominal discount rate.

###\begin{aligned} V_0 &= \dfrac{V_\text{4, nominal}}{(1+r_\text{nominal})^4} \\ &= \dfrac{1,000}{(1+0.08)^4} \\ &= 735.0298528 \end{aligned}###Question 577 inflation, real and nominal returns and cash flows

What is the present value of a real payment of $500 in 2 years? The nominal discount rate is 7% pa and the inflation rate is 4% pa.

The real cash flow cannot be discounted by a nominal discount rate.

Method 1: Discount the real cash flow by the real discount rate

The nominal discount rate can be converted into a real rate using the Fisher equation.

###1+r_\text{real} = \dfrac{1+r_\text{nominal}}{1+r_\text{inflation}}### ###1+r_\text{real} = \dfrac{1+0.07}{1+0.04}### ###\begin{aligned} r_\text{real} &= \dfrac{1+0.07}{1+0.04} -1 \\ &= 0.028846154 \\ \end{aligned}###Now discount the real payment by the real discount rate.

###\begin{aligned} V_0 &= \dfrac{V_\text{2, real}}{(1+r_\text{real})^2} \\ &= \dfrac{500}{(1+0.028846154)^2} \\ &= 472.3556643 \\ \end{aligned}###Method 2: Discount the nominal cash flow by the nominal discount rate

The real cash flow can be converted into a nominal cash flow by growing using the inflation rate:

###V_\text{2, real} = \dfrac{V_\text{2, nominal}}{(1+r_\mathbf{inflation})^2} ### ###500 = \dfrac{V_\text{2, nominal}}{(1+0.04)^2} ### ###\begin{aligned} V_\text{2, nominal} &= 500 \times (1+0.04)^2 \\ &= 540.8 \\ \end{aligned}###Now discount the nominal payment by the nominal discount rate.

###\begin{aligned} V_0 &= \dfrac{V_\text{2, nominal}}{(1+r_\text{nominal})^2} \\ &= \dfrac{540.8 }{(1+0.07)^2} \\ &= 472.3556643 \\ \end{aligned}###Question 578 inflation, real and nominal returns and cash flows

Which of the following statements about inflation is NOT correct?

Interest rates at the bank are almost always quoted as nominal rates, not real rates. When a bank advertises an interest rate of say 5% pa on deposits, you would always assume that this is a nominal rate. Therefore it has not been reduced by inflation. The real rate would be lower.

Question 604 inflation, real and nominal returns and cash flows

Apples and oranges currently cost $1 each. Inflation is 5% pa, and apples and oranges are equally affected by this inflation rate. Note that when payments are not specified as real, as in this question, they're conventionally assumed to be nominal.

Which of the following statements is NOT correct?

A (nominal) payment of $105 in one year is worth $100 in real terms today, not $105. This is because in one year oranges and apples will cost $1.05 each, so $105 in one year will only buy 100 (=$105/$1.05) apples or oranges. Therefore the real value of a nominal payment of $105 in one year is only worth 100 apples or oranges which is worth $100 in real terms today.

Another way that the real value of a future nominal payment can be found is to discount it by the inflation rate:

###V_\text{T, real} = \dfrac{V_\text{T, nominal}}{(1+r_\text{inflation})^T} ### ###\begin{aligned} V_\text{1, real} &= \dfrac{V_\text{1, nominal}}{(1+r_\text{inflation})^1} \\ &= \dfrac{105}{(1+0.05)^1} \\ &= 100 \\ \end{aligned}###Economists call real values 'constant prices' values. This is because real values pretend that prices are constant and don't change. Inflation reduces the real value of money, it erodes the buying power of nominal wealth. That's why real values are always lower than nominal values when inflation is positive.

Economists call nominal values 'current prices' values. This is because current prices are those actually observed at the current time. Over time, (current) prices rise when inflation is positive.

Question 664 real and nominal returns and cash flows, inflation, no explanation

What is the present value of real payments of $100 every year forever, with the first payment in one year? The nominal discount rate is 7% pa and the inflation rate is 4% pa.

No explanation provided.

Question 728 inflation, real and nominal returns and cash flows, income and capital returns, no explanation

Which of the following statements about gold is NOT correct? Assume that the gold price increases by inflation. Gold has a:

No explanation provided.

Question 732 real and nominal returns and cash flows, inflation, income and capital returns

An investor bought a bond for $100 (at t=0) and one year later it paid its annual coupon of $1 (at t=1). Just after the coupon was paid, the bond price was $100.50 (at t=1). Inflation over the past year (from t=0 to t=1) was 3% pa, given as an effective annual rate.

Which of the following statements is NOT correct? The bond investment produced a:

All statements are true except for (e). This is because the current stock price of $100 should not be discounted by the inflation rate since it is a value now that is both real and nominal, there's no need to convert it to real. Only the nominal stock price in one year of $100.50 should be discounted by the inflation rate to convert it into a real value in one year.

###\begin{aligned} P_\text{T real} &= P_\text{T nominal}/(1+r_\text{inflation})^T \\ \end{aligned}### ###\begin{aligned} r_\text{real capital} &= \dfrac{P_\text{1 real} - P_0}{P_0} \\ &= \dfrac{P_\text{1 nominal}/(1+r_\text{inflation})^1 - P_0}{P_0} \\ &= \dfrac{100.5/(1+0.03)^1 - 100}{100} \\ &= -0.024271845 \\ \end{aligned}###An alternative method to find the real capital return is to use the exact Fisher equation which gives the same solution.

Question 734 real and nominal returns and cash flows, inflation, DDM, no explanation

An equities analyst is using the dividend discount model to price a company's shares. The company operates domestically and has no plans to expand overseas. It is part of a mature industry with stable positive growth prospects.

The analyst has estimated the real required return (r) of the stock and the value of the dividend that the stock just paid a moment before ##(C_\text{0 before})##.

What is the highest perpetual real growth rate of dividends (g) that can be justified? Select the most correct statement from the following choices. The highest perpetual real expected growth rate of dividends that can be justified is the country's expected:

No explanation provided.

Question 739 real and nominal returns and cash flows, inflation

There are a number of different formulas involving real and nominal returns and cash flows. Which one of the following formulas is NOT correct? All returns are effective annual rates. Note that the symbol ##\approx## means 'approximately equal to'.

Answer c is the false statement. The real future value of a nominal future payment can be found by shrinking the nominal value by the inflation rate which requires division by ##(1+r_\text{inflation})^t##, not multiplication.

###V_\text{t,real} = \dfrac{V_\text{t,nominal}}{(1+r_\text{inflation})^t}###This makes sense since the real value of a future payment is always less than the nominal value when inflation is positive.

All other statements are true. Answer a is the approximate Fisher equation while answer b is the exact Fisher equation.

Note that a present value ##(V_0)## is both real and nominal, there's no distinction. This is because positive inflation only makes nominal future values bigger than real future values after some time has elapsed. Since there's no time for inflation to have an effect because the values are at the present, then the real present value is equal to the nominal present value. So ##V_\text{0} = V_\text{0, real} = V_\text{0, nominal}##.

Question 740 real and nominal returns and cash flows, DDM, inflation

Taking inflation into account when using the DDM can be hard. Which of the following formulas will NOT give a company's current stock price ##(P_0)##? Assume that the annual dividend was just paid ##(C_0)##, and the next dividend will be paid in one year ##(C_1)##.

Answer d is incorrect because it wrongly includes the dividend at time zero ##C_0## when actually that dividend was just paid (past tense) so if you buy the stock now you will not receive that dividend. That past dividend needs to be subtracted from the stock price, so this is the adjustment required:

###P_0=\dfrac{C_0 (1+r_\text{real})^1}{r_\text{real} - g_\text{real}} - C_0###Question 744 income and capital returns, real and nominal returns and cash flows, inflation

If someone says "my shares rose by 10% last year", what do you assume that they mean? The effective annual:

The statement 'my shares rose by 10% last year' suggests that the nominal capital return was 10% pa over the last year. This is because a rising share price is a positive capital return. Nothing is said about the stock's dividend yield.

By default you would assume that all returns are nominal unless stated otherwise, so this is a nominal return and not a real return.

Since the return was in the past, it's a historical return, not an expected future return.

Question 745 real and nominal returns and cash flows, inflation, income and capital returns

If the nominal gold price is expected to increase at the same rate as inflation which is 3% pa, which of the following statements is NOT correct?

The real income return of gold is zero since it pays nothing. No interest, dividends or rent. The nominal income yield on gold is also zero. Income yields are generally not affected much by inflation, unlike capital returns and total returns. One way to calculate the real income return from the nominal income return is:

###\begin{aligned} r_\text{real income} &= \dfrac{C_\text{1,real}}{P_0} \\ &= \dfrac{C_\text{1,nominal}/(1+r_\text{inflation})^1}{P_0} \\ &= \dfrac{\left(\dfrac{C_\text{1,nominal}}{P_0}\right)}{(1+r_\text{inflation})^1} \\ &= \dfrac{r_\text{nominal income}}{1+r_\text{inflation}} \\ &= \dfrac{0}{1+0.03} \\ &= 0 \\ \end{aligned}###What proportion of managers are evaluating projects correctly, based on table 8 from Meier and Tarhan's (2006) survey of corporate managers?

| Table 8: Consistency of nominal or real hurdle rates and cash flows | |||

| Hurdle rate | Cash flows | Total | |

|---|---|---|---|

| Nominal | Real | ||

| Nominal | 29.8% | 11.6% | 41.3% |

| Real | 19.8% | 38.4% | 58.7% |

| Total | 49.6% | 50.4% | 100.0% |

Table 8 footnote: The rows in this cross-tabulation show whether the firm uses a nominal or real hurdle rate, the columns indicate whether cash flows are calculated in nominal or real terms. The fractions denote the number of firms for each combination relative to the total of 123 respondents that responded to both separate survey questions.

What proportion of managers are evaluating projects correctly?

Of the surveyed managers, 68.2% (=29.8%+38.4%) value their projects correctly, which includes those:

- 29.8% who discount nominal cash flows by nominal hurdle rates; and

- 38.4% who discount real cash flows by real hurdle rates, which is also fine.