Total cash flows can be broken into income and capital cash flows. What is the name given to the income cash flow from owning shares?

Shares pay dividends. Note that paying a dividend is a form of 'equity payout' from the dividend-paying firm's perspective. From the shareholder's perspective the dividend is income.

An Apple (NASDAQ:AAPL) stock was purchased by an investor for $120 and one year later was sold for $150. A dividend of $4 was also collected at the end of the year just before the stock was sold.

Which of the following statements about the stock investment is NOT correct? Ignore taxes.

Over the year, the investor made a:

.

The dividend yield is equal to the cash dividend divided by the buy price at the start, not the sell price at the end of the year:

###\begin{aligned} r_\text{dividend} &= \dfrac{C_1}{P_0} \\ &= \dfrac{4}{120} \\ &= 0.033333333 \\ &= 3.3333333\% \\ \end{aligned}###The total return is the sum of the capital return and dividend return:

###\begin{aligned} r_\text{total} &= r_\text{capital} + r_\text{dividend} \\ &= \dfrac{P_\text{sell at end} - P_\text{buy at start}}{P_\text{buy at start}} + \dfrac{C_\text{end}}{P_\text{buy at start}} \\ &= \dfrac{P_1 - P_0}{P_0} + \dfrac{C_1}{P_0} \\ &= \dfrac{150 - 120}{120} + \dfrac{4}{120} \\ &= 0.25 + 0.033333333 \\ &= 0.283333333 \\ &= 28.3333333\% \\ \end{aligned}###An asset's total expected return over the next year is given by:

###r_\text{total} = \dfrac{c_1+p_1-p_0}{p_0} ###

Where ##p_0## is the current price, ##c_1## is the expected income in one year and ##p_1## is the expected price in one year. The total return can be split into the income return and the capital return.

Which of the following is the expected capital return?

The expected capital return is shown in answer d: ##r_\text{capital} = \dfrac{p_1}{p_0} - 1 = \dfrac{p_1-p_0}{p_0}##.

Answer a is the expected dollar income: ##c_1##.

Answer b is the expected dollar capital gain rather than return: ##p_1 - p_0##.

Answer c is the expected income return: ##\dfrac{c_1}{p_0}##.

Answer e is sometimes called the expected gross capital return: ##\dfrac{p_1}{p_0}##. Note that the gross return minus one equals the net capital return. Capital return and net capital return are used interchangeably. So ##r_\text{capital} = r_\text{net capital} = r_\text{gross capital} - 1##.

Total cash flows can be broken into income and capital cash flows.

What is the name given to the cash flow generated from selling shares at a higher price than they were bought?

A capital gain is earned when an asset price rises. The capital gain is the sale price at the end ##(P_1)## less the buy price at the start ##(P_0)##.

###\text{Capital gain} = P_1 - P_0###The capital return is the capital gain scaled by the buy price ##(P_0)##.

###\text{Capital return} = r_\text{capital} = \dfrac{P_1 - P_0}{P_0} = \dfrac{P_1}{P_0} - 1###Question 525 income and capital returns, real and nominal returns and cash flows, inflation

Which of the following statements about cash in the form of notes and coins is NOT correct? Assume that inflation is positive.

Notes and coins:

Notes and coins pay no income and therefore have zero nominal and real income returns. Since $100 of notes and coins are worth $100 now and will still be worth $100 in one year, the nominal capital return is zero. The nominal total return is the sum of the nominal income and capital return therefore it's also zero.

However, $100 of notes and coins will buy less goods and services in one year than it will now if inflation is positive because the price of things will increase. Therefore the real capital return and real total returns of notes and coins are negative.

Which of the following equations is NOT equal to the total return of an asset?

Let ##p_0## be the current price, ##p_1## the expected price in one year and ##c_1## the expected income in one year.

All except answer d are mathematically equal to the total required return.

###\begin{aligned} r_\text{total} &= \dfrac{c_1+p_1-p_0}{p_0} \\ &= \dfrac{c_1}{p_0} + \dfrac{p_1-p_0}{p_0} \\ &= \dfrac{c_1}{p_0} + \dfrac{p_1}{p_0} - 1 \\ &= \dfrac{c_1+p_1}{p_0} - 1 \\ \end{aligned}###The total return of any asset can be broken down in different ways. One possible way is to use the dividend discount model (or Gordon growth model):

###p_0 = \frac{c_1}{r_\text{total}-r_\text{capital}}###

Which, since ##c_1/p_0## is the income return (##r_\text{income}##), can be expressed as:

###r_\text{total}=r_\text{income}+r_\text{capital}###

So the total return of an asset is the income component plus the capital or price growth component.

Another way to break up total return is to use the Capital Asset Pricing Model:

###r_\text{total}=r_\text{f}+β(r_\text{m}- r_\text{f})###

###r_\text{total}=r_\text{time value}+r_\text{risk premium}###

So the risk free rate is the time value of money and the term ##β(r_\text{m}- r_\text{f})## is the compensation for taking on systematic risk.

Using the above theory and your general knowledge, which of the below equations, if any, are correct?

(I) ##r_\text{income}=r_\text{time value}##

(II) ##r_\text{income}=r_\text{risk premium}##

(III) ##r_\text{capital}=r_\text{time value}##

(IV) ##r_\text{capital}=r_\text{risk premium}##

(V) ##r_\text{income}+r_\text{capital}=r_\text{time value}+r_\text{risk premium}##

Which of the equations are correct?

The only correct statement is that the Gordon growth model (GGM) and capital asset pricing model (CAPM) both give an asset's total required return:

###r_\text{total, GGM} = r_\text{total, CAPM} ### ###\frac{c_1}{p_0}+r_\text{capital} = r_f + \beta(r_m - r_f) ### ###r_\text{income}+r_\text{capital} = r_\text{time value}+r_\text{risk premium} ###The income return in the GGM is unrelated to the time value of money (##r_f##) or the market risk premium (##\beta (r_m - r_f)##) in the CAPM. This is mainly because the income cash flow from an asset is often discretionary, such as:

- Dividends on shares which are decided by the company's board of directors.

- Coupon payments on fixed-coupon debt which are often set equal to the yield when the bond is first issued (so it's issued at par), but after that as the yield (which is the total return of debt) goes up or down, the coupon stays the same since it's fixed.

Both of these are examples of how the income return component of total returns is often quite arbitrary and unrelated to the risk free rate or market risk premium in the CAPM. Therefore, the capital return is also unrelated to either the time value of money or market risk premium too.

On the other hand, it could be argued that the floating coupon income return on a floating rate bond are closely related to the risk free rate.

The perpetuity with growth formula, also known as the dividend discount model (DDM) or Gordon growth model, is appropriate for valuing a company's shares. ##P_0## is the current share price, ##C_1## is next year's expected dividend, ##r## is the total required return and ##g## is the expected growth rate of the dividend.

###P_0=\dfrac{C_1}{r-g}###

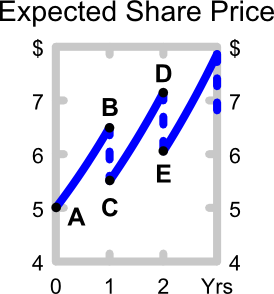

The below graph shows the expected future price path of the company's shares. Which of the following statements about the graph is NOT correct?

Between points D and E, the share price is expected to instantaneously fall by:

###C_2 = C_1.(1+\mathbf{g})^1###This is because the second dividend ##C_2## is expected to be equal to the first dividend ##C_1## grown by the dividend growth rate ##g##, not the total return ##r##.

The following equation is called the Dividend Discount Model (DDM), Gordon Growth Model or the perpetuity with growth formula: ### P_0 = \frac{ C_1 }{ r - g } ###

What is ##g##? The value ##g## is the long term expected:

The pronumeral ##g## is the expected growth rate of the dividend which must also be the expected growth rate of the stock price, which is the expected capital return of the stock.

If the stock price grew by a rate less than the dividend in perpetuity, then the dividend would eventually grow bigger than the stock price which is impossible.

If the stock price grew by a rate more than the dividend in perpetuity, then the stock price would eventually grow so big compared to the dividend that the dividend yield (expected dividend in one year divided by stock price now) would be close to zero. To maintain the same total return, the capital return of the stock price must increase until it is very close (or equal) to the total return. If the total return is more than the country's GDP growth rate, then the capital return of the stock will be more than the average firm in perpetuity (forever), so the firm must take over the country. This is very unlikely.

Mathematically:

### P_0 = \frac{ C_1 }{ r - g } ### ### r - g = \frac{ C_1 }{ P_0 } ### ###g = r - \frac{ C_1 }{ P_0 } ###Substitute for the total return, ##r = \dfrac{P_1 - P_0 + C_1}{P_0}##

###\begin{aligned} g &= \frac{ P_1 - P_0 + C_1 }{ P_0 } - \frac{ C_1 }{ P_0 } \\ &= \frac{ P_1 - P_0 }{ P_0 } \\ &= r_\text{capital} \\ \end{aligned}###The following equation is the Dividend Discount Model, also known as the 'Gordon Growth Model' or the 'Perpetuity with growth' equation.

### p_{0} = \frac{c_1}{r_{\text{eff}} - g_{\text{eff}}} ###

What is the discount rate '## r_\text{eff} ##' in this equation?

Rearranging this equation:

###p_{0} = \frac{c_1}{r_{\text{eff}} - g_{\text{eff}}} ### ###r_{\text{eff}} - g_{\text{eff}} = \frac{c_1}{p_{0}} ### ###r_{\text{eff}} = g_{\text{eff}} + \frac{c_1}{p_{0}} ###This is equivalent to:

###\begin{aligned} r_{\text{eff, total}} =& r_{\text{eff, capital}} + r_{\text{eff, income}} \\ \end{aligned} ###

Where ##r_{\text{eff, capital}} = g## and ##r_{\text{eff, income}} = c_1/p_0##.

It's clear that ##r_{\text{eff}}## is the expected total return of the stock which is the sum of the expected capital and income returns.

The following equation is the Dividend Discount Model, also known as the 'Gordon Growth Model' or the 'Perpetuity with growth' equation.

### P_{0} = \frac{C_1}{r_{\text{eff}} - g_{\text{eff}}} ###

What would you call the expression ## C_1/P_0 ##?

For a stock, the expected income return is the ratio of the dividend expected to be paid in one year to the stock price now. Another name for it is the expected dividend yield.

Rearranging this equation:

###P_{0} = \frac{C_1}{r_{\text{eff}} - g_{\text{eff}}} ### ###r_{\text{eff}} - g_{\text{eff}} = \frac{C_1}{P_{0}} ### ###r_{\text{eff}} = g_{\text{eff}} + \frac{C_1}{P_{0}} ###This is equivalent to:

###\begin{aligned} r_{\text{eff, total}} =& r_{\text{eff, capital}} + r_{\text{eff, income}} \\ \end{aligned} ###

Where ##r_{\text{eff, capital}} = g## and ##r_{\text{eff, income}} = d_1/p_0##.

A share was bought for $20 (at t=0) and paid its annual dividend of $3 one year later (at t=1). Just after the dividend was paid, the share price was $16 (at t=1). What was the total return, capital return and income return? Calculate your answers as effective annual rates.

The choices are given in the same order: ## r_\text{total},r_\text{capital},r_\text{income} ##.

###\begin{aligned} r_\text{total} =& r_\text{capital} + r_\text{income} \\ =& \frac{P_1 - P_0}{P_0} + \frac{C_1}{P_0} \\ =& \frac{16 - 20}{20} + \frac{3}{20} \\ =& \frac{-4}{20} + \frac{3}{20} \\ =& -0.2 + 0.15 \\ \end{aligned}### So the capital return is -0.2 and the income return is 0.15. The total return is the sum, so: ### r_\text{total} = -0.05 ###

A share was bought for $10 (at t=0) and paid its annual dividend of $0.50 one year later (at t=1). Just after the dividend was paid, the share price was $11 (at t=1).

What was the total return, capital return and income return? Calculate your answers as effective annual rates. The choices are given in the same order:

##r_\text{total}##, ##r_\text{capital}##, ##r_\text{dividend}##.

###\begin{aligned} r_\text{total} =& r_\text{capital} + r_\text{income} \\ =& \frac{P_1 - P_0}{P_0} + \frac{C_1}{P_0} \\ =& \frac{11 - 10}{10} + \frac{0.5}{10} \\ =& \frac{1}{10} + \frac{0.5}{10} \\ =& 0.1 + 0.05 \\ \end{aligned}### So the capital return is 0.1 and the income return is 0.05. The total return is the sum, so: ### r_\text{total} = 0.15 ###

The following is the Dividend Discount Model (DDM) used to price stocks:

###P_0=\dfrac{C_1}{r-g}###

If the assumptions of the DDM hold and the stock is fairly priced, which one of the following statements is NOT correct? The long term expected:

All statements are true except for answer c. The expected dividend yield is defined as ##c_1/p_0## whereas the expected growth rate in the dividend is ##g##.

Rearranging this equation:

###P_{0} = \dfrac{C_1}{r - g} ### ###r - g = \dfrac{C_1}{P_{0}} ### ###r = g + \dfrac{C_1}{P_{0}} ###This is equivalent to:

###\begin{aligned} r_{\text{total}} =& r_{\text{capital}} + r_{\text{income}} \\ \end{aligned} ###

Where ##r_{\text{capital}} = g## and ##r_{\text{income}} = C_1/P_0##. Note that the expected dividend yield can also be called the share's expected income return ##r_{\text{income}}##.

A share was bought for $4 and paid an dividend of $0.50 one year later (at t=1 year).

Just after the dividend was paid, the share price fell to $3.50 (at t=1 year). What were the total return, capital return and income returns given as effective annual rates? The answer choices are given in the same order:

##r_\text{total}##, ##r_\text{capital}##, ## r_\text{income}##

###\begin{aligned} r_\text{total} =& r_\text{capital} + r_\text{income} \\ =& \frac{P_1 - P_0}{P_0} + \frac{C_1}{P_0} \\ =& \frac{3.50 - 4}{4} + \frac{0.50}{4} \\ =& \frac{-0.5}{4} + \frac{0.5}{4} \\ =& -0.125 + 0.125 \\ \end{aligned}###

So the capital return is -0.125 and the income return is 0.125.

The total return is the sum which is zero:

### r_\text{total} = 0###

The following equation is the Dividend Discount Model, also known as the 'Gordon Growth Model' or the 'Perpetuity with growth' equation.

### p_0= \frac{c_1}{r-g} ###

Which expression is equal to the expected dividend return?

Answer d is the expected dividend yield (the income return on shares). This is because ##c_3/p_2## is equivalent to ##c_1/p_0## since: ###\dfrac{c_3}{p_2} = \dfrac{c_1(1+g)^2}{p_0(1+g)^2} = \dfrac{c_1}{p_0} = \text{expected income return}###

To show that the expected dividend yield equals ##c_1/p_0##, rearrange the perpetuity equation:

###p_{0} = \frac{c_1}{r_{\text{eff}} - g_{\text{eff}}} ### ###r_{\text{eff}} - g_{\text{eff}} = \frac{c_1}{p_{0}} ### ###r_{\text{eff}} = g_{\text{eff}} + \frac{c_1}{p_{0}} ###This is equivalent to:

###\begin{aligned} r_{\text{eff, total}} =& r_{\text{eff, capital}} + r_{\text{eff, income}} \\ \end{aligned} ###

So the expected dividend yield is ##r_{\text{eff, income}} = c_1/p_0##.

Note that answers b, c and e are equivalent to the expected capital return which is:

###r_{\text{eff, capital}} = g = (p_1/p_0) -1 = (c_5/c_4) -1 = (p_1/p_0) - 1###Answer a is not very useful, it's the expected dividend yield minus one.

Question 730 DDM, income and capital returns, no explanation

A stock’s current price is $1. Its expected total return is 10% pa and its long term expected capital return is 4% pa. It pays an annual dividend and the next one will be paid in one year. All rates are given as effective annual rates. The dividend discount model is thought to be a suitable model for the stock. Ignore taxes. Which of the following statements about the stock is NOT correct?

No explanation provided.

In the dividend discount model (DDM), share prices fall when dividends are paid. Let the high price before the fall be called the peak, and the low price after the fall be called the trough.

###P_0=\dfrac{C_1}{r-g}###

Which of the following statements about the DDM is NOT correct?

Dividends are expected to grow by the capital return ‘g’, not the total return 'r'. So the dividend at time 2 (##C_2##) is equal to the dividend at time 1 (##C_1##) multipled by (1+g)^1:

###C_2=C_1(1+g)^1### ###C_3=C_1(1+g)^2=C_2(1+g)^1### ###C_4=C_1(1+g)^3=C_2(1+g)^2=C_3(1+g)^1###