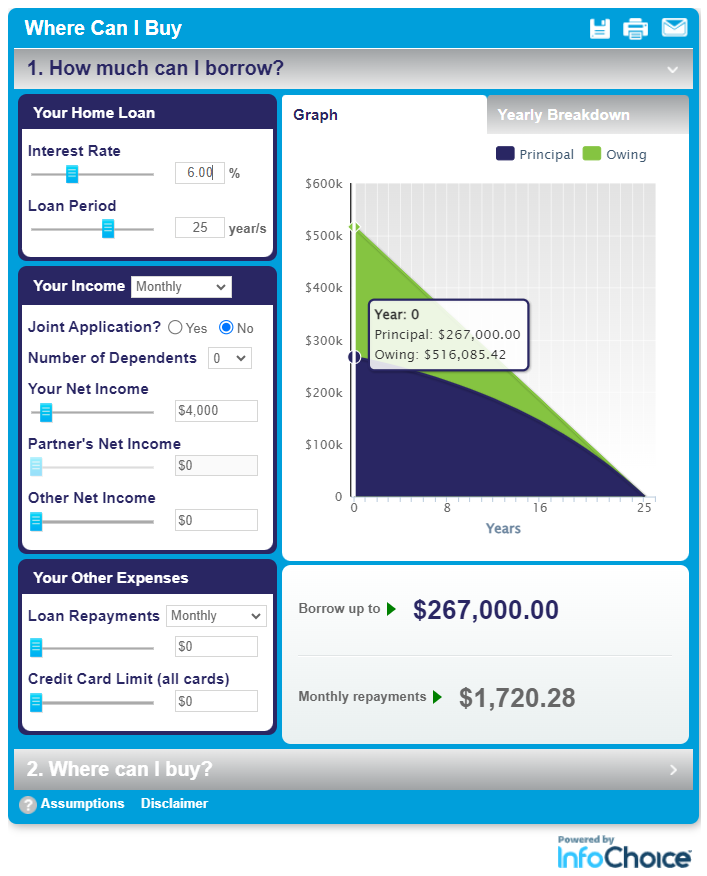

Below is a 'borrowing power' calculator by the company InfoChoice which helps calculate how much you can borrow to buy a house, based on your income and expenses.

An individual (not a couple) with no children (zero dependents) earning $4,000 net income per month with no other income, no other loans, no credit cards (zero credit card limit) and $21,092.76 annual living expenses with a 6% pa interest rate on a 25 year loan subjected to an APRA-imposed interest rate buffer of 3% pa can borrow up to $267,000, rounded down to the nearest thousand.

https://www.infochoice.com.au/home-loans/where-can-i-buy-calculator

All information needed to answer the below questions is given in the screenshot above, except the $21,092.76 annual living expenses ($1,757.73 paid monthly in arrears) which are contained in the assumptions

Which of the below statements about this borrowing power calculator is NOT correct?