All things remaining equal, the variance of a portfolio of two positively-weighted stocks rises as:

A stock is expected to pay the following dividends:

| Cash Flows of a Stock | ||||||

| Time (yrs) | 0 | 1 | 2 | 3 | 4 | ... |

| Dividend ($) | 2 | 2 | 2 | 10 | 3 | ... |

After year 4, the dividend will grow in perpetuity at 4% pa. The required return on the stock is 10% pa. Both the growth rate and required return are given as effective annual rates.

What is the current price of the stock?

A project has the following cash flows:

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -90 |

| 1 | 30 |

| 2 | 105 |

The required return of a project is 10%, given as an effective annual rate. Assume that the cash flows shown in the table are paid all at once at the given point in time.

What is the Profitability Index (PI) of the project?

Question 245 foreign exchange rate, monetary policy, foreign exchange rate direct quote, no explanation

Investors expect Australia's central bank, the RBA, to leave the policy rate unchanged at their next meeting.

Then unexpectedly, the policy rate is reduced due to fears that Australia's GDP growth is slowing.

What do you expect to happen to Australia's exchange rate? Direct and indirect quotes are given from the perspective of an Australian.

The Australian dollar will:

Your main expense is fuel for your car which costs $100 per month. You just refueled, so you won't need any more fuel for another month (first payment at t=1 month).

You have $2,500 in a bank account which pays interest at a rate of 6% pa, payable monthly. Interest rates are not expected to change.

Assuming that you have no income, in how many months time will you not have enough money to fully refuel your car?

Question 445 financing decision, corporate financial decision theory

The financing decision primarily affects which part of a business?

Question 536 idiom, bond pricing, capital structure, leverage

The expression 'my word is my bond' is often used in everyday language to make a serious promise.

Why do you think this expression uses the metaphor of a bond rather than a share?

In February a company sold one December 40,000 pound (about 18 metric tons) lean hog futures contract. It closed out its position in May.

The spot price was $0.68 per pound in February. The December futures price was $0.70 per pound when the trader entered into the contract in February, $0.60 when he closed out his position in May, and $0.55 when the contract matured in December.

What was the total profit?

If a variable, say X, is normally distributed with mean ##\mu## and variance ##\sigma^2## then mathematicians write ##X \sim \mathcal{N}(\mu, \sigma^2)##.

If a variable, say Y, is log-normally distributed and the underlying normal distribution has mean ##\mu## and variance ##\sigma^2## then mathematicians write ## Y \sim \mathbf{ln} \mathcal{N}(\mu, \sigma^2)##.

The below three graphs show probability density functions (PDF) of three different random variables Red, Green and Blue.

Select the most correct statement:

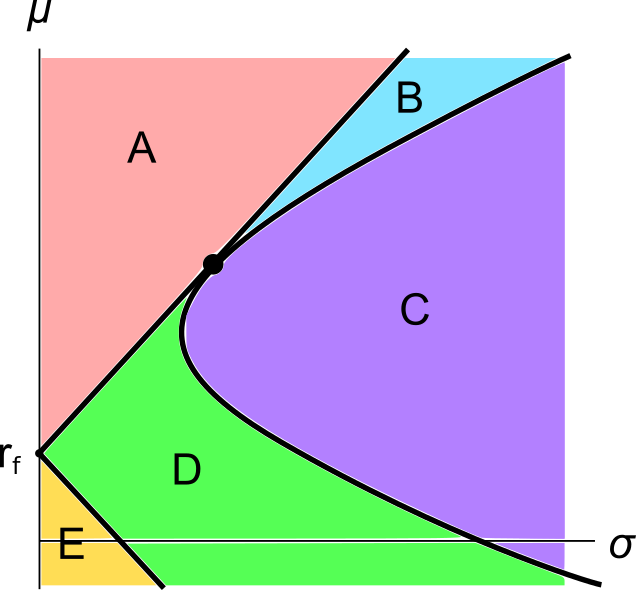

A graph of assets’ expected returns ##(\mu)## versus standard deviations ##(\sigma)## is given in the below diagram.

Each letter corresponds to a separate coloured area. The portfolios at the boundary of the areas, on the black lines, are excluded from each area. Assume that all assets represented in this graph are fairly priced, and that all risky assets can be short-sold.

Which of the following statements about this graph and Markowitz portfolio theory is NOT correct?