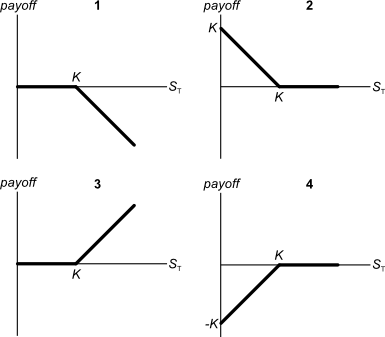

Below are 4 option graphs. Note that the y-axis is payoff at maturity (T). What options do they depict? List them in the order that they are numbered

You want to buy an apartment priced at $500,000. You have saved a deposit of $50,000. The bank has agreed to lend you the $450,000 as a fully amortising loan with a term of 30 years. The interest rate is 6% pa and is not expected to change. What will be your monthly payments?

Question 322 foreign exchange rate, monetary policy, American and European terms

The market expects the Reserve Bank of Australia (RBA) to decrease the policy rate by 25 basis points at their next meeting.

Then unexpectedly, the RBA announce that they will decrease the policy rate by 50 basis points due to fears of a recession and deflation.

What do you expect to happen to Australia's exchange rate? The Australian dollar will:

Question 469 franking credit, personal tax on dividends, imputation tax system, no explanation

A firm pays a fully franked cash dividend of $70 to one of its Australian shareholders who has a personal marginal tax rate of 45%. The corporate tax rate is 30%.

What will be the shareholder's personal tax payable due to the dividend payment?

Question 542 price gains and returns over time, IRR, NPV, income and capital returns, effective return

For an asset price to double every 10 years, what must be the expected future capital return, given as an effective annual rate?

Question 543 price gains and returns over time, IRR, NPV, income and capital returns, effective return

For an asset price to triple every 5 years, what must be the expected future capital return, given as an effective annual rate?

Which of the following statements about futures contracts on shares is NOT correct, assuming that markets are efficient?

When an equity future is first negotiated (at t=0):

Question 691 continuously compounding rate, effective rate, continuously compounding rate conversion, no explanation

A bank quotes an interest rate of 6% pa with quarterly compounding. Note that another way of stating this rate is that it is an annual percentage rate (APR) compounding discretely every 3 months.

Which of the following statements about this rate is NOT correct? All percentages are given to 6 decimal places. The equivalent:

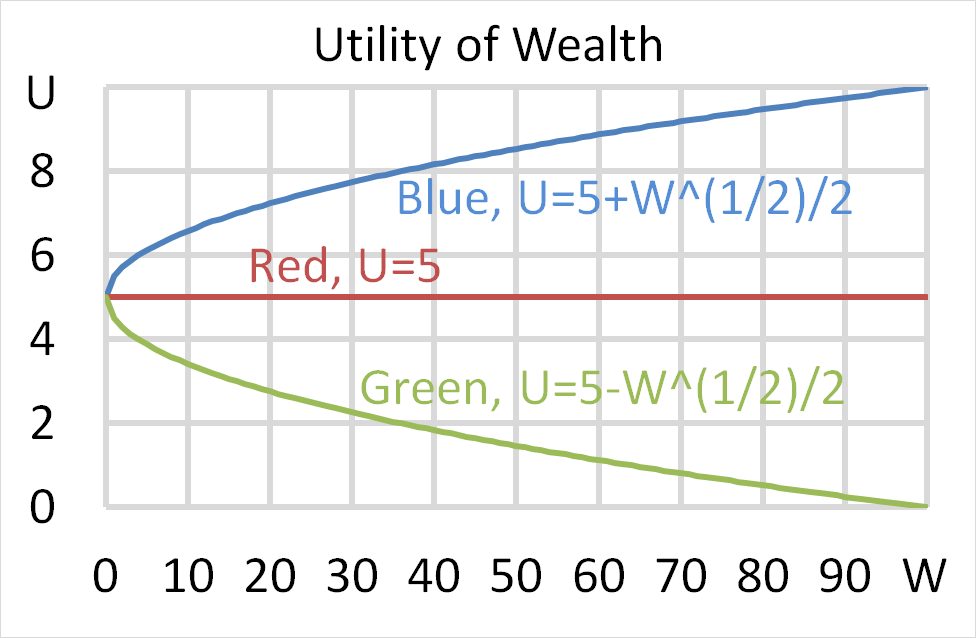

Question 700 utility, risk aversion, utility function, gamble

Mr Blue, Miss Red and Mrs Green are people with different utility functions.

Each person has $50 of initial wealth. A coin toss game is offered to each person at a casino where the player can win or lose $50. Each player can flip a coin and if they flip heads, they receive $50. If they flip tails then they will lose $50. Which of the following statements is NOT correct?