Suppose that the US government recently announced that subsidies for fresh milk producers will be gradually phased out over the next year. Newspapers say that there are expectations of a 40% increase in the spot price of fresh milk over the next year.

Option prices on fresh milk trading on the Chicago Mercantile Exchange (CME) reflect expectations of this 40% increase in spot prices over the next year. Similarly to the rest of the market, you believe that prices will rise by 40% over the next year.

What option trades are likely to be profitable, or to be more specific, result in a positive Net Present Value (NPV)?

Assume that:

- Only the spot price is expected to increase and there is no change in expected volatility or other variables that affect option prices.

- No taxes, transaction costs, information asymmetry, bid-ask spreads or other market frictions.

A stock pays annual dividends. It just paid a dividend of $5. The growth rate in the dividend is 1% pa. You estimate that the stock's required return is 8% pa. Both the discount rate and growth rate are given as effective annual rates.

Using the dividend discount model, what will be the share price?

Question 207 income and capital returns, bond pricing, coupon rate, no explanation

For a bond that pays fixed semi-annual coupons, how is the annual coupon rate defined, and how is the bond's annual income yield from time 0 to 1 defined mathematically?

Let: ##P_0## be the bond price now,

##F_T## be the bond's face value,

##T## be the bond's maturity in years,

##r_\text{total}## be the bond's total yield,

##r_\text{income}## be the bond's income yield,

##r_\text{capital}## be the bond's capital yield, and

##C_t## be the bond's coupon at time t in years. So ##C_{0.5}## is the coupon in 6 months, ##C_1## is the coupon in 1 year, and so on.

You deposit money into a bank. Which of the following statements is NOT correct? You:

A stock is expected to pay its first dividend of $20 in 3 years (t=3), which it will continue to pay for the next nine years, so there will be ten $20 payments altogether with the last payment in year 12 (t=12).

From the thirteenth year onward, the dividend is expected to be 4% more than the previous year, forever. So the dividend in the thirteenth year (t=13) will be $20.80, then $21.632 in year 14, and so on forever. The required return of the stock is 10% pa. All rates are effective annual rates. Calculate the current (t=0) stock price.

Question 850 gross domestic product, gross domestic product per capita

Below is a table showing some countries’ GDP, population and GDP per capita.

| Countries' GDP and Population | |||

| GDP | Population | GDP per capita | |

| USD million | millions of people | USD | |

| United States | 18,036,648 | 325 | 55,492 |

| China | 11,158,457 | 1,383 | 8,066 |

| Japan | 4,383,076 | 127 | 34,586 |

| Germany | 3,363,600 | 83 | 40,623 |

| Norway | 500,519 | 5 | 95,027 |

Source: "GDP and its breakdown at current prices in US Dollars" United Nations Statistics Division. December 2016.

Using this data only, which one of these countries’ citizens have the highest living standards?

Question 896 comparative advantage in trade, production possibilities curve, no explanation

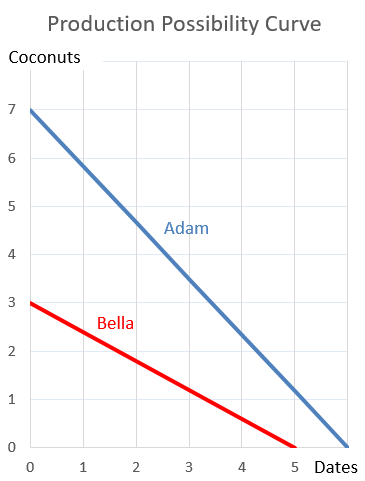

Adam and Bella are the only people on a remote island. Their production possibility curves are shown in the graph.

Which of the following statements is NOT correct?