Question 218 NPV, IRR, profitability index, average accounting return

Which of the following statements is NOT correct?

A 30 year Japanese government bond was just issued at par with a yield of 1.7% pa. The fixed coupon payments are semi-annual. The bond has a face value of $100.

Six months later, just after the first coupon is paid, the yield of the bond increases to 2% pa. What is the bond's new price?

A large proportion of a levered firm's assets is cash held at the bank. The firm is financed with half equity and half debt.

Which of the following statements about this firm's enterprise value (EV) and total asset value (V) is NOT correct?

The saying "buy low, sell high" suggests that investors should make a:

Question 513 stock split, reverse stock split, stock dividend, bonus issue, rights issue

Which of the following statements is NOT correct?

Question 522 income and capital returns, real and nominal returns and cash flows, inflation, real estate

A residential investment property has an expected nominal total return of 6% pa and nominal capital return of 2.5% pa. Inflation is expected to be 2.5% pa.

All of the above are effective nominal rates and investors believe that they will stay the same in perpetuity.

What are the property's expected real total, capital and income returns?

The answer choices below are given in the same order.

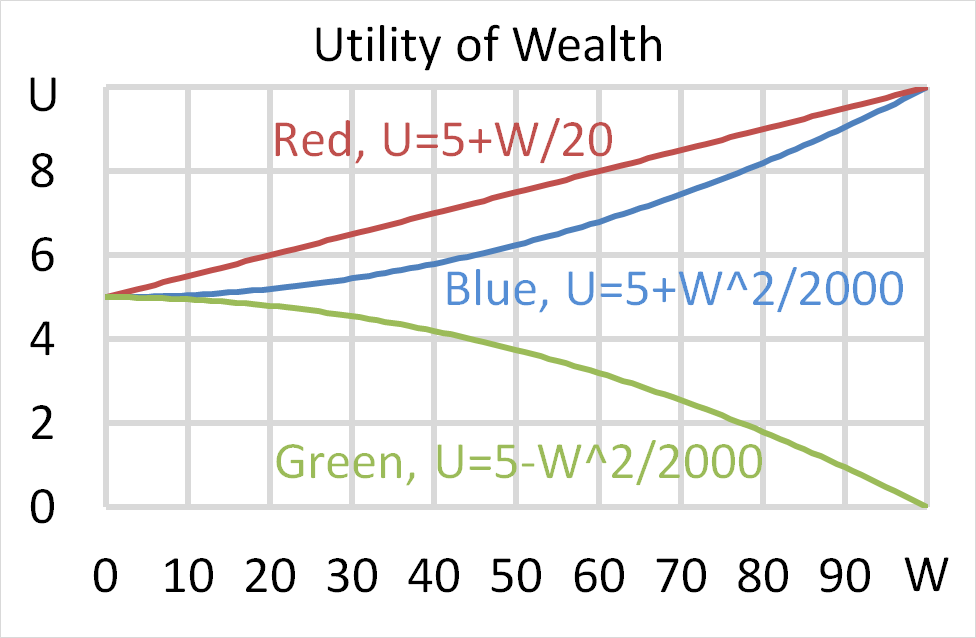

Mr Blue, Miss Red and Mrs Green are people with different utility functions. Which of the statements about the 3 utility functions is NOT correct?

Question 739 real and nominal returns and cash flows, inflation

There are a number of different formulas involving real and nominal returns and cash flows. Which one of the following formulas is NOT correct? All returns are effective annual rates. Note that the symbol ##\approx## means 'approximately equal to'.

A 12 month European-style call option with a strike price of $11 is written on a dividend paying stock currently trading at $10. The dividend is paid annually and the next dividend is expected to be $0.40, paid in 9 months. The risk-free interest rate is 5% pa continuously compounded and the standard deviation of the stock’s continuously compounded returns is 30 percentage points pa. The stock's continuously compounded returns are normally distributed. Using the Black-Scholes-Merton option valuation model, determine which of the following statements is NOT correct.

Being long a call and short a put which have the same exercise prices and underlying stock is equivalent to being: