A European bond paying annual coupons of 6% offers a yield of 10% pa.

Convert the yield into an effective monthly rate, an effective annual rate and an effective daily rate. Assume that there are 365 days in a year.

All answers are given in the same order:

### r_\text{eff, monthly} , r_\text{eff, yearly} , r_\text{eff, daily} ###

A fairly priced stock has an expected return of 15% pa. Treasury bonds yield 5% pa and the market portfolio's expected return is 10% pa. What is the beta of the stock?

Question 215 equivalent annual cash flow, effective rate conversion

You're about to buy a car. These are the cash flows of the two different cars that you can buy:

- You can buy an old car for $5,000 now, for which you will have to buy $90 of fuel at the end of each week from the date of purchase. The old car will last for 3 years, at which point you will sell the old car for $500.

- Or you can buy a new car for $14,000 now for which you will have to buy $50 of fuel at the end of each week from the date of purchase. The new car will last for 4 years, at which point you will sell the new car for $1,000.

Bank interest rates are 10% pa, given as an effective annual rate. Assume that there are exactly 52 weeks in a year. Ignore taxes and environmental and pollution factors.

Should you buy the or the ?

A company increases the proportion of debt funding it uses to finance its assets by issuing bonds and using the cash to repurchase stock, leaving assets unchanged.

Ignoring the costs of financial distress, which of the following statements is NOT correct:

Question 407 income and capital returns, inflation, real and nominal returns and cash flows

A stock has a real expected total return of 7% pa and a real expected capital return of 2% pa.

Inflation is expected to be 2% pa. All rates are given as effective annual rates.

What is the nominal expected total return, capital return and dividend yield? The answers below are given in the same order.

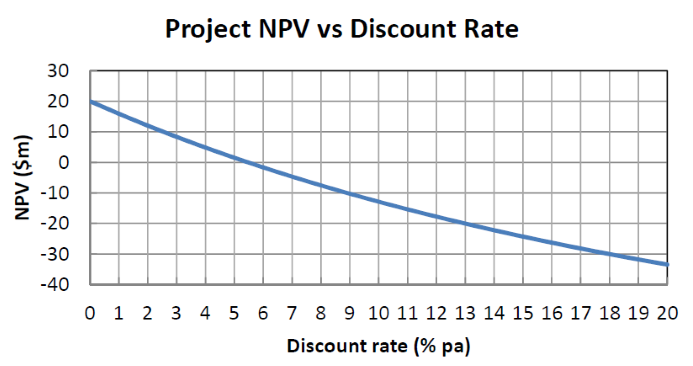

The below graph shows a project's net present value (NPV) against its annual discount rate.

For what discount rate or range of discount rates would you accept and commence the project?

All answer choices are given as approximations from reading off the graph.

Alice, Bob, Chris and Delta are traders in the futures market. The following trades occur over a single day in a newly-opened equity index future that matures in one year which the exchange just made available.

1. Alice buys a future from Bob.

2. Chris buys a future from Delta.

3. Delta buys a future from Bob.

These were the only trades made in this equity index future. What was the trading volume and what is the open interest?

Question 732 real and nominal returns and cash flows, inflation, income and capital returns

An investor bought a bond for $100 (at t=0) and one year later it paid its annual coupon of $1 (at t=1). Just after the coupon was paid, the bond price was $100.50 (at t=1). Inflation over the past year (from t=0 to t=1) was 3% pa, given as an effective annual rate.

Which of the following statements is NOT correct? The bond investment produced a:

The Australian central bank implements monetary policy by directly controlling which interest rate?

You work for XYZ company and you’ve been asked to evaluate a new project which has double the systematic risk of the company’s other projects.

You use the Capital Asset Pricing Model (CAPM) formula and input the treasury yield ##(r_f )##, market risk premium ##(r_m-r_f )## and the company’s asset beta risk factor ##(\beta_{XYZ} )## into the CAPM formula which outputs a return.

This return that you’ve just found is: