A stock is expected to pay the following dividends:

| Cash Flows of a Stock | ||||||

| Time (yrs) | 0 | 1 | 2 | 3 | 4 | ... |

| Dividend ($) | 0.00 | 1.00 | 1.05 | 1.10 | 1.15 | ... |

After year 4, the annual dividend will grow in perpetuity at 5% pa, so;

- the dividend at t=5 will be $1.15(1+0.05),

- the dividend at t=6 will be $1.15(1+0.05)^2, and so on.

The required return on the stock is 10% pa. Both the growth rate and required return are given as effective annual rates. What is the current price of the stock?

A stock pays annual dividends. It just paid a dividend of $3. The growth rate in the dividend is 4% pa. You estimate that the stock's required return is 10% pa. Both the discount rate and growth rate are given as effective annual rates. Using the dividend discount model, what will be the share price?

Unrestricted negative gearing is allowed in Australia, New Zealand and Japan. Negative gearing laws allow income losses on investment properties to be deducted from a tax-payer's pre-tax personal income. Negatively geared investors benefit from this tax advantage. They also hope to benefit from capital gains which exceed the income losses.

For example, a property investor buys an apartment funded by an interest only mortgage loan. Interest expense is $2,000 per month. The rental payments received from the tenant living on the property are $1,500 per month. The investor can deduct this income loss of $500 per month from his pre-tax personal income. If his personal marginal tax rate is 46.5%, this saves $232.5 per month in personal income tax.

The advantage of negative gearing is an example of the benefits of:

Your main expense is fuel for your car which costs $100 per month. You just refueled, so you won't need any more fuel for another month (first payment at t=1 month).

You have $2,500 in a bank account which pays interest at a rate of 6% pa, payable monthly. Interest rates are not expected to change.

Assuming that you have no income, in how many months time will you not have enough money to fully refuel your car?

Question 405 DDM, income and capital returns, no explanation

The perpetuity with growth formula is:

###P_0= \dfrac{C_1}{r-g}###

Which of the following is NOT equal to the total required return (r)?

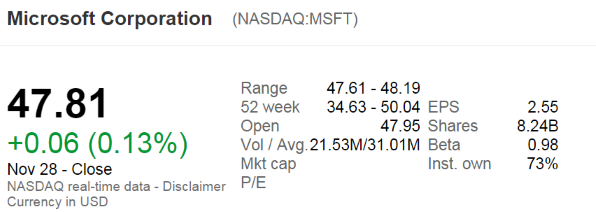

The below screenshot of Microsoft's (MSFT) details were taken from the Google Finance website on 28 Nov 2014. Some information has been deliberately blanked out.

What was MSFT's approximate payout ratio over the last year?

Note that MSFT's past four quarterly dividends were $0.31, $0.28, $0.28 and $0.28.

A low-quality second-hand car can be bought now for $1,000 and will last for 1 year before it will be scrapped for nothing.

A high-quality second-hand car can be bought now for $4,900 and it will last for 5 years before it will be scrapped for nothing.

What is the equivalent annual cost of each car? Assume a discount rate of 10% pa, given as an effective annual rate.

The answer choices are given as the equivalent annual cost of the low-quality car and then the high quality car.

Question 526 real and nominal returns and cash flows, inflation, no explanation

How can a nominal cash flow be precisely converted into a real cash flow?

Question 861 open interest, closing out future contract, no explanation

Alice, Bob, Chris and Delta are traders in the futures market. The following trades occur over a single day in a newly-opened equity index future that matures in one year which the exchange just made available.

1. Alice buys 2 future from Bob.

2. Chris buys 5 futures from Delta.

3. Chris buys 9 futures from Bob.

These were the only trades made in this equity index future.

Which of the following statements is NOT correct?

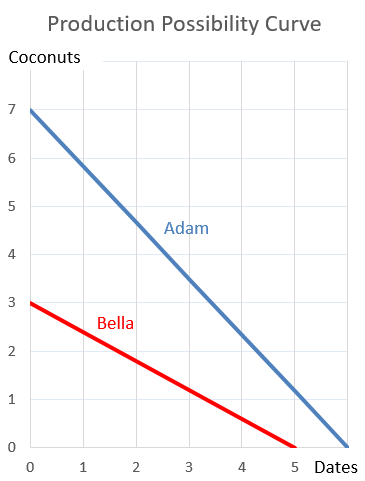

Question 895 comparative advantage in trade, production possibilities curve

Adam and Bella are the only people on a remote island.

Luckily there are Coconut and Date palm trees on the island that grow delicious fruit. The problem is that harvesting the fruit takes a lot of work.

Adam can pick 7 coconuts per hour, 6 dates per hour or any linear combination of coconuts and dates. For example, he could pick 3.5 coconuts and 3 dates per hour.

Bella can pick 3 coconuts per hour, 5 dates per hour or any linear combination. For example, she could pick 1.5 coconuts and 2.5 dates per hour.

This information is summarised in the table and graph:

| Harvest Rates Per Hour | ||

| Coconuts | Dates | |

| Adam | 7 | 6 |

| Bella | 3 | 5 |

Which of the following statements is NOT correct?