The required return of a project is 10%, given as an effective annual rate. Assume that the cash flows shown in the table are paid all at once at the given point in time.

What is the Profitability Index (PI) of the project?

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -100 |

| 1 | 0 |

| 2 | 121 |

You just started work at your new job which pays $48,000 per year.

The human resources department have given you the option of being paid at the end of every week or every month.

Assume that there are 4 weeks per month, 12 months per year and 48 weeks per year.

Bank interest rates are 12% pa given as an APR compounding per month.

What is the dollar gain over one year, as a net present value, of being paid every week rather than every month?

A firm plans to issue equity and use the cash raised to pay off its debt. No assets will be bought or sold. Ignore the costs of financial distress.

Which of the following statements is NOT correct, all things remaining equal?

Alice, Bob, Chris and Delta are traders in the futures market. The following trades occur over a single day in a newly-opened equity index future that matures in one year which the exchange just made available.

1. Alice buys a future from Bob.

2. Chris buys a future from Delta.

3. Delta buys a future from Bob.

These were the only trades made in this equity index future. What was the trading volume and what is the open interest?

An equity index is currently at 4,800 points. The 1.5 year futures price is 5,100 points and the total required return is 6% pa with continuous compounding. Each index point is worth $25.

What is the implied dividend yield as a continuously compounded rate per annum?

Question 721 mean and median returns, return distribution, arithmetic and geometric averages, continuously compounding rate

Fred owns some Commonwealth Bank (CBA) shares. He has calculated CBA’s monthly returns for each month in the past 20 years using this formula:

###r_\text{t monthly}=\ln \left( \dfrac{P_t}{P_{t-1}} \right)###He then took the arithmetic average and found it to be 1% per month using this formula:

###\bar{r}_\text{monthly}= \dfrac{ \displaystyle\sum\limits_{t=1}^T{\left( r_\text{t monthly} \right)} }{T} =0.01=1\% \text{ per month}###He also found the standard deviation of these monthly returns which was 5% per month:

###\sigma_\text{monthly} = \dfrac{ \displaystyle\sum\limits_{t=1}^T{\left( \left( r_\text{t monthly} - \bar{r}_\text{monthly} \right)^2 \right)} }{T} =0.05=5\%\text{ per month}###Which of the below statements about Fred’s CBA shares is NOT correct? Assume that the past historical average return is the true population average of future expected returns.

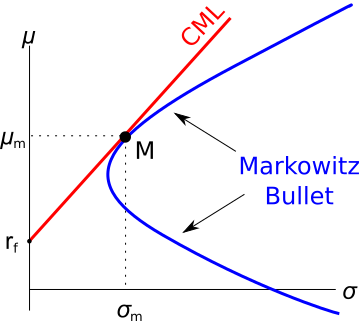

Question 778 CML, systematic and idiosyncratic risk, portfolio risk, CAPM

The capital market line (CML) is shown in the graph below. The total standard deviation is denoted by σ and the expected return is μ. Assume that markets are efficient so all assets are fairly priced.

Which of the below statements is NOT correct?

Question 850 gross domestic product, gross domestic product per capita

Below is a table showing some countries’ GDP, population and GDP per capita.

| Countries' GDP and Population | |||

| GDP | Population | GDP per capita | |

| USD million | millions of people | USD | |

| United States | 18,036,648 | 325 | 55,492 |

| China | 11,158,457 | 1,383 | 8,066 |

| Japan | 4,383,076 | 127 | 34,586 |

| Germany | 3,363,600 | 83 | 40,623 |

| Norway | 500,519 | 5 | 95,027 |

Source: "GDP and its breakdown at current prices in US Dollars" United Nations Statistics Division. December 2016.

Using this data only, which one of these countries’ citizens have the highest living standards?

Question 1012 moral hazard, principal agent problem, asymmetric information

When does the ‘principal-agent problem’ occur? Is it when:

I. The principal has conflicting incentives (moral hazard);

II. The agent has conflicting incentives (moral hazard);

III. The principal has incomplete information about the agent (asymmetric information); or

IV. The agent has incomplete information about the principal (asymmetric information)?

The principal-agent problem occurs when the following statements are true:

Question 1013 book build, initial public offering, capital raising, demand schedule

A firm is floating its stock in an IPO and its underwriter has received the following bids, listed in order from highest to lowest share price:

| IPO Book Build Bids | ||

| Bidders | Share price | Number of shares |

| $/share | millions | |

| BidderA | 2.5 | 2 |

| BidderB | 2 | 1.5 |

| BidderC | 1.5 | 4 |

| BidderD | 1 | 3 |

| BidderE | 0.5 | 2 |

Suppose that the firm's owner wishes to sell all of their 8 million shares, so no new money will be raised and no money will re-invested back into the firm. Which of the following statements is NOT correct?