A two year Government bond has a face value of $100, a yield of 2.5% pa and a fixed coupon rate of 0.5% pa, paid semi-annually. What is its price?

A fairly priced stock has an expected return of 15% pa. Treasury bonds yield 5% pa and the market portfolio's expected return is 10% pa. What is the beta of the stock?

A firm can issue 5 year annual coupon bonds at a yield of 8% pa and a coupon rate of 12% pa.

The beta of its levered equity is 1. Five year government bonds yield 5% pa with a coupon rate of 6% pa. The market's expected dividend return is 4% pa and its expected capital return is 6% pa.

The firm's debt-to-equity ratio is 2:1. The corporate tax rate is 30%.

What is the firm's after-tax WACC? Assume a classical tax system.

Question 408 leverage, portfolio beta, portfolio risk, real estate, CAPM

You just bought a house worth $1,000,000. You financed it with an $800,000 mortgage loan and a deposit of $200,000.

You estimate that:

- The house has a beta of 1;

- The mortgage loan has a beta of 0.2.

What is the beta of the equity (the $200,000 deposit) that you have in your house?

Also, if the risk free rate is 5% pa and the market portfolio's return is 10% pa, what is the expected return on equity in your house? Ignore taxes, assume that all cash flows (interest payments and rent) were paid and received at the end of the year, and all rates are effective annual rates.

Question 584 option, option payoff at maturity, option profit

Which of the following statements about European call options on non-dividend paying stocks is NOT correct?

Which of the below formulas gives the payoff at maturity ##(f_T)## from being long a future? Let the underlying asset price at maturity be ##S_T## and the locked-in futures price be ##K_T##.

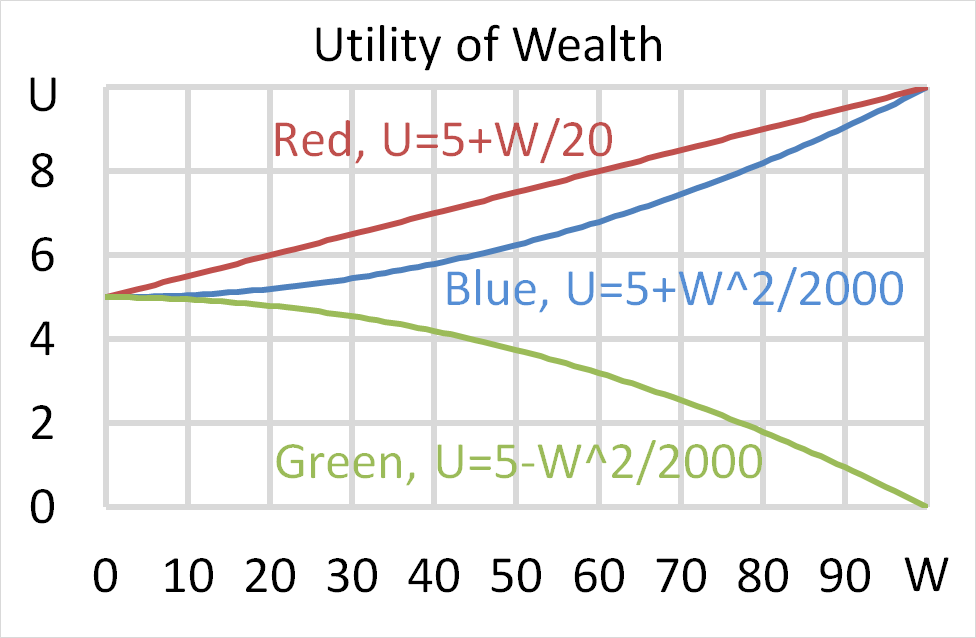

Mr Blue, Miss Red and Mrs Green are people with different utility functions. Which of the statements about the 3 utility functions is NOT correct?

A 90 day bank bill has a face value of $100,000.

Investor A bought the bill when it was first issued at a simple yield to maturity of 3% pa and sold it 20 days later to Investor B who expected to earn a simple yield to maturity of 5% pa. Investor B held it until maturity.

Which of the following statements is NOT correct?