For a price of $102, Andrea will sell you a share which just paid a dividend of $10 yesterday, and is expected to pay dividends every year forever, growing at a rate of 5% pa.

So the next dividend will be ##10(1+0.05)^1=$10.50## in one year from now, and the year after it will be ##10(1+0.05)^2=11.025## and so on.

The required return of the stock is 15% pa.

A project has the following cash flows:

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -400 |

| 1 | 200 |

| 2 | 250 |

What is the Profitability Index (PI) of the project? Assume that the cash flows shown in the table are paid all at once at the given point in time. The required return is 10% pa, given as an effective annual rate.

You're thinking of starting a new cafe business, but you're not sure if it will be profitable.

You have to decide what type of cups, mugs and glasses you wish to buy. You can pay to have your cafe's name printed on them, or just buy the plain un-marked ones. For marketing reasons it's better to have the cafe name printed. But the plain un-marked cups, mugs and glasses maximise your:

Question 558 portfolio weights, portfolio return, short selling

An investor wants to make a portfolio of two stocks A and B with a target expected portfolio return of 16% pa.

- Stock A has an expected return of 8% pa.

- Stock B has an expected return of 12% pa.

What portfolio weights should the investor have in stocks A and B respectively?

Which of the below formulas gives the profit ##(\pi)## from being short a call option? Let the underlying asset price at maturity be ##S_T##, the exercise price be ##X_T## and the option price be ##f_{LC,0}##. Note that ##S_T##, ##X_T## and ##f_{LC,0}## are all positive numbers.

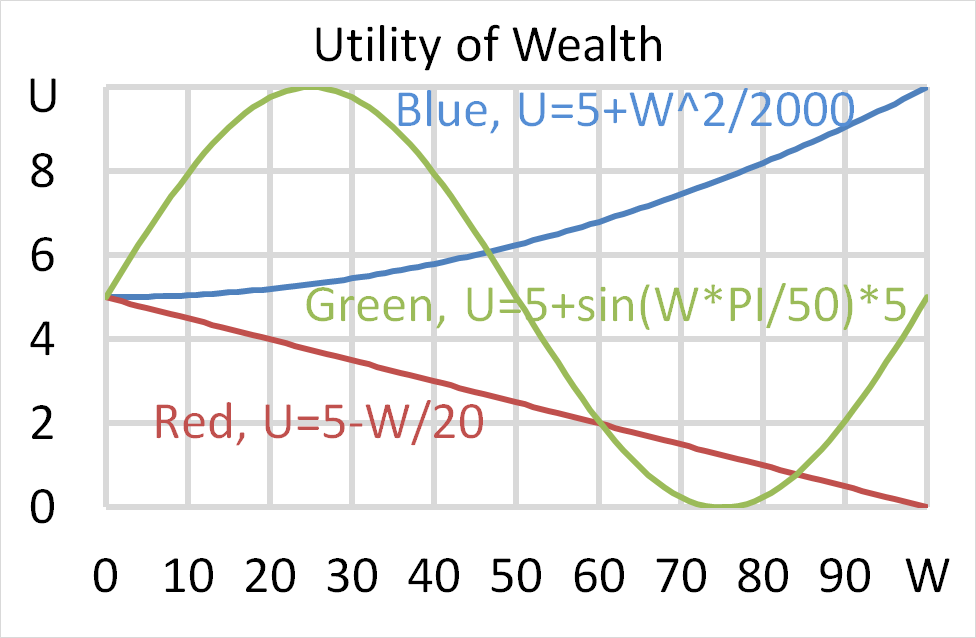

Question 702 utility, risk aversion, utility function, gamble

Mr Blue, Miss Red and Mrs Green are people with different utility functions.

Each person has $50 of initial wealth. A coin toss game is offered to each person at a casino where the player can win or lose $50. Each player can flip a coin and if they flip heads, they receive $50. If they flip tails then they will lose $50. Which of the following statements is NOT correct?

A firm conducts a two-for-one stock split. Which of the following consequences would NOT be expected?

A stock, a call, a put and a bond are available to trade. The call and put options' underlying asset is the stock they and have the same strike prices, ##K_T##.

You are currently long the stock. You want to hedge your long stock position without actually trading the stock. How would you do this?

Question 856 credit terms, no explanation

Your supplier’s credit terms are "1/10 net 30". Which of the following statements about these credit terms is NOT correct?

If you intend to buy an item from your supplier for a tag price of $100 and you: