A person is thinking about borrowing $100 from the bank at 7% pa and investing it in shares with an expected return of 10% pa. One year later the person intends to sell the shares and pay back the loan in full. Both the loan and the shares are fairly priced.

What is the Net Present Value (NPV) of this one year investment? Note that you are asked to find the present value (##V_0##), not the value in one year (##V_1##).

The shares are expected to be worth $110 in one year, and the loan will be worth $107. So there is a positive expected cash flow of $3 in one year.

###\begin{aligned} V_1 &= V_\text{1, shares} - V_\text{1, loan} \\ &= V_\text{0, shares}(1+r_\text{shares})^1 - V_\text{0, loan}(1+r_\text{loan})^1 \\ &= 100(1+0.1)^1 - 100(1+0.07)^1 \\ &= 110 - 107 \\ &= 3 \\ \end{aligned} ###

Most people then discount the future value of $3 to get a present value of either $2.8037 or $2.7273 depending on whether they use a discount rate of 7 or 10% respectively. But this approach is wrong. The problem becomes apparent when trying to justify the use of one discount rate over another to find the present value of the $3. Should it be 10% or 7% or an average? Unfortunately this way of thinking was flawed from the beginning when the share's and loan's cash flows were added together because they have different risks and should be discounted by different required returns.

The way to analyse this question is to consider buying the shares and selling the loan separately. Note that 'borrowing' is the same thing as 'selling' a loan.

Since the shares are fairly priced, the NPV of buying them is zero. Similarly for the fairly priced loan, the NPV of selling it must be zero. So the NPV of the two transactions is zero plus zero which equals zero.

Alternatively, a more mathematical way of looking at it is that the expected returns of the fairly priced shares and loan are exactly equal to their respective discount rates. So they cancel out as follows:

###\begin{aligned} V_1 &= V_\text{1, shares} - V_\text{1, loan} \\ V_0 &= \frac{V_\text{1, shares}}{(1+r_\text{shares})^1} - \frac{V_\text{1, loan}}{(1+r_\text{loan})^1} \\ &= \frac{V_\text{0, shares}(1+r_\text{shares})^1}{(1+r_\text{shares})^1} - \frac{V_\text{0, loan}(1+r_\text{loan})^1}{(1+r_\text{loan})^1} \\ &= \frac{100(1+0.1)^1}{(1+0.1)^1} - \frac{100(1+0.07)^1}{(1+0.07)^1} \\ &= \frac{110}{(1+0.1)^1} - \frac{107}{(1+0.07)^1} \\ &= 100 - 100 \\ &= 0 \\ \end{aligned} ###

It seems nonsensical that there is a positive expected cash flow of $3 in one year, yet the NPV is zero. The reason why this scenario occurs in theory and in real life is that the expected value of the shares is $110 in one year but it could be a lot less. The loan, on the other hand, will definitely have $107 owing. In the worst case, after one year the shares become worthless (price = 0) and $107 is owed on the loan.

The expected gain of $3 is deserved for taking on the stock's higher level of systematic risk compared with the loan. Investors who suffer higher systematic risk deserve a higher return.

Other interesting view points about this scenario:

- In a risk-neutral world, all assets earn the risk-free rate thus there would be no positive expected future cash flow of $3. But in a risk-averse world, the $3 is compensation for taking on systematic risk.

- The principal of no-arbitrage says that in an efficient market it should be impossible to make unlimited risk-free gains. The portfolio of shares funded by the loan requires no capital so its payoff is unlimited, but the $3 expected gain is not risk-free. Thus the principal of no-(risk-free)-arbitrage holds.

- Banks prefer to lend with some form of security which has a value of more than the loan. The shares have the same value as the loan so they are unlikely to provide sufficient security. In the real world, margin loans on shares generally have a maximum debt-to-assets ratio of 0.7. Residential real estate lenders prefer borrowers to contribute a deposit of 20% of the house price, which equates to a debt-to-assets ratio of 0.8.

- An interesting line of research is the 'Kelly Criterion' and the 'Growth Optimal Portfolio'. The Kelly Criterion is widely known in the gambling literature and is used to calculate the optimal proportion of wealth to wager on a risky bet when the odds are in your favour. The Kelly criterion maximises the growth rate of wealth. It can also be applied to financial decisions such as this if the investor prefers to maximise her expected growth rate of wealth rather than her utility function which takes return and volatility into account.

A very low-risk stock just paid its semi-annual dividend of $0.14, as it has for the last 5 years. You conservatively estimate that from now on the dividend will fall at a rate of 1% every 6 months.

If the stock currently sells for $3 per share, what must be its required total return as an effective annual rate?

If risk free government bonds are trading at a yield of 4% pa, given as an effective annual rate, would you consider buying or selling the stock?

The stock's required total return is:

Using the dividend discount model (DDM),

###\begin{aligned} P_{0} &= \frac{C_\text{6mth}}{r_\text{eff 6mth} - g_\text{eff 6mth}} \\ &= \frac{C_0(1+g_\text{eff 6mth})^1}{r_\text{eff 6mth} - g_\text{eff 6mth}} \\ \end{aligned} ### ###\begin{aligned} 3 &= \frac{0.14(1-0.01)^1}{r_\text{eff 6mth} - (-0.01)} \\ \end{aligned} ### ###\begin{aligned} r_\text{eff 6mth} &= \frac{0.14(1-0.01)^1}{3} - 0.01 \\ &= 0.0362 \\ \end{aligned} ### ###\begin{aligned} r_\text{eff annual} &= (1+r_\text{eff 6mth})^2-1 \\ &= (1+0.0362 )^2-1 \\ &= 0.07371044 \\ \end{aligned} ###Since this stock is very low risk, we can guess that it should have a low return close to the risk free rate which is the time value of money. Since this stock returns much more than the risk free rate (7.37% vs 4%), this stock is returning more than what we deserve. It is a good stock that we would like to buy. Its price is too low so it is under-priced, and buying it would have a positive NPV.

Note that this assumes that the stock's high historical rate of return in the past will continue into the future, but this might not be true.

The famous investor Warren Buffett is one of few portfolio managers who appears to have consistently beaten the market. His company Berkshire Hathaway (BRK) appears to have outperformed the US S&P500 market index, shown in the graph below.

Read the below statements about Warren Buffett and the implications for the Efficient Markets Hypothesis (EMH) theory of Eugene Fama. Assume that the first sentence is true. Analyse the second sentence and select the answer option which is NOT correct. In other words, find the false statement in the second sentence.

If Buffett were an insider trader who illegally makes money from private information (which is not true, but suppose he is), this would provide evidence for rejecting the strong form EMH only, not the semi-strong form EMH.

Markets can still be semi-strong form efficient while insider traders are operating. This is because semi-strong form efficiency says that all public (not private) information is reflected in share prices. Strong form market efficiency says that all public and private information is reflected in stock prices.

Select the most correct statement from the following.

'Chartists', also known as 'technical traders', believe that:

Chartists make charts of past prices or returns and try to use them to extrapolate future prices or returns.

If a chartist can make consistent returns above what they deserve according to the systematic risk they take on, then they are breaking weak-form market efficiency, they are proving the random walk hypothesis wrong.

Most finance practitioners do not believe that chartists can make consistent positive abnormal returns. On the contrary, many expect that compared to a buy-and-hold strategy, most chartists would do worse since they simply rack up transaction costs with each trade where they sell a fairly priced stock and buy another fairly priced stock.

The idea of market efficiency in finance is very similar to competitive markets in economics. In the long run, firms operating in competitive markets with low barriers to entry will make zero economic profits. Note that economic profits include opportunity costs such as the cost of capital which accounting profit ignores.

Similarly, in the highly competitive financial markets it's very hard to make positive abnormal returns. If it was easy, someone would have already done it and bid the under-priced assets up and sold the over-priced assets down.

Fundamentalists who analyse company financial reports and news announcements (but who don't have inside information) will make positive abnormal returns if:

If fundamentalists make returns above the return that they deserve, for the level of systematic risk that they take on, then they earn positive abnormal returns and semi-strong form market efficiency must be broken. Therefore markets must be semi-strong form inefficient.

Fundamentalists benefit from semi-strong form market inefficiency. Chartists, another name for 'technical traders', benefit from weak form market inefficiency.

According to Eugene Fama, who constructed this theory, the levels of market efficiency are built on one another, so if markets are weak form inefficient then they are also semi-strong and strong-form inefficient which means that all forms of efficiency are broken.

Question 455 income and capital returns, payout policy, DDM, market efficiency

A fairly priced unlevered firm plans to pay a dividend of $1 next year (t=1) which is expected to grow by 3% pa every year after that. The firm's required return on equity is 8% pa.

The firm is thinking about reducing its future dividend payments by 10% so that it can use the extra cash to invest in more projects which are expected to return 8% pa, and have the same risk as the existing projects. Therefore, next year's dividend will be $0.90. No new equity or debt will be issued to fund the new projects, they'll all be funded by the cut in dividends.

What will be the stock's new annual capital return (proportional increase in price per year) if the change in payout policy goes ahead?

Assume that payout policy is irrelevant to firm value (so there's no signalling effects) and that all rates are effective annual rates.

The firm is fairly priced, so its required return (cost of capital) of 8% must equal its expected return (or internal rate of return). Since the new projects' risks are the same as the old projects, the required return must also be 8%.

###r_\text{total, new} = r_\text{total, old} = 0.08###The new projects' expected return is 8% too, so the new projects must be fairly priced, therefore they have a zero net present value. Another way of looking at this is that the cost of capital (total required return or deserved return) equals the internal rate of return (expected return) therefore the NPV is zero.

The share price must not change since the NPV of the projects is zero and there is no new money raised or paid by the firm. Also, payout policy is irrelevant to firm value. So the new share price ##P_{0, \text{new}}## must equal the old share price ##P_{0, \text{old}}##. The old 3% growth rate in the dividend must be equal to the old growth rate in the share price which is the old capital return ##P_\text{capital old}##, according to the theory of the perpetuity equation. Applying the perpetuity with growth formula:

###\begin{aligned} P_{0, \text{new}} &= P_{0, \text{old}} \\ &= \dfrac{C_\text{1 old}}{r_\text{total old} - r_\text{capital old}} \\ &= \dfrac{1}{0.08 - 0.03} \\ &= 20 \\ \end{aligned}###The new dividend ##C_\text{1 new}## will be only $0.90, so the new long term capital return in the perpetuity formula can be calculated:

###\begin{aligned} P_{0, \text{new}} &= \dfrac{C_\text{1 new}}{r_\text{total new} - r_\text{capital new}} \\ 20 &= \dfrac{0.9}{0.08 - r_\text{capital new}} \\ \end{aligned}### ###\begin{aligned} r_\text{capital new} &= 0.08 - \dfrac{0.9}{20} \\ &= 0.08 - 0.045 \\ &= 0.035 \\ \end{aligned}###This new 3.5% pa growth rate in the dividends is also the long term capital return of the stock. Therefore the stock price should increase 3.5% each year, faster than the old 3% pa rate. This makes sense since the firm is re-investing more money and should be able to generate higher growth in assets, dividends and the stock price.

Note that the instantaneous capital return is zero since there was no price-sensitive news released, just a change in payout policy. All of the new projects that will be invested in have zero NPV. So there is no reason for the stock price to increase straightaway.

A managed fund charges fees based on the amount of money that you keep with them. The fee is 2% of the end-of-year amount, paid at the end of every year.

This fee is charged regardless of whether the fund makes gains or losses on your money.

The fund offers to invest your money in shares which have an expected return of 10% pa before fees.

You are thinking of investing $100,000 in the fund and keeping it there for 40 years when you plan to retire.

How much money do you expect to have in the fund in 40 years? Also, what is the future value of the fees that the fund expects to earn from you? Give both amounts as future values in 40 years. Assume that:

- The fund has no private information.

- Markets are weak and semi-strong form efficient.

- The fund's transaction costs are negligible.

- The cost and trouble of investing your money in shares by yourself, without the managed fund, is negligible.

- The fund invests its fees in the same companies as it invests your funds in, but with no fees.

The below answer choices list your expected wealth in 40 years, and then the fund's expected wealth in 40 years.

There are two interesting ways of thinking about this question which give the same answer. The easy method is discussed first.

During the first year your net wealth in the fund will grow by 10%, then it will have the 2% fee chopped off.

###\begin{aligned} V_\text{1, net} &= V_0(1+r_\text{gross})(1-f_\text{end-of-year fee}) \\ &= 100,000(1+0.1)(1-0.02) \\ \end{aligned}###This will repeat every year for 40 years, so multiplying the previous result by ##(1+0.1)(1-0.02)## another 39 times will give your net wealth after fees in 40 years. Of course this is equivalent to raising the growth factor to the power of 40.

###V_\text{T, net} = V_0 \left( (1+r_\text{gross})(1-f_\text{end-of-year fee}) \right)^{T} ### ###\begin{aligned} V_\text{40,net} &= 100,000 \left( (1+0.1)(1-0.02) \right)^{40} \\ &= 2,017,206.85 \\ \end{aligned}###The future value of the fees which are invested in stocks can be found by subtracting your net wealth from the gross value of the stocks. The gross value of the shares in 40 years is:

###V_\text{T, gross} = V_0(1+r_\text{gross})^{T} ### ###\begin{aligned} V_\text{40, gross} &= 100,000(1+0.1)^{40} \\ &= 4,525,925.56 \\ \end{aligned}###This gross value of the stocks must be the sum of your net wealth and the fees in 40 years:

###V_\text{40, gross} = V_\text{40, net} + V_\text{40, fees} ### ###4,525,925.56 = 2,017,206.85 + V_\text{40, fees} ### ###\begin{aligned} V_\text{40, fees} &= 4,525,925.56 - 2,017,206.85 \\ &= 2,508,718.71 \\ \end{aligned}###Thanks to Wendy Wang for this interesting answer. The next method is a little more difficult but more flexible. It puts the question in the framework of the Gordon growth model which makes it more familiar and easier to deal with.

The fee can be converted into an income yield, expressed as the cash flow (dollar fee) in one year divided by the value (dollar wealth in the fund) at the start, rather than in one year.

###\begin{aligned} r_\text{fee yield} &= \dfrac{C_\text{1, fee}}{V_0} \\ &= \dfrac{V_\text{1, gross}.f_\text{end-of-year fee}}{V_0} \\ &= \dfrac{V_0.(1+r_\text{gross}).f_\text{end-of-year fee}}{V_0} \\ &= \dfrac{100,000 \times (1+0.1) \times 0.02}{100,000} \\ &= 0.022 = 2.2\%\\ \end{aligned}###The $100,000 of share assets have a 10% gross yield which can be viewed as a total return. The 2.2% fee yield paid to the fund's management is similar to an income return that reduces the value of the share assets. The net return after fees can be seen as the capital yield. You as the investor are only entitled to this net return after fees:

###r_\text{total} = r_\text{income} + r_\text{capital} ### ###r_\text{gross} = r_\text{fee yield} + r_\text{net} ### ###\begin{aligned} r_\text{net} &= r_\text{gross} - r_\text{fee yield} \\ &= 0.1 - 0.022 \\ &= 0.078 = 7.8\% \\ \end{aligned}###To find the value of your net wealth after fees in 40 years, just grow the original wealth by the 7.8% net return after fees.

###V_\text{T, net} = V_0(1+r_\text{net})^{T} ### ###\begin{aligned} V_\text{40, net} &= 100,000(1+0.078)^{40} \\ &= 2,017,206.85 \\ \end{aligned}###Similarly to the previous method, the fund's fee wealth can be found by subtracting the gross value of the shares by your net wealth in the fund. Alternatively, the value of the fees in 40 years can be found using the annuity with growth formula. The fees grow by the same growth rate as your net wealth, the net return of 7.8%. The first dollar fee paid in one year (t=1) is the fee yield of 2.2% multiplied by the original wealth $100,000 which is $2,200. The required return on the fees is the same as the required return on the shares: the gross return of 10%.

###V_0 = \dfrac{C_1}{r - g} \left( 1 - \left( \dfrac{1+g}{1+r} \right)^T \right) ### ###\begin{aligned} V_\text{0, fees} &= \dfrac{C_\text{1, fees}}{r_\text{gross} - r_\text{net}} \left( 1 - \left( \dfrac{1+r_\text{net}}{1+r_\text{gross}} \right)^{40} \right) \\ &= \dfrac{0.022 \times 100,000}{0.1 - 0.078} \left( 1 - \left( \dfrac{1+0.78}{1+0.1} \right)^{40} \right) \\ &= 55,429.9596 \\ \end{aligned}###The value of the fees in 40 years can be found by growing the shares by the gross return of 10% since the fund pays no fees on its own money.

###\begin{aligned} V_\text{40, fees} &= V_\text{0, fees}(1+r_\text{gross})^{40} \\ &= 55,429.9596(1+0.1)^{40} \\ &= 2,508,718.71 \\ \end{aligned}###It's interesting that the fund ends up with more money than you do even though they started with nothing and you had $100,000. Financial planners in Australia commonly charge fees of 2% of funds under management, 0.75% is theirs and 1.25% is paid to the funds with whom they invest their clients' superannuation (pension) wealth. On top of this they often charge trailing commissions of 20% of dollar gains in wealth. It shows how savvy investors who take a little effort to manage their own wealth can short-cut the finance industry's fees and save a lot of money.

A company advertises an investment costing $1,000 which they say is underpriced. They say that it has an expected total return of 15% pa, but a required return of only 10% pa. Assume that there are no dividend payments so the entire 15% total return is all capital return.

Assuming that the company's statements are correct, what is the NPV of buying the investment if the 15% return lasts for the next 100 years (t=0 to 100), then reverts to 10% pa after that time? Also, what is the NPV of the investment if the 15% return lasts forever?

In both cases, assume that the required return of 10% remains constant. All returns are given as effective annual rates.

The answer choices below are given in the same order (15% for 100 years, and 15% forever):

One hundred year case

Since there are no dividends, the expected total return is all capital return ##(r_\text{expected capital}=0.15)## and the value of the investment in 100 years can be found by growing the initial price ##(P_{\text{0, actual}})## forward.

###\begin{aligned} P_\text{100} &= P_{\text{0, actual}}.(1+r_\text{expected capital})^{100} \\ &= 1,000(1+0.15)^{100} \\ &= 1,174,313,451.70 \\ \end{aligned}###The net present value ##(V_0)## is the present value of the investment using the required total return ##(r_\text{required total}=0.1)##, subtracted by the initial price ##(P_{\text{0, actual}})##.

###\begin{aligned} NPV &= -\text{Cost} + \text{Benefit} \\ &= -P_{\text{0, actual}} + P_{\text{0, fair}} \\ &= -P_{\text{0, actual}} + \dfrac{P_\text{100}}{(1+r_\text{required total})^{100}} \\ &= -1,000 + \dfrac{1,174,313,451.70}{(1+0.1)^{100}} \\ &= -1,000 + 85,214.89624 \\ &= 84,214.89624 \\ \end{aligned}###Perpetual case

If the expected capital return is more than the required return forever, then the investment should have an infinite price and net present value.

###\begin{aligned} NPV &= -\text{Cost} + \text{Benefit} \\ &= -P_{\text{0, actual}} + P_{\text{0, fair}} \\ &= -P_{\text{0, actual}} + P_\text{0, actual} \left( \dfrac{1+r_\text{expected capital}}{1+r_\text{required total}} \right)^{\infty} \\ &= -1,000 + 1,000 \times \left( \dfrac{1+0.15}{1+0.1} \right)^{\infty} \\ &= -1,000 + 1,000 \times \infty \\ &= \infty \\ \end{aligned}###Note that an infinite price is impossible so the firm's claims about the 15% expected return lasting forever must be untrue.

Commentary: Actual and fair prices in the one hundred year case

These questions can be confusing because there appear to be two prices. Consider the one hundred year case. The current price of the investment offered by the firm is $1,000, let's call this the 'actual price'.

###P_\text{0, actual} = 1,000###The other price which is easily confused is the 'fair price', the price according to our calculations. This is the true or fundamental price that the investment should be worth, assuming that the firm's claims are true.

###\begin{aligned} P_\text{0, fair} &= \dfrac{P_\text{0, actual}.(1+r_\text{capital total})^{100}}{(1+r_\text{required total})^{100}} \\ &= \dfrac{1,000(1+0.15)^{100}}{(1+0.1)^{100}} \\ &= \dfrac{1,174,313,451.70}{(1+0.1)^{100}} \\ &= 85,214.89624 \\ \end{aligned}###Clearly, the actual $1,000 price offered by the firm selling the investment is too low compared to the fair price. The investment is under-priced, it has a positive alpha (or excess return) of 5% pa ##(=0.15-0.1)##, and that's why buying the investment is positive NPV.

###\begin{aligned} NPV &= -P_\text{0, actual} + P_\text{0, fair} \\ &= -1,000 + 85,214.89624 \\ &= 84,214.89624 \\ \end{aligned}###A company advertises an investment costing $1,000 which they say is underpriced. They say that it has an expected total return of 15% pa, but a required return of only 10% pa. Of the 15% pa total expected return, the dividend yield is expected to always be 7% pa and rest is the capital yield.

Assuming that the company's statements are correct, what is the NPV of buying the investment if the 15% total return lasts for the next 100 years (t=0 to 100), then reverts to 10% after that time? Also, what is the NPV of the investment if the 15% return lasts forever?

In both cases, assume that the required return of 10% remains constant, the dividends can only be re-invested at 10% pa and all returns are given as effective annual rates.

The answer choices below are given in the same order (15% for 100 years, and 15% forever):

One hundred year case

To find the NPV of the investment when the 15% pa total return lasts for 100 years, subtract the price now and add the present value of the growing dividends and the capital price in 100 years.

Note that the fair total required return is 10% so ##r_\text{total} = 0.1## and the dividend yield is 7% so ##r_\text{div} = 0.07##. The growth rate in the dividend for the first 100 years must be 8% which is the 15% expected total return less the 7% dividend yield, so ##g_\text{div growth} = 0.08##.

###\begin{aligned} NPV &= -\text{Cost} + \text{Benefit} \\ &= -P_{\text{0, actual}} + P_{\text{0, fair}} \\ &= -P_{\text{0, actual}} + \text{PresentValueOfDividendsFor100Years} + \text{PresentValueOfFairPriceIn100Years} \\ &= -P_{\text{0, actual}} + \dfrac{C_1}{r_\text{total} - g_\text{div growth}} \left( 1 - \left( \dfrac{1+g_\text{div growth}}{1+r_\text{total}} \right)^{100} \right) + \dfrac{P_\text{100, fair}}{(1+r_\text{total})^{100}} \\ &= -P_{\text{0, actual}} + \dfrac{P_{\text{0, actual}} . r_\text{div}}{r_\text{total} - g_\text{div growth}} \left( 1 - \left( \dfrac{1+g_\text{div growth}}{1+r_\text{total}} \right)^{100} \right) + \dfrac{P_{\text{0, actual}}.(1+g_\text{div growth})^{100}}{(1+r_\text{total})^{100}} \\ &= -1,000 + \dfrac{1,000 \times 0.07}{0.1 - 0.08} \left( 1 - \left( \dfrac{1+0.08}{1+0.1} \right)^{100} \right) + \dfrac{1,000(1+0.08)^{100}}{(1+0.1)^{100}} \\ &=-1,000 + 3,100.93 \\ &=2,100.93 \\ \end{aligned}###Note that there's another way to calculate the fair price at time 100 ##P_\text{100, fair} = 1000(1+0.08)^{100} = 2,199,761.25634##, which is to value the stock as a perpetuity of the dividends from year 101 onwards:

###\begin{aligned} P_\text{100, fair} &= \dfrac{C_{101}}{r_\text{total} - g_\text{div growth low}} \\ &= \dfrac{C_{1}(1+g_\text{div growth high})^{100}}{r_\text{total} - g_\text{div growth low}} \\ &= \dfrac{P_\text{0, actual}.r_\text{div}(1+g_\text{div growth high})^{100}}{r_\text{total} - g_\text{div growth low}} \\ &= \dfrac{1,000 \times 0.07 \times (1+0.08)^{100}}{0.1 - 0.02} \\ &= \dfrac{70 \times (1+0.08)^{100}}{0.1 - 0.02} \\ &= 2,199,761.25634 \\ \end{aligned}###Perpetual case

To find the NPV of the investment when the 15% pa total return lasts forever, subtract the actual price now and add the present value of the fair price which is perpetuity of growing dividends using the DDM.

###\begin{aligned} NPV &= -\text{Cost} + \text{Benefit} \\ &= -P_{\text{0, actual}} + P_{\text{0, fair}} \\ &= -P_{\text{0, actual}} + \dfrac{C_\text{1}}{r_\text{total} - g_\text{div growth}} \\ &= -P_{\text{0, actual}} + \dfrac{P_{\text{0, actual}} . r_\text{div, actual}}{r_\text{total} - g_\text{div growth}} \\ &= -1,000 + \dfrac{1,000 \times 0.07}{0.1 - 0.08} \\ &= -1,000 + 3,500 \\ &=2,500 \\ \end{aligned}###| Actual and Fair Values and Returns | ||

| Actual | Fair Perpetual | |

| Total return pa | 0.15 | 0.10 |

| Capital return and dividend growth rate pa |

0.08 | 0.08 |

| Dividend return pa | 0.07 | 0.02 |

| Price ##(P_0)## | 1,000 | 3,500 |

Question 780 mispriced asset, NPV, DDM, market efficiency, no explanation

A company advertises an investment costing $1,000 which they say is under priced. They say that it has an expected total return of 15% pa, but a required return of only 10% pa. Of the 15% pa total expected return, the dividend yield is expected to be 4% pa and the capital yield 11% pa. Assume that the company's statements are correct.

What is the NPV of buying the investment if the 15% total return lasts for the next 100 years (t=0 to 100), then reverts to 10% after that time? Also, what is the NPV of the investment if the 15% return lasts forever?

In both cases, assume that the required return of 10% remains constant, the dividends can only be re-invested at 10% pa and all returns are given as effective annual rates. The answer choices below are given in the same order (15% for 100 years, and 15% forever):

No explanation provided.

Question 338 market efficiency, CAPM, opportunity cost, technical analysis

A man inherits $500,000 worth of shares.

He believes that by learning the secrets of trading, keeping up with the financial news and doing complex trend analysis with charts that he can quit his job and become a self-employed day trader in the equities markets.

What is the expected gain from doing this over the first year? Measure the net gain in wealth received at the end of this first year due to the decision to become a day trader. Assume the following:

- He earns $60,000 pa in his current job, paid in a lump sum at the end of each year.

- He enjoys examining share price graphs and day trading just as much as he enjoys his current job.

- Stock markets are weak form and semi-strong form efficient.

- He has no inside information.

- He makes 1 trade every day and there are 250 trading days in the year. Trading costs are $20 per trade. His broker invoices him for the trading costs at the end of the year.

- The shares that he currently owns and the shares that he intends to trade have the same level of systematic risk as the market portfolio.

- The market portfolio's expected return is 10% pa.

Measure the net gain over the first year as an expected wealth increase at the end of the year.

Since the share market is weak-form efficient, there's no use trying to predict price movements from past prices and returns (technical analysis) because prices don't follow any pattern, they'll be a random walk whose up and down moves are determined by the release of good and bad news. Of course in the very long run, prices should trend upwards to reflect the time value of money and risk premium, but they bump up and down as price-sensitive news is released.

Since the share market is also semi-strong form efficient, there's no use reading the financial news, because any price-sensitive information will be instantly reflected in share prices.

Since the man has no inside information, his time spent day-trading is wasted since he can only expect to earn the market rate of return which he would earn anyway as a passive buy-and-hold investor. Actually, by actively day-trading he will only rack up transaction costs and lose the potential wages he could have earned doing his old job (an opportunity cost).

Therefore the net gain as a cash flow measured at the end of the year will be the future value of his transaction costs and opportunity costs of not working. Since they are both paid at the end of the year, these amounts can be simply summed:

###\begin{aligned} V_1 &= - (\text{opportunity cost of not working}) - (\text{transaction costs}) \\ &= - 60,000 - 250 \times 20 \\ &= - 60,000 - 5,000 \\ &= - 65,000 \\ \end{aligned}###So the man should not quit his ordinary job and become a day trader. If he does that he'll lose $65,000 at the end of each year.

Note that the expected cash flow he'll earn from having his money invested in shares is not a gain since he would have earned that regardless of his decision to quit his job and become a day-trader or not. Also, the return he earns on the shares is exactly the return he deserves for the risk, so the NPV of investing is zero so there is no gain after adjusting for risk anyway.

A managed fund charges fees based on the amount of money that you keep with them. The fee is 2% of the start-of-year amount, but it is paid at the end of every year.

This fee is charged regardless of whether the fund makes gains or losses on your money.

The fund offers to invest your money in shares which have an expected return of 10% pa before fees.

You are thinking of investing $100,000 in the fund and keeping it there for 40 years when you plan to retire.

What is the Net Present Value (NPV) of investing your money in the fund? Note that the question is not asking how much money you will have in 40 years, it is asking: what is the NPV of investing in the fund? Assume that:

- The fund has no private information.

- Markets are weak and semi-strong form efficient.

- The fund's transaction costs are negligible.

- The cost and trouble of investing your money in shares by yourself, without the managed fund, is negligible.

Since the fund doesn't actually have any inside information and markets are efficient, the fund contributes nothing so its fees are value-destructive to investors. Therefore the NPV must be negative.

There are two ways of thinking about this question. The simplest way is to find how much money will be in the fund in 40 years, which will grow by 8% pa which is the expected return (10%) less fees (2%). Then discount this amount by the required return which is 10%, since the fund has the same level of systematic risk as the market portfolio which returns 10%. This present value less the original $100,000 investment will equal the NPV of investing in the fund: ###\begin{aligned} V_0 &= -C_{0} + \frac{C_{40}}{(1+r)^{40}} \\ &= -C_{0} + \frac{C_{0}(1+g)^{40}}{(1+r)^{40}} \\ &= -100,000 + \frac{100,000(1+0.08)^{40}}{(1+0.1)^{40}} \\ &= -100,000 + 48,000.17 \\ &= -51,999.83 \\ \end{aligned}###Another way to find the NPV of the decision to invest is to calculate the NPV of the fees. Since investing in an efficient market with no inside information, transaction costs or economies of scale is a zero-NPV-sum game, any gain to the fund must be a loss to the investor. Therefore the positive NPV of the fees to the fund must be the negative NPV of paying the fees for investors. The NPV of the growing fees can be found using the annuity with growth equation (see question 65 for a derivation):

###\begin{aligned} V_0 &= \frac{-C_{1\text{,fee}}}{r-g} \left( 1 - \left( \frac{1+g}{1+r} \right)^T \right) \\ &= \frac{-100,000 \times 0.02}{0.1-0.08} \left( 1 - \left( \frac{1+0.08}{1+0.1} \right)^{40} \right) \\ &= -51,999.83 \\ \end{aligned}###Question 416 real estate, market efficiency, income and capital returns, DDM, CAPM

A residential real estate investor believes that house prices will grow at a rate of 5% pa and that rents will grow by 2% pa forever.

All rates are given as nominal effective annual returns. Assume that:

- His forecast is true.

- Real estate is and always will be fairly priced and the capital asset pricing model (CAPM) is true.

- Ignore all costs such as taxes, agent fees, maintenance and so on.

- All rental income cash flow is paid out to the owner, so there is no re-investment and therefore no additions or improvements made to the property.

- The non-monetary benefits of owning real estate and renting remain constant.

Which one of the following statements is NOT correct? Over time:

All statements are true except the last if the forecasts and assumptions are correct.

-

Statement a is true. Since the price ##(P)## is increasing by more than the net rent ##(C)## then the net rental yield ##(C_{t+1}/P_{t})## must fall and approach zero over time.

-

Statement b is true. The total required return on real estate ##(r_\text{real estate, total})## is the sum of the rental and capital yields.

###\begin{aligned} r_\text{real estate, total} &= r_\text{real estate, rent} + r_\text{real estate, capital} \\ &= \dfrac{C_1}{P_0} + \dfrac{P_1 - P_0}{P_0} \\ \end{aligned}###Since the price is and always will be fairly priced, and the rental yield approaches zero, then the total return must fall. The total yield will approach the capital yield.

-

Statement c is true. The total required return is based on the (systematic) risk of the investment, which is determined by the capital asset pricing model (CAPM). Since real estate is and always will be fairly priced, then real estate must plot on the CAPM's security market line (SML):

###\begin{aligned} r_\text{real estate, total} &= r_f + \beta_\text{real estate}.(r_m-r_f) \\ &= r_f + \beta_\text{real estate}.(r_\text{market risk premium}) \\ \end{aligned}###So for the required total return on real estate to fall ##(r_\text{real estate, total})##, either one or more of the risk free rate ##(r_f)##, market risk premium ##(r_\text{market risk premium} = r_m-r_f)##, or systematic risk as measured by beta ##(\beta_\text{real estate})## must fall.

-

Statement d is true. Real estate comprises part of a country's wealth. If real estate prices grow by more than the country's wealth forever, then eventually real estate will become the only significant asset in the economy.

-

Statement e is false . Rent comprises part of a country's gross domestic product (GDP). If rents grow by less than the country's GDP forever, then eventually rent will become insignificant compared to rest of the country's production. Rent will approach zero percent of the economy's production, not 100%.

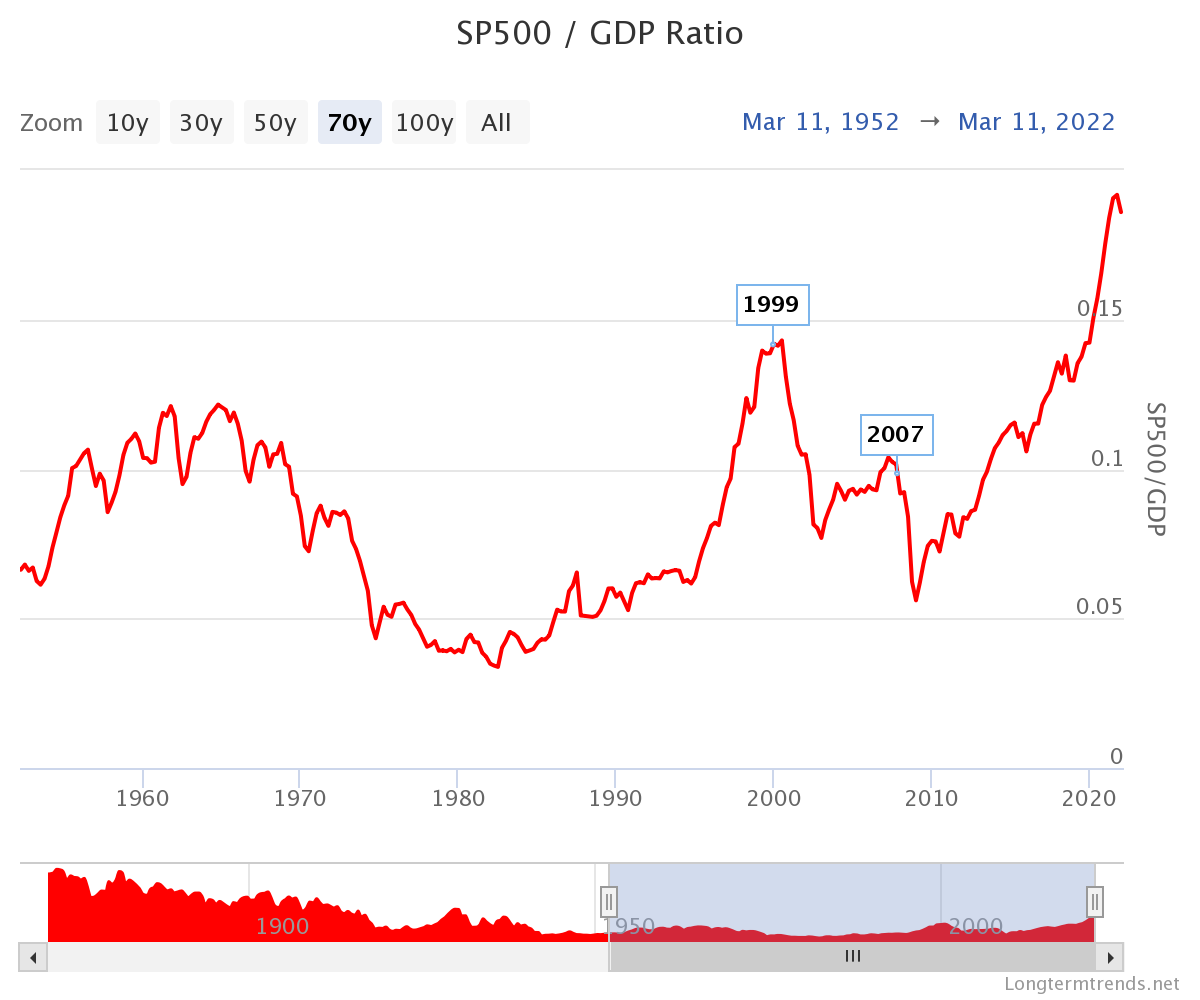

Question 1029 Buffett ratio

Tesla CEO Elon Musk asked a question to ARK Invest CEO Cathie Wood on 6 April 2021: "What do you think of the unusually high ratio of the S&P market cap to GDP?", to which Cathie Wood replied.

What are the units of this S&P500 market cap to GDP ratio, commonly known as the Buffett ratio?

The units of this S&P500-to-GDP ratio is time. More specificaly, it's years if the gross domestic product (GDP) is annual:

###\dfrac{\text{Market capitalisation as at a date}}{\text{GDP per annum}} = \dfrac{\text{\$}}{\$/\text{year}} = \dfrac{\text{1}}{1/\text{year}} = \text{years} ###The ratio is notable as the Buffett ratio since Warren Buffett once said it's "the best single measure of where valuations stand at any given moment".

Source: https://www.longtermtrends.net/market-cap-to-gdp-the-buffett-indicator/

Here's an excerpt from an interview between Magellan fund co-founder Hamish Douglass and AFR reporter Vesna Poljak, which appeared in the Australian Financial Review article ‘It's all about interest rates: Hamish Douglass’, 19 July 2019:

Take a business growing at 4 per cent a year, with a cost of equity of 10 per cent based off a 5 per cent risk-free rate and a 5 per cent market risk premium: you would value that at around 16.6 times free cashflow.

Now take a business growing at the same rate, with a 4 per cent risk free rate. At a 9 per cent cost of equity that would command a 20 times multiple, he says.

At a 3 per cent risk-free rate, the cost of equity is 8 per cent, and the multiple is 25.

Finally at 2 per cent – 'which is where the world is at the moment' – the same business would be worth around 33 times free cashflow.

In August 2021, the RBA overnight cash rate and 3 year Australian government treasury bond yield were both 0.1% pa. If this low risk-free yield was expected to persist forever, what approximate equity price-to-cashflow multiple would that imply for a business expected to grow at 4% pa in perpetuity with a 5% equity risk premium?

At a 0.1% pa risk free rate, together with a 5% pa market risk premium and CAPM beta of 1, the required return on equity would be:

###\begin{aligned} r_E &= r_f + \beta_E . MRP \\ &= 0.001 + 1 \times 0.05 \\ &= 0.051 \\ \end{aligned}###Substituting this into the dividend discount model (DDM):

###\begin{aligned} P_0 &= \dfrac{C_1}{r_E-g} \\ &= C_1 \times \dfrac{1}{r_E-g} \\ &= C_1 \times \dfrac{1}{0.051-0.04} \\ &= C_1 \times 90.9090909091 \end{aligned}###Therefore, the equity would command a multiple of nearly 91 times the expected equity free cash flow at the end of the year ##(C_1)##.