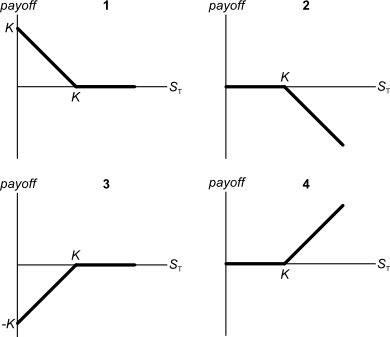

Below are 4 option graphs. Note that the y-axis is payoff at maturity (T). What options do they depict? List them in the order that they are numbered.

You want to buy an apartment priced at $500,000. You have saved a deposit of $50,000. The bank has agreed to lend you the $450,000 as an interest only loan with a term of 30 years. The interest rate is 6% pa and is not expected to change. What will be your monthly payments?

Which one of the following is NOT usually considered an 'investable' asset for long-term wealth creation?

Question 405 DDM, income and capital returns, no explanation

The perpetuity with growth formula is:

###P_0= \dfrac{C_1}{r-g}###

Which of the following is NOT equal to the total required return (r)?

A European call option will mature in ##T## years with a strike price of ##K## dollars. The underlying asset has a price of ##S## dollars.

What is an expression for the payoff at maturity ##(f_T)## in dollars from having written (being short) the call option?

Which of the following is NOT a valid method to estimate future revenues or costs in a pro-forma income statement when trying to value a company?

What is the covariance of a variable X with itself?

The cov(X, X) or ##\sigma_{X,X}## equals:

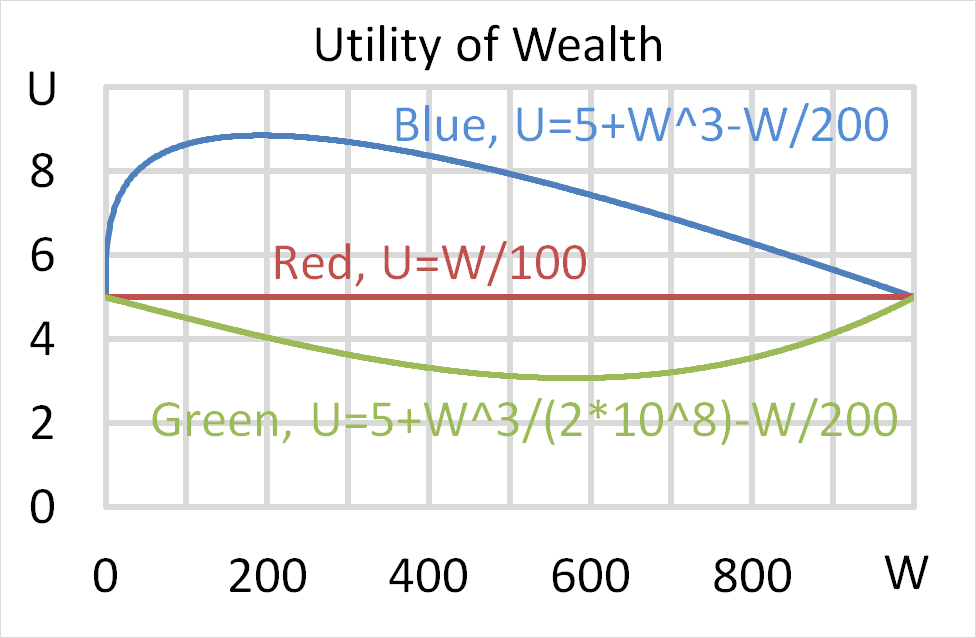

Mr Blue, Miss Red and Mrs Green are people with different utility functions.

Which of the following statements is NOT correct?

Question 745 real and nominal returns and cash flows, inflation, income and capital returns

If the nominal gold price is expected to increase at the same rate as inflation which is 3% pa, which of the following statements is NOT correct?

Which of the following statements about bond convexity is NOT correct?