A stock was bought for $8 and paid a dividend of $0.50 one year later (at t=1 year). Just after the dividend was paid, the stock price was $7 (at t=1 year).

What were the total, capital and dividend returns given as effective annual rates? The choices are given in the same order:

##r_\text{total}##, ##r_\text{capital}##, ##r_\text{dividend}##.

Question 271 CAPM, option, risk, systematic risk, systematic and idiosyncratic risk

All things remaining equal, according to the capital asset pricing model, if the systematic variance of an asset increases, its required return will increase and its price will decrease.

If the idiosyncratic variance of an asset increases, its price will be unchanged.

What is the relationship between the price of a call or put option and the total, systematic and idiosyncratic variance of the underlying asset that the option is based on? Select the most correct answer.

Call and put option prices increase when the:

Two years ago Fred bought a house for $300,000.

Now it's worth $500,000, based on recent similar sales in the area.

Fred's residential property has an expected total return of 8% pa.

He rents his house out for $2,000 per month, paid in advance. Every 12 months he plans to increase the rental payments.

The present value of 12 months of rental payments is $23,173.86.

The future value of 12 months of rental payments one year ahead is $25,027.77.

What is the expected annual growth rate of the rental payments? In other words, by what percentage increase will Fred have to raise the monthly rent by each year to sustain the expected annual total return of 8%?

Question 738 financial statement, balance sheet, income statement

Where can a private firm's market value of equity be found? It can be sourced from the company's:

Question 771 debt terminology, interest expense, interest tax shield, credit risk, no explanation

You deposit money into a bank account. Which of the following statements about this deposit is NOT correct?

Question 897 comparative advantage in trade, production possibilities curve, no explanation

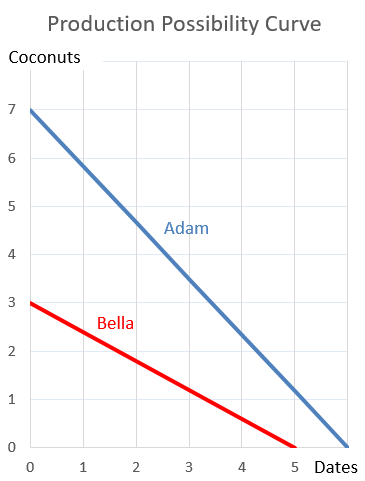

Adam and Bella are the only people on a remote island. Their production possibility curves are shown in the graph.

Which of the following statements is NOT correct?

Question 904 option, Black-Scholes-Merton option pricing, option on future on stock index

A six month European-style call option on six month S&P500 index futures has a strike price of 2800 points.

The six month futures price on the S&P500 index is currently at 2740.805274 points. The futures underlie the call option.

The S&P500 stock index currently trades at 2700 points. The stock index underlies the futures. The stock index's standard deviation of continuously compounded returns is 25% pa.

The risk-free interest rate is 5% pa continuously compounded.

Use the Black-Scholes-Merton formula to calculate the option price. The call option price now is: