Interest expense (IntExp) is an important part of a company's income statement (or 'profit and loss' or 'statement of financial performance').

How does an accountant calculate the annual interest expense of a fixed-coupon bond that has a liquid secondary market? Select the most correct answer:

Annual interest expense is equal to:

A European company just issued two bonds, a

- 3 year zero coupon bond at a yield of 6% pa, and a

- 4 year zero coupon bond at a yield of 6.5% pa.

What is the company's forward rate over the fourth year (from t=3 to t=4)? Give your answer as an effective annual rate, which is how the above bond yields are quoted.

The saying "buy low, sell high" suggests that investors should make a:

Question 568 rights issue, capital raising, capital structure

A company conducts a 1 for 5 rights issue at a subscription price of $7 when the pre-announcement stock price was $10. What is the percentage change in the stock price and the number of shares outstanding? The answers are given in the same order. Ignore all taxes, transaction costs and signalling effects.

A stock has a beta of 1.5. The market's expected total return is 10% pa and the risk free rate is 5% pa, both given as effective annual rates.

In the last 5 minutes, bad economic news was released showing a higher chance of recession. Over this time the share market fell by 1%. The risk free rate was unchanged.

What do you think was the stock's historical return over the last 5 minutes, given as an effective 5 minute rate?

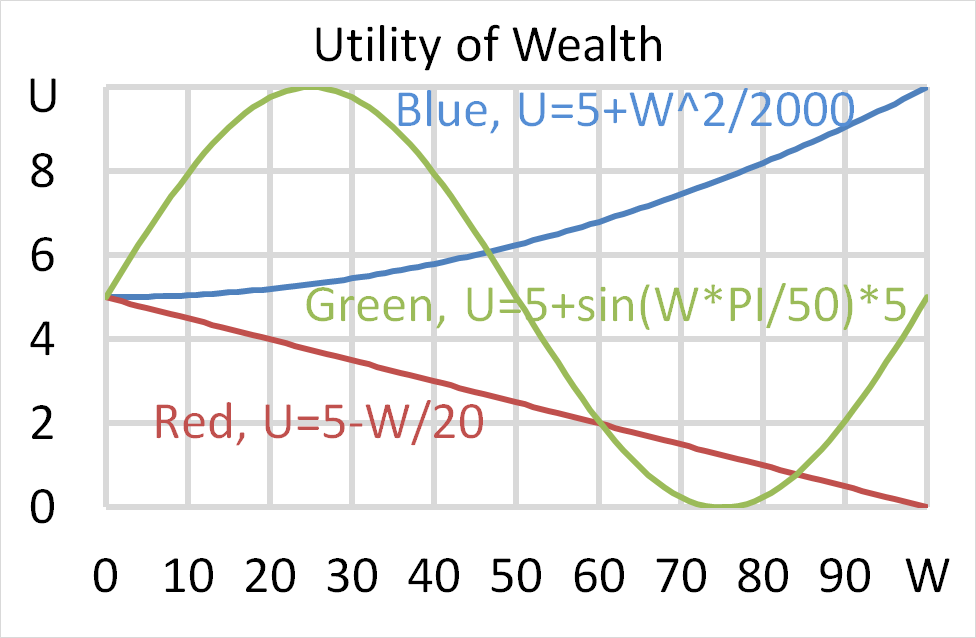

Question 702 utility, risk aversion, utility function, gamble

Mr Blue, Miss Red and Mrs Green are people with different utility functions.

Each person has $50 of initial wealth. A coin toss game is offered to each person at a casino where the player can win or lose $50. Each player can flip a coin and if they flip heads, they receive $50. If they flip tails then they will lose $50. Which of the following statements is NOT correct?

Which form of production is included in the Gross Domestic Product (GDP) reported by the government statistics agency?

Question 920 SML, CAPM, Sharpe ratio, Treynor ratio, Jensens alpha, no explanation

Over-priced assets should NOT:

A non-dividend paying stock has a current price of $20.

The risk free rate is 5% pa given as a continuously compounded rate.

Options on the stock are currently priced at $5 for calls and $5.55 for puts where both options have a 2 year maturity and an exercise price of $24.

You suspect that the call option contract is mis-priced and would like to conduct a risk-free arbitrage that requires zero capital. Which of the following steps about arbitraging the situation is NOT correct?