Question 246 foreign exchange rate, forward foreign exchange rate, cross currency interest rate parity

Suppose the Australian cash rate is expected to be 8.15% pa and the US federal funds rate is expected to be 3.00% pa over the next 2 years, both given as nominal effective annual rates. The current exchange rate is at parity, so 1 USD = 1 AUD.

What is the implied 2 year forward foreign exchange rate?

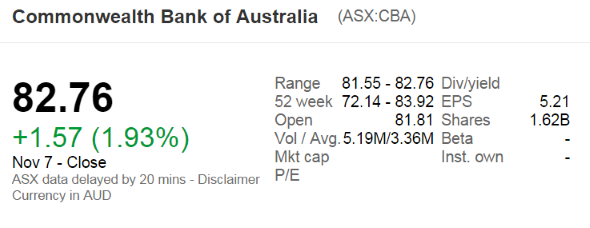

The below screenshot of Commonwealth Bank of Australia's (CBA) details were taken from the Google Finance website on 7 Nov 2014. Some information has been deliberately blanked out.

What was CBA's approximate payout ratio over the 2014 financial year?

Note that the firm's interim and final dividends were $1.83 and $2.18 respectively over the 2014 financial year.

A Chinese man wishes to convert AUD 1 million into Chinese Renminbi (RMB, also called the Yuan (CNY)). The exchange rate is 6.35 RMB per USD, and 0.72 USD per AUD. How much is the AUD 1 million worth in RMB?

Which of the following statements about yield curves is NOT correct?

Below are some statements about European-style options on non-dividend paying stocks. Assume that the risk free rate is always positive. Which of these statements is NOT correct?

A British man wants to calculate how many British pounds (GBP) he needs to buy a 1 million euro (EUR) apartment in Germany. The exchange rate is 1.42 USD per GBP and 1.23 USD per EUR. What is the EUR 1 million equivalent to in GBP?

Question 973 foreign exchange rate, monetary policy, no explanation

Suppose the market expects the Reserve Bank of Australia (RBA) to increase the policy rate by 25 basis points at their next meeting. The current exchange rate is 0.8 USD per AUD.

Then unexpectedly, the RBA announce that they will leave the policy rate unchanged due to increasing unemployment and fears of a potential recession.

What do you expect to happen to Australia's exchange rate on the day when the surprise announcement is made? The Australian dollar is likely to:

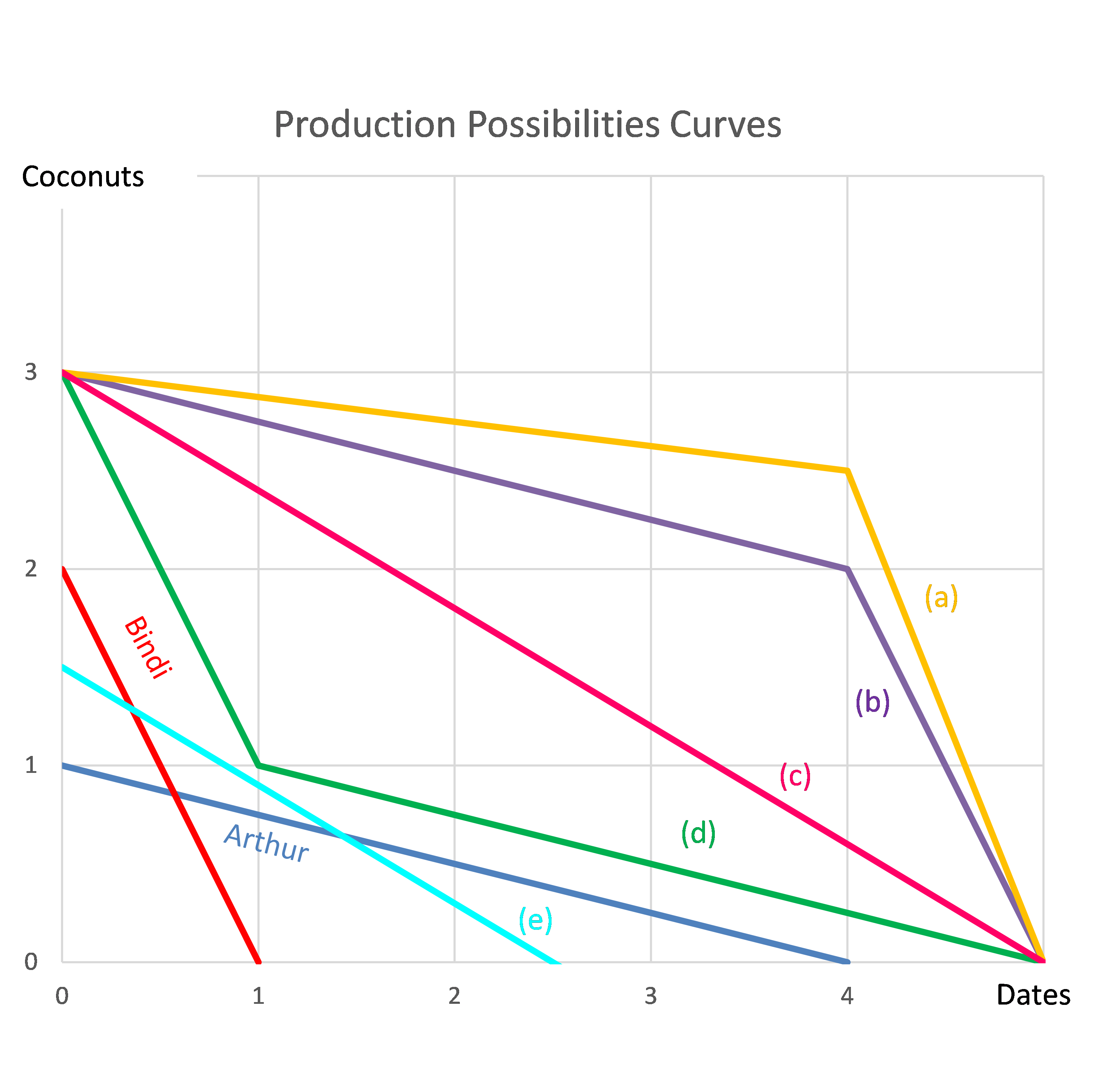

Question 978 comparative advantage in trade, production possibilities curve, no explanation

Arthur and Bindi are the only people on a remote island. Their production possibility curves are shown in the graph.

Assuming that Arthur and Bindi cooperate according to the principles of comparative advantage, what will be their combined production possibilities curve?