A share was bought for $20 (at t=0) and paid its annual dividend of $3 one year later (at t=1). Just after the dividend was paid, the share price was $16 (at t=1). What was the total return, capital return and income return? Calculate your answers as effective annual rates.

The choices are given in the same order: ## r_\text{total},r_\text{capital},r_\text{income} ##.

A firm is considering a new project of similar risk to the current risk of the firm. This project will expand its existing business. The cash flows of the project have been calculated assuming that there is no interest expense. In other words, the cash flows assume that the project is all-equity financed.

In fact the firm has a target debt-to-equity ratio of 1, so the project will be financed with 50% debt and 50% equity. To find the levered value of the firm's assets, what discount rate should be applied to the project's unlevered cash flows? Assume a classical tax system.

Your neighbour asks you for a loan of $100 and offers to pay you back $120 in one year.

You don't actually have any money right now, but you can borrow and lend from the bank at a rate of 10% pa. Rates are given as effective annual rates.

Assume that your neighbour will definitely pay you back. Ignore interest tax shields and transaction costs.

The Net Present Value (NPV) of lending to your neighbour is $9.09. Describe what you would do to actually receive a $9.09 cash flow right now with zero net cash flows in the future.

Question 433 Merton model of corporate debt, real option, option, no explanation

A risky firm will last for one period only (t=0 to 1), then it will be liquidated. So it's assets will be sold and the debt holders and equity holders will be paid out in that order. The firm has the following quantities:

##V## = Market value of assets.

##E## = Market value of (levered) equity.

##D## = Market value of zero coupon bonds.

##F_1## = Total face value of zero coupon bonds which is promised to be paid in one year.

What is the payoff to equity holders at maturity, assuming that they keep their shares until maturity?

Question 604 inflation, real and nominal returns and cash flows

Apples and oranges currently cost $1 each. Inflation is 5% pa, and apples and oranges are equally affected by this inflation rate. Note that when payments are not specified as real, as in this question, they're conventionally assumed to be nominal.

Which of the following statements is NOT correct?

A company can invest funds in a five year project at LIBOR plus 50 basis points pa. The five-year swap rate is 4% pa. What fixed rate of interest can the company earn over the next five years by using the swap?

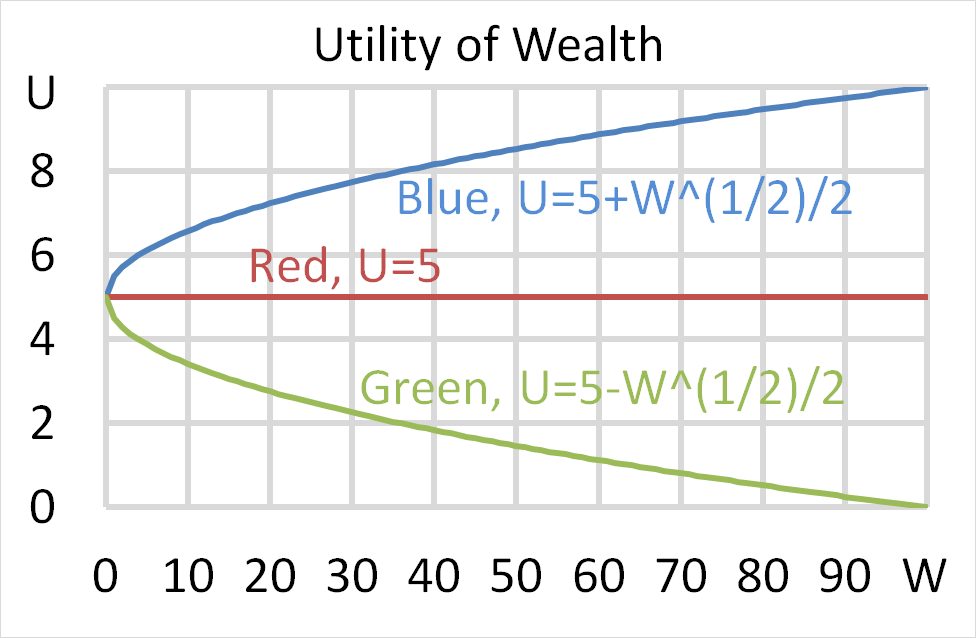

Mr Blue, Miss Red and Mrs Green are people with different utility functions. Which of the statements about the 3 utility functions is NOT correct?

Safe firms with low chances of bankruptcy will tend to have:

Question 899 comparative advantage in trade, production possibilities curve, no explanation

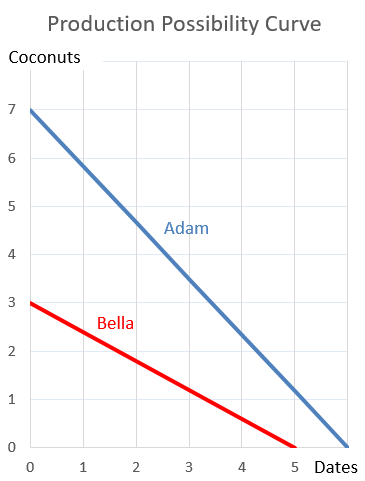

Adam and Bella are the only people on a remote island. Their production possibility curves are shown in the graph.

Assume that Adam and Bella cooperate according to the principle of comparative advantage.

Which of the following statements is NOT correct?

Which of the following statements about Macaulay duration is NOT correct? The Macaulay duration: