Question 56 income and capital returns, bond pricing, premium par and discount bonds

Which of the following statements about risk free government bonds is NOT correct?

Hint: Total return can be broken into income and capital returns as follows:

###\begin{aligned} r_\text{total} &= \frac{c_1}{p_0} + \frac{p_1-p_0}{p_0} \\ &= r_\text{income} + r_\text{capital} \end{aligned} ###

The capital return is the growth rate of the price.

The income return is the periodic cash flow. For a bond this is the coupon payment.

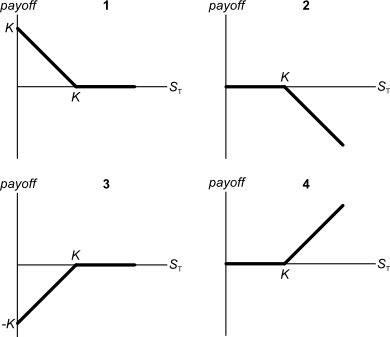

Below are 4 option graphs. Note that the y-axis is payoff at maturity (T). What options do they depict? List them in the order that they are numbered.

Which one of the following bonds is trading at a premium?

You just started work at your new job which pays $48,000 per year.

The human resources department have given you the option of being paid at the end of every week or every month.

Assume that there are 4 weeks per month, 12 months per year and 48 weeks per year.

Bank interest rates are 12% pa given as an APR compounding per month.

What is the dollar gain over one year, as a net present value, of being paid every week rather than every month?

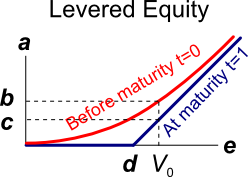

Question 385 Merton model of corporate debt, real option, option

A risky firm will last for one period only (t=0 to 1), then it will be liquidated. So it's assets will be sold and the debt holders and equity holders will be paid out in that order. The firm has the following quantities:

##V## = Market value of assets.

##E## = Market value of (levered) equity.

##D## = Market value of zero coupon bonds.

##F_1## = Total face value of zero coupon bonds which is promised to be paid in one year.

The levered equity graph above contains bold labels a to e. Which of the following statements about those labels is NOT correct?

A managed fund charges fees based on the amount of money that you keep with them. The fee is 2% of the end-of-year amount, paid at the end of every year.

This fee is charged regardless of whether the fund makes gains or losses on your money.

The fund offers to invest your money in shares which have an expected return of 10% pa before fees.

You are thinking of investing $100,000 in the fund and keeping it there for 40 years when you plan to retire.

How much money do you expect to have in the fund in 40 years? Also, what is the future value of the fees that the fund expects to earn from you? Give both amounts as future values in 40 years. Assume that:

- The fund has no private information.

- Markets are weak and semi-strong form efficient.

- The fund's transaction costs are negligible.

- The cost and trouble of investing your money in shares by yourself, without the managed fund, is negligible.

- The fund invests its fees in the same companies as it invests your funds in, but with no fees.

The below answer choices list your expected wealth in 40 years, and then the fund's expected wealth in 40 years.

Question 522 income and capital returns, real and nominal returns and cash flows, inflation, real estate

A residential investment property has an expected nominal total return of 6% pa and nominal capital return of 2.5% pa. Inflation is expected to be 2.5% pa.

All of the above are effective nominal rates and investors believe that they will stay the same in perpetuity.

What are the property's expected real total, capital and income returns?

The answer choices below are given in the same order.

Alice, Bob, Chris and Delta are traders in the futures market. The following trades occur over a single day in a newly-opened equity index future that matures in one year which the exchange just made available.

1. Alice buys a future from Bob.

2. Chris buys a future from Delta.

3. Delta buys a future from Bob.

These were the only trades made in this equity index future. What was the trading volume and what is the open interest?

A stock has a beta of 1.5. The market's expected total return is 10% pa and the risk free rate is 5% pa, both given as effective annual rates.

In the last 5 minutes, bad economic news was released showing a higher chance of recession. Over this time the share market fell by 1%. The risk free rate was unchanged.

What do you think was the stock's historical return over the last 5 minutes, given as an effective 5 minute rate?

Below is a table of the 'Risk-weights for residential mortgages' as shown in APRA Basel 3 Prudential Standard APS 112 Capital Adequacy: Standardised Approach to Credit Risk January 2013.

| LVR (%) |

Standard eligible mortgages |

Non-standard eligible mortgages |

||

|

|

Risk-weight (no mortgage insurance) % |

Risk-weight (with at least 40% of the mortgage insured by an acceptable LMI) % |

Risk-weight (no mortgage insurance) % |

Risk-weight (with at least 40% of the mortgage insured by an acceptable LMI) % |

| 0 – 60 |

35 |

35 |

50 |

35 |

| 60.01 – 80 |

35 |

35 |

75 |

50 |

| 80.01 – 90 |

50 |

35 |

100 |

75 |

| 90.01 – 100 |

75 |

50 |

100 |

75 |

| > 100.01 |

100 |

75 |

100 |

100 |

A bank is considering granting a home loan to a man to buy a house worth $1.25 million using his own funds and the loan. The loan would be standard with no lenders mortgage insurance (LMI) and an LVR of 80%.

What is the minimum regulatory capital that the bank requires to grant the home loan under the Basel 3 Accord? Ignore the capital conservation buffer.