Government bonds currently have a return of 5%. A stock has a beta of 2 and the market return is 7%. What is the expected return of the stock?

| Portfolio Details | ||||||

| Stock | Expected return |

Standard deviation |

Correlation ##(\rho_{A,B})## | Dollars invested |

||

| A | 0.1 | 0.4 | 0.5 | 60 | ||

| B | 0.2 | 0.6 | 140 | |||

What is the standard deviation (not variance) of returns of the above portfolio?

Bonds X and Y are issued by the same company. Both bonds yield 10% pa, and they have the same face value ($100), maturity, seniority, and payment frequency.

The only difference is that bond X pays coupons of 6% pa and bond Y pays coupons of 8% pa. Which of the following statements is true?

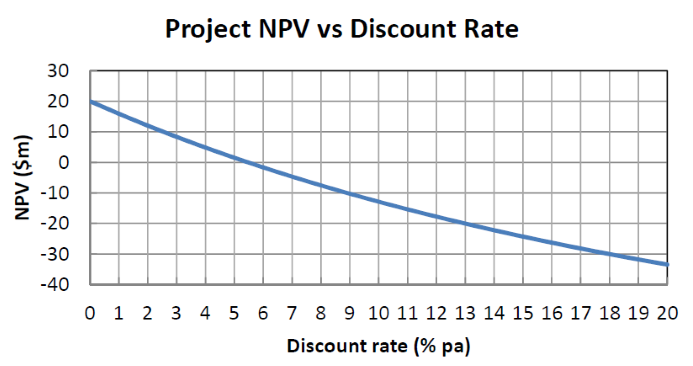

The below graph shows a project's net present value (NPV) against its annual discount rate.

Which of the following statements is NOT correct?

An investor owns an empty block of land that has local government approval to be developed into a petrol station, car wash or car park. The council will only allow a single development so the projects are mutually exclusive.

All of the development projects have the same risk and the required return of each is 10% pa. Each project has an immediate cost and once construction is finished in one year the land and development will be sold. The table below shows the estimated costs payable now, expected sale prices in one year and the internal rates of returns (IRR's).

| Mutually Exclusive Projects | |||

| Project | Cost now ($) |

Sale price in one year ($) |

IRR (% pa) |

| Petrol station | 9,000,000 | 11,000,000 | 22.22 |

| Car wash | 800,000 | 1,100,000 | 37.50 |

| Car park | 70,000 | 110,000 | 57.14 |

Which project should the investor accept?

Question 548 equivalent annual cash flow, time calculation, no explanation

An Apple iPhone 6 smart phone can be bought now for $999. An Android Kogan Agora 4G+ smart phone can be bought now for $240.

If the Kogan phone lasts for one year, approximately how long must the Apple phone last for to have the same equivalent annual cost?

Assume that both phones have equivalent features besides their lifetimes, that both are worthless once they've outlasted their life, the discount rate is 10% pa given as an effective annual rate, and there are no extra costs or benefits from either phone.

An Indonesian lady wishes to convert 1 million Indonesian rupiah (IDR) to Australian dollars (AUD). Exchange rates are 13,125 IDR per USD and 0.79 USD per AUD. How many AUD is the IDR 1 million worth?

A share’s current price is $60. It’s expected to pay a dividend of $1.50 in one year. The growth rate of the dividend is 0.5% pa and the stock’s required total return is 3% pa. The stock’s price can be modeled using the dividend discount model (DDM):

##P_0=\dfrac{C_1}{r-g}##

Which of the following methods is NOT equal to the stock’s expected price in one year and six months (t=1.5 years)? Note that the symbolic formulas shown in each line below do equal the formulas with numbers. The formula is just repeated with symbols and then numbers in case it helps you to identify the incorrect statement more quickly.

A firm wishes to raise $50 million now. They will issue 7% pa semi-annual coupon bonds that will mature in 6 years and have a face value of $100 each. Bond yields are 5% pa, given as an APR compounding every 6 months, and the yield curve is flat.

How many bonds should the firm issue?

Question 795 option, Black-Scholes-Merton option pricing, option delta, no explanation

Which of the following quantities from the Black-Scholes-Merton option pricing formula gives the Delta of a European put option?