Question 99 capital structure, interest tax shield, Miller and Modigliani, trade off theory of capital structure

A firm changes its capital structure by issuing a large amount of debt and using the funds to repurchase shares. Its assets are unchanged.

Assume that:

- The firm and individual investors can borrow at the same rate and have the same tax rates.

- The firm's debt and shares are fairly priced and the shares are repurchased at the market price, not at a premium.

- There are no market frictions relating to debt such as asymmetric information or transaction costs.

- Shareholders wealth is measured in terms of utiliity. Shareholders are wealth-maximising and risk-averse. They have a preferred level of overall leverage. Before the firm's capital restructure all shareholders were optimally levered.

According to Miller and Modigliani's theory, which statement is correct?

You're trying to save enough money for a deposit to buy a house. You want to buy a house worth $400,000 and the bank requires a 20% deposit ($80,000) before it will give you a loan for the other $320,000 that you need.

You currently have no savings, but you just started working and can save $2,000 per month, with the first payment in one month from now. Bank interest rates on savings accounts are 4.8% pa with interest paid monthly and interest rates are not expected to change.

How long will it take to save the $80,000 deposit? Round your answer up to the nearest month.

Over the next year, the management of an unlevered company plans to:

- Make $5m in sales, $1.9m in net income and $2m in equity free cash flow (EFCF).

- Pay dividends of $1m.

- Complete a $1.3m share buy-back.

Assume that:

- All amounts are received and paid at the end of the year so you can ignore the time value of money.

- The firm has sufficient retained profits to legally pay the dividend and complete the buy back.

- The firm plans to run a very tight ship, with no excess cash above operating requirements currently or over the next year.

How much new equity financing will the company need? In other words, what is the value of new shares that will need to be issued?

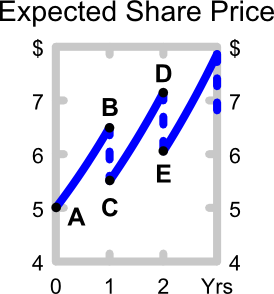

The perpetuity with growth formula, also known as the dividend discount model (DDM) or Gordon growth model, is appropriate for valuing a company's shares. ##P_0## is the current share price, ##C_1## is next year's expected dividend, ##r## is the total required return and ##g## is the expected growth rate of the dividend.

###P_0=\dfrac{C_1}{r-g}###

The below graph shows the expected future price path of the company's shares. Which of the following statements about the graph is NOT correct?

Question 548 equivalent annual cash flow, time calculation, no explanation

An Apple iPhone 6 smart phone can be bought now for $999. An Android Kogan Agora 4G+ smart phone can be bought now for $240.

If the Kogan phone lasts for one year, approximately how long must the Apple phone last for to have the same equivalent annual cost?

Assume that both phones have equivalent features besides their lifetimes, that both are worthless once they've outlasted their life, the discount rate is 10% pa given as an effective annual rate, and there are no extra costs or benefits from either phone.

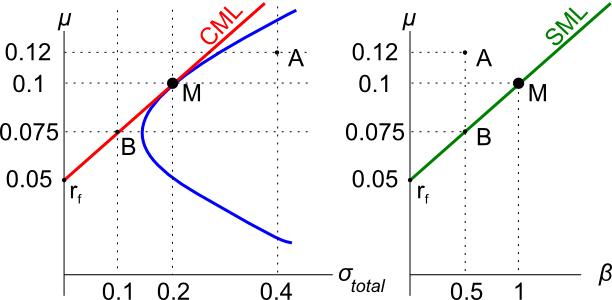

Assets A, B, M and ##r_f## are shown on the graphs above. Asset M is the market portfolio and ##r_f## is the risk free yield on government bonds. Assume that investors can borrow and lend at the risk free rate. Which of the below statements is NOT correct?

Question 734 real and nominal returns and cash flows, inflation, DDM, no explanation

An equities analyst is using the dividend discount model to price a company's shares. The company operates domestically and has no plans to expand overseas. It is part of a mature industry with stable positive growth prospects.

The analyst has estimated the real required return (r) of the stock and the value of the dividend that the stock just paid a moment before ##(C_\text{0 before})##.

What is the highest perpetual real growth rate of dividends (g) that can be justified? Select the most correct statement from the following choices. The highest perpetual real expected growth rate of dividends that can be justified is the country's expected:

Radio-Rentals.com offers the Apple iphone 5S smart phone for rent at $12.95 per week paid in advance on a 2 year contract. After renting the phone, you must return it to Radio-Rentals.

Kogan.com offers the Apple iphone 5S smart phone for sale at $699. You estimate that the phone will last for 3 years before it will break and be worthless.

Currently, the effective annual interest rate is 11.351%, the effective monthly interest rate 0.9% and the effective weekly interest rate is 0.207%. Assume that there are exactly 52 weeks per year and 12 months per year.

Find the equivalent annual cost of renting the phone and also buying the phone. The answers below are listed in the same order.