According to the theory of the Capital Asset Pricing Model (CAPM), total variance can be broken into two components, systematic variance and idiosyncratic variance. Which of the following events would be considered the most diversifiable according to the theory of the CAPM?

Diversifiable events affect only a specific company or industry or area, such as a firm's poor earnings announcement. Systematic events affect a whole country or the world and can't be avoided.

A stock's required total return will increase when its:

Total required returns only depend on systematic risk since that's the only risk that can't be diversified. Investors are afraid of systematic risk and deserve a higher expected return when exposed to this undiversifiable risk. This relationship is expressed mathematically in the security market line (SML) equation from the capital asset pricing model (CAPM). The total required return ##(r_\text{i, total})## of some asset ##i## is a function of its beta ##(\beta_i)##, which measures systematic risk.

###r_\text{i, total} = r_f + \beta_i(r_m - r_f)###Treasury bonds currently have a return of 5% pa. A stock has a beta of 0.5 and the market return is 10% pa. What is the expected return of the stock?

Let the stock be represented by 'i'. To make the notation elegant, let the stock's expected return (##E(r_i)##) be represented by ##\mu_i##.

Using the CAPM's SML equation,

###\begin{aligned} \mu_i &= r_f + \beta_i(\mu_m-r_f) \\ &= 0.05 + 0.5(0.1-0.05) \\ &= 0.075 \end{aligned} ###

A stock has a beta of 0.5. Its next dividend is expected to be $3, paid one year from now. Dividends are expected to be paid annually and grow by 2% pa forever. Treasury bonds yield 5% pa and the market portfolio's expected return is 10% pa. All returns are effective annual rates.

What is the price of the stock now?

Starting with the CAPM's SML equation we can find the required return from the stock's beta, the market return and the risk free rate:

###\begin{aligned} \mu_E &= r_f + \beta_E(\mu_m-r_f) \\ &= 0.05 + 0.5(0.1-0.05) \\ &= 0.075 \\ \end{aligned} ###

Now that we have the required return on equity we can discount the dividends on equity using the perpetuity with growth formula, also known as the Gordon growth model.

###\begin{aligned} P_0 =& \frac{C_1}{\mu_{E} - g} \\ =& \frac{3}{0.075-0.02} \\ =& 54.5454545 \end{aligned}###Question 235 SML, NPV, CAPM, risk

The security market line (SML) shows the relationship between beta and expected return.

Investment projects that plot on the SML would have:

Investment assets that plot on the SML are:

- Expected to neither over- or under-perform, having a zero abnormal return or 'alpha';

- Fairly priced, since the price is fair for the buyer and the seller;

- Zero NPV decisions when bought or sold.

Note that the SML relates beta (a measure of systematic risk) to expected return, so it only accounts for systematic risk and can not be used to gauge diversifiable risk or total risk.

Question 244 CAPM, SML, NPV, risk

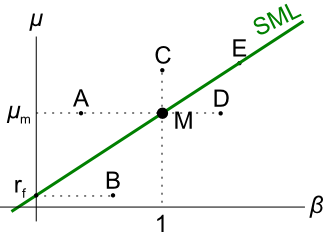

Examine the following graph which shows stocks' betas ##(\beta)## and expected returns ##(\mu)##:

Assume that the CAPM holds and that future expectations of stocks' returns and betas are correctly measured. Which statement is NOT correct?

This question is related to the security market line (SML) in the capital asset pricing model (CAPM). Stocks that plot:

- Above the SML have a positive alpha (or positive abnormal return), are under-priced, and buying them is a positive NPV investment.

Assets A and C are in this category. - On the SML have a zero alpha (or zero abnormal return), are fairly-priced, and buying them is a zero NPV investment.

Assets E, M and ##r_f## are in this category. - Below the SML have a negative alpha (or negative abnormal return), are over-priced, and buying them is a negative NPV investment.

Assets B and D are in this category.

Therefore, answer choices (a), (b), (c) and (e) are all correct.

But answer (d) is not correct since stock D has a higher beta (##\beta##) than the market portfolio (M) since it plots further to the right. Because beta is a measure of systematic risk, stock D must have more systematic risk than the market portfolio, not less.

| Portfolio Details | ||||||

| Stock | Expected return |

Standard deviation |

Correlation | Beta | Dollars invested |

|

| A | 0.2 | 0.4 | 0.12 | 0.5 | 40 | |

| B | 0.3 | 0.8 | 1.5 | 80 | ||

What is the beta of the above portfolio?

Using the portfolio beta equation,

###\begin{aligned} \beta_P &= x_A.\beta_A + x_B.\beta_B \\ &= \frac{40}{40+80} \times 0.5 + \frac{80}{40+80} \times 1.5 \\ &= 1.16666666667 \end{aligned} ###

Which statement(s) are correct?

(i) All stocks that plot on the Security Market Line (SML) are fairly priced.

(ii) All stocks that plot above the Security Market Line (SML) are overpriced.

(iii) All fairly priced stocks that plot on the Capital Market Line (CML) have zero idiosyncratic risk.

Select the most correct response:

Statement (i) is true since a stock that plots on the SML is returning exactly what the CAPM says it should for its level of systematic risk (beta).

Statement (ii) is false since a stock that plots above the SML is returning more than it should for its level of systematic risk (it has a positive alpha), therefore it is a good stock that investors want to buy because it is underpriced, it is too cheap.

Statement (iii) is true since a fairly priced stock that plots on the CML must be a portfolio of the risk free asset and the market portfolio which each have zero diversifiable risk, therefore a portfolio of them will also have zero diversifiable (same as idiosyncratic) risk.

A firm changes its capital structure by issuing a large amount of debt and using the funds to repurchase shares. Its assets are unchanged. Ignore interest tax shields.

According to the Capital Asset Pricing Model (CAPM), which statement is correct?

Beta (##\beta##) is a measure of systematic risk.

Since the value of the firm's assets must equal the value of its debt and equity,###V=D+E### The firm's assets' beta must equal the weighted average beta of the debt and equity, so: ###\beta_V = \frac{D}{V}\beta_D + \frac{E}{V}\beta_E###

In this question, there is no change in the firm's assets. Therefore, all things remaining equal, there shouldn't be any change in the beta of the firm's assets (##\beta_V##).

Since the firm is issuing more debt by borrowing in the form of a loan or a bond, the amount of debt will increase (↑ D). The funds raised from the debt are being used to repurchase equity, so the amount of equity will decrease (↓ E).

Equity holders have a residual claim on the firm's assets, which means that they get paid last if the firm goes bankrupt. So shareholders get paid after debt holders. Therefore the increase in the amount of debt means that the equity holders are less likely to receive any money if the firm goes bankrupt. It also means that there will be a larger amount of interest payments that the firm must meet so there is a higher chance of going bankrupt. This means that equity must have more systematic risk, so it's beta will increase (↑##\beta_E##). This is the answer.

Also note that since there are more debt-holders, the larger amount of debt also has more systematic risk (↑##\beta_D##). This may appear impossible since how can the beta on debt and equity rise, while the beta on assets remain constant? But this is possible since the beta on debt is always less than the beta on equity (##\beta_D < \beta_E##), and while both betas rise, there is a larger weight on debt (↑##\frac{D}{V}##), and a lower weight on equity (↓##\frac{E}{V}##), so the asset beta stays the same.

To summarise: ###\begin{matrix} \cdot \\ \beta_V \\ \end{matrix} \begin{matrix} \phantom{1} \\ = \\ \end{matrix} \begin{matrix} \uparrow \\ \frac{D}{V} \\ \end{matrix} \begin{matrix} \uparrow \\ \beta_D \\ \end{matrix} \begin{matrix} \phantom{1} \\ + \\ \end{matrix} \begin{matrix} \downarrow \\ \frac{E}{V} \\ \end{matrix} \begin{matrix} \uparrow \\ \beta_E \\ \end{matrix}###

The total return of any asset can be broken down in different ways. One possible way is to use the dividend discount model (or Gordon growth model):

###p_0 = \frac{c_1}{r_\text{total}-r_\text{capital}}###

Which, since ##c_1/p_0## is the income return (##r_\text{income}##), can be expressed as:

###r_\text{total}=r_\text{income}+r_\text{capital}###

So the total return of an asset is the income component plus the capital or price growth component.

Another way to break up total return is to use the Capital Asset Pricing Model:

###r_\text{total}=r_\text{f}+β(r_\text{m}- r_\text{f})###

###r_\text{total}=r_\text{time value}+r_\text{risk premium}###

So the risk free rate is the time value of money and the term ##β(r_\text{m}- r_\text{f})## is the compensation for taking on systematic risk.

Using the above theory and your general knowledge, which of the below equations, if any, are correct?

(I) ##r_\text{income}=r_\text{time value}##

(II) ##r_\text{income}=r_\text{risk premium}##

(III) ##r_\text{capital}=r_\text{time value}##

(IV) ##r_\text{capital}=r_\text{risk premium}##

(V) ##r_\text{income}+r_\text{capital}=r_\text{time value}+r_\text{risk premium}##

Which of the equations are correct?

The only correct statement is that the Gordon growth model (GGM) and capital asset pricing model (CAPM) both give an asset's total required return:

###r_\text{total, GGM} = r_\text{total, CAPM} ### ###\frac{c_1}{p_0}+r_\text{capital} = r_f + \beta(r_m - r_f) ### ###r_\text{income}+r_\text{capital} = r_\text{time value}+r_\text{risk premium} ###The income return in the GGM is unrelated to the time value of money (##r_f##) or the market risk premium (##\beta (r_m - r_f)##) in the CAPM. This is mainly because the income cash flow from an asset is often discretionary, such as:

- Dividends on shares which are decided by the company's board of directors.

- Coupon payments on fixed-coupon debt which are often set equal to the yield when the bond is first issued (so it's issued at par), but after that as the yield (which is the total return of debt) goes up or down, the coupon stays the same since it's fixed.

Both of these are examples of how the income return component of total returns is often quite arbitrary and unrelated to the risk free rate or market risk premium in the CAPM. Therefore, the capital return is also unrelated to either the time value of money or market risk premium too.

On the other hand, it could be argued that the floating coupon income return on a floating rate bond are closely related to the risk free rate.

Question 408 leverage, portfolio beta, portfolio risk, real estate, CAPM

You just bought a house worth $1,000,000. You financed it with an $800,000 mortgage loan and a deposit of $200,000.

You estimate that:

- The house has a beta of 1;

- The mortgage loan has a beta of 0.2.

What is the beta of the equity (the $200,000 deposit) that you have in your house?

Also, if the risk free rate is 5% pa and the market portfolio's return is 10% pa, what is the expected return on equity in your house? Ignore taxes, assume that all cash flows (interest payments and rent) were paid and received at the end of the year, and all rates are effective annual rates.

The house asset (V) is financed by the home loan debt (D) and the owners wealth or equity in the house (E).

###V = D + E###Owning all of the debt and equity is equivalent to owning the house asset. Therefore the house asset can be seen as a portfolio of debt and equity.

Method 1: Use the CAPM Portfolio beta equation to solve for the beta of equity

Applying the portfolio beta equation, the beta of the asset must equal the weighted average of the betas on debt and equity.

###\beta_\text{portfolio} = \beta_1.x_1 + \beta_2.x_2 + ... + \beta_n.x_n ### ###\begin{aligned} \beta_V &= \beta_D.x_D + \beta_E.x_E \\ &= \beta_D.\frac{D}{V} + \beta_E.\frac{E}{V} \\ 1 &= 0.2 \times \frac{800,000}{1,000,000} + \beta_E.\frac{200,000}{1,000,000} \\ \end{aligned} ### ### \beta_E = 4.2 ###Applying the CAPM,

###\begin{aligned} r_E &= r_f + \beta_E.(r_m - r_f) \\ &= 0.05 + 4.2 \times (0.1 - 0.05) \\ &= 0.26 \\ \end{aligned} ###It may seem surprising that the equity's beta and required total return is so high. The reason is because of leverage. The debt-to-assets ratio (D/V) is 80% and the debt-to-equity ratio (D/E) is 400%. If the value of the house asset rose by 1%, the value of equity would rise by 5%.

Method 2: Use the WACC equation to solve for the cost of equity

Find the required return on debt ##(r_D)## and assets ##(r_V)## using the CAPM:

###\begin{aligned} r_D &= r_f + \beta_D.(r_m - r_f) \\ &= 0.05 + 0.2 \times (0.1 - 0.05) \\ &= 0.06 \\ \end{aligned} ### ###\begin{aligned} r_V &= r_f + \beta_V.(r_m - r_f) \\ &= 0.05 + 1 \times (0.1 - 0.05) \\ &= 0.1 \\ \end{aligned} ###Using the weighted average cost of capital (WACC) equation (before tax since the question says ignore taxes), the cost of equity (also known as the required return on equity or opportunity cost of equity) can be found. ###\begin{aligned} r_V &= \text{WACC}_\text{before tax} \\ &= r_D.\dfrac{D}{V} + r_E.\dfrac{E}{V} \\ 0.1 &= 0.06 \times \dfrac{800,000}{1,000,000} + r_E \times \dfrac{200,000}{1,000,000} \\ \end{aligned} ### ###\begin{aligned} r_E &= \left(0.1 - 0.06 \times \dfrac{800,000}{1,000,000} \right) \times \dfrac{1,000,000}{200,000} \\ &= 0.26 \\ \end{aligned} ###

We can use the CAPM to find the beta of equity from this required return on equity:

###r_E = r_f + \beta_E.(r_m - r_f) ### ###0.26 = 0.05 + \beta_E.(0.1 - 0.05) ### ###\begin{aligned} \beta_E &= \dfrac{0.26 - 0.05}{0.1 - 0.05} \\ &= 4.2 \\ \end{aligned} ###A firm can issue 5 year annual coupon bonds at a yield of 8% pa and a coupon rate of 12% pa.

The beta of its levered equity is 1. Five year government bonds yield 5% pa with a coupon rate of 6% pa. The market's expected dividend return is 4% pa and its expected capital return is 6% pa.

The firm's debt-to-equity ratio is 2:1. The corporate tax rate is 30%.

What is the firm's after-tax WACC? Assume a classical tax system.

This question is a little tricky since the debt-to-equity ratio is given, not the debt-to-assets ratio. To transform between them, one way is:

###\dfrac{D}{E} = \dfrac{2}{1}###So the value of the firm's assets could be:

###V = D+E=2+1=3###Therefore, the debt to assets ratio will be:

###\dfrac{D}{V} = \dfrac{D}{D+E} = \dfrac{2}{2+1} = \dfrac{2}{3}###For the cost of debt and the risk free rate, always use the yield since it's the total return, ignore the coupon rate which is irrelevant in this question.

Since the equity beta is one, which is the same as the market, the cost of equity must be the same as the expected market return assuming that the equity is fairly priced. The market return is its expected dividend yield plus capital return which is 10%.

For the after-tax WACC,

###\begin{aligned} r_\text{wacc after tax} &= r_\text{e, ord}.\frac{E_\text{ord}}{V} + r_\text{d}.(1 - t_c).\frac{D}{V} \\ &= 0.1 \times \left( 1- \frac{2}{3} \right) + 0.08 \times (1-0.3) \times \frac{2}{3} \\ &= 0.070666667 \\ \end{aligned} ###There are many different ways to value a firm's assets. Which of the following will NOT give the correct market value of a levered firm's assets ##(V_L)##? Assume that:

- The firm is financed by listed common stock and vanilla annual fixed coupon bonds, which are both traded in a liquid market.

- The bonds' yield is equal to the coupon rate, so the bonds are issued at par. The yield curve is flat and yields are not expected to change. When bonds mature they will be rolled over by issuing the same number of new bonds with the same expected yield and coupon rate, and so on forever.

- Tax rates on the dividends and capital gains received by investors are equal, and capital gains tax is paid every year, even on unrealised gains regardless of when the asset is sold.

- There is no re-investment of the firm's cash back into the business. All of the firm's excess cash flow is paid out as dividends so real growth is zero.

- The firm operates in a mature industry with zero real growth.

- All cash flows and rates in the below equations are real (not nominal) and are expected to be stable forever. Therefore the perpetuity equation with no growth is suitable for valuation.

Where:

###r_\text{WACC before tax} = r_D.\frac{D}{V_L} + r_{EL}.\frac{E_L}{V_L} = \text{Weighted average cost of capital before tax}### ###r_\text{WACC after tax} = r_D.(1-t_c).\frac{D}{V_L} + r_{EL}.\frac{E_L}{V_L} = \text{Weighted average cost of capital after tax}### ###NI_L=(Rev-COGS-FC-Depr-\mathbf{IntExp}).(1-t_c) = \text{Net Income Levered}### ###CFFA_L=NI_L+Depr-CapEx - \varDelta NWC+\mathbf{IntExp} = \text{Cash Flow From Assets Levered}### ###NI_U=(Rev-COGS-FC-Depr).(1-t_c) = \text{Net Income Unlevered}### ###CFFA_U=NI_U+Depr-CapEx - \varDelta NWC= \text{Cash Flow From Assets Unlevered}###Answer (e) double counts the interest tax shields and thus over-estimates the value of the levered firm's assets.

The cash flow from assets is big since it's levered and therefore adds the benefit of the interest tax shields from the debt ##(IntExp.t_c)## since:

###CFFA_L = CFFA_U + IntExp.t_c###The discount rate is small since it subtracts the benefit of the proportional interest tax shield since

###r_\text{WACC after tax} = r_\text{WACC before tax} - D.r_D.t_c/V_L### Because the perpetuity equation's cash flows are bigger and the discount rate is smaller, the benefit of the interest tax shields are double counted and we've over-valued the levered business's assets ##(V_L)##.All other answers give the correct valuation of the levered firm's assets ##(V_L)##. They are all equivalent. They count the benefit of interest tax shields only once.

Thanks to Shahzada for correcting an error in the solutions.