A company increases the proportion of debt funding it uses to finance its assets by issuing bonds and using the cash to repurchase stock, leaving assets unchanged.

Ignoring the costs of financial distress, which of the following statements is NOT correct:

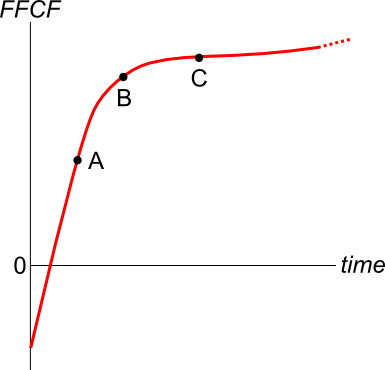

A new company's Firm Free Cash Flow (FFCF, same as CFFA) is forecast in the graph below.

To value the firm's assets, the terminal value needs to be calculated using the perpetuity with growth formula:

###V_{\text{terminal, }t-1} = \dfrac{FFCF_{\text{terminal, }t}}{r-g}###

Which point corresponds to the best time to calculate the terminal value?

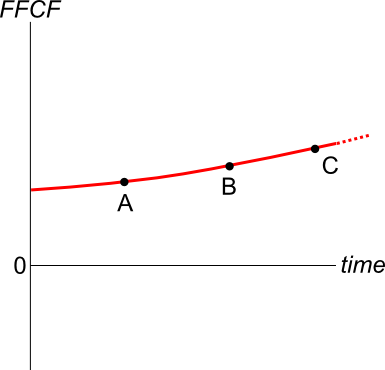

An old company's Firm Free Cash Flow (FFCF, same as CFFA) is forecast in the graph below.

To value the firm's assets, the terminal value needs to be calculated using the perpetuity with growth formula:

###V_{\text{terminal, }t-1} = \dfrac{FFCF_{\text{terminal, }t}}{r-g}###

Which point corresponds to the best time to calculate the terminal value?

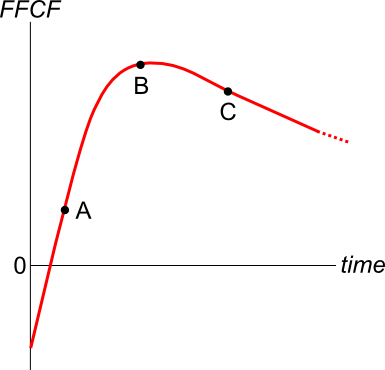

A new company's Firm Free Cash Flow (FFCF, same as CFFA) is forecast in the graph below.

To value the firm's assets, the terminal value needs to be calculated using the perpetuity with growth formula:

###V_{\text{terminal, }t-1} = \dfrac{FFCF_{\text{terminal, }t}}{r-g}###

Which point corresponds to the best time to calculate the terminal value?

Use the below information to value a levered company with constant annual perpetual cash flows from assets. The next cash flow will be generated in one year from now, so a perpetuity can be used to value this firm. Both the operating and firm free cash flows are constant (but not equal to each other).

| Data on a Levered Firm with Perpetual Cash Flows | ||

| Item abbreviation | Value | Item full name |

| ##\text{OFCF}## | $100m | Operating free cash flow |

| ##\text{FFCF or CFFA}## | $112m | Firm free cash flow or cash flow from assets (includes interest tax shields) |

| ##g## | 0% pa | Growth rate of OFCF and FFCF |

| ##\text{WACC}_\text{BeforeTax}## | 7% pa | Weighted average cost of capital before tax |

| ##\text{WACC}_\text{AfterTax}## | 6.25% pa | Weighted average cost of capital after tax |

| ##r_\text{D}## | 5% pa | Cost of debt |

| ##r_\text{EL}## | 9% pa | Cost of levered equity |

| ##D/V_L## | 50% pa | Debt to assets ratio, where the asset value includes tax shields |

| ##t_c## | 30% | Corporate tax rate |

What is the value of the levered firm including interest tax shields?