For a price of $95, Sherylanne will sell you a share which is expected to pay its first dividend of $10 in 7 years (t=7), and will continue to pay the same $10 dividend every year after that forever.

The required return of the stock is 10% pa.

A stock's correlation with the market portfolio increases while its total risk is unchanged. What will happen to the stock's expected return and systematic risk?

Find Candys Corporation's Cash Flow From Assets (CFFA), also known as Free Cash Flow to the Firm (FCFF), over the year ending 30th June 2013.

| Candys Corp | ||

| Income Statement for | ||

| year ending 30th June 2013 | ||

| $m | ||

| Sales | 200 | |

| COGS | 50 | |

| Operating expense | 10 | |

| Depreciation | 20 | |

| Interest expense | 10 | |

| Income before tax | 110 | |

| Tax at 30% | 33 | |

| Net income | 77 | |

| Candys Corp | ||

| Balance Sheet | ||

| as at 30th June | 2013 | 2012 |

| $m | $m | |

| Assets | ||

| Current assets | 220 | 180 |

| PPE | ||

| Cost | 300 | 340 |

| Accumul. depr. | 60 | 40 |

| Carrying amount | 240 | 300 |

| Total assets | 460 | 480 |

| Liabilities | ||

| Current liabilities | 175 | 190 |

| Non-current liabilities | 135 | 130 |

| Owners' equity | ||

| Retained earnings | 50 | 60 |

| Contributed equity | 100 | 100 |

| Total L and OE | 460 | 480 |

Note: all figures are given in millions of dollars ($m).

A fairly priced stock has an expected return equal to the market's. Treasury bonds yield 5% pa and the market portfolio's expected return is 10% pa. What is the stock's beta?

A young lady is trying to decide if she should attend university. Her friends say that she should go to university because she is more likely to meet a clever young man than if she begins full time work straight away.

What's the correct way to classify this item from a capital budgeting perspective when trying to find the Net Present Value of going to university rather than working?

The opportunity to meet a desirable future spouse should be classified as:

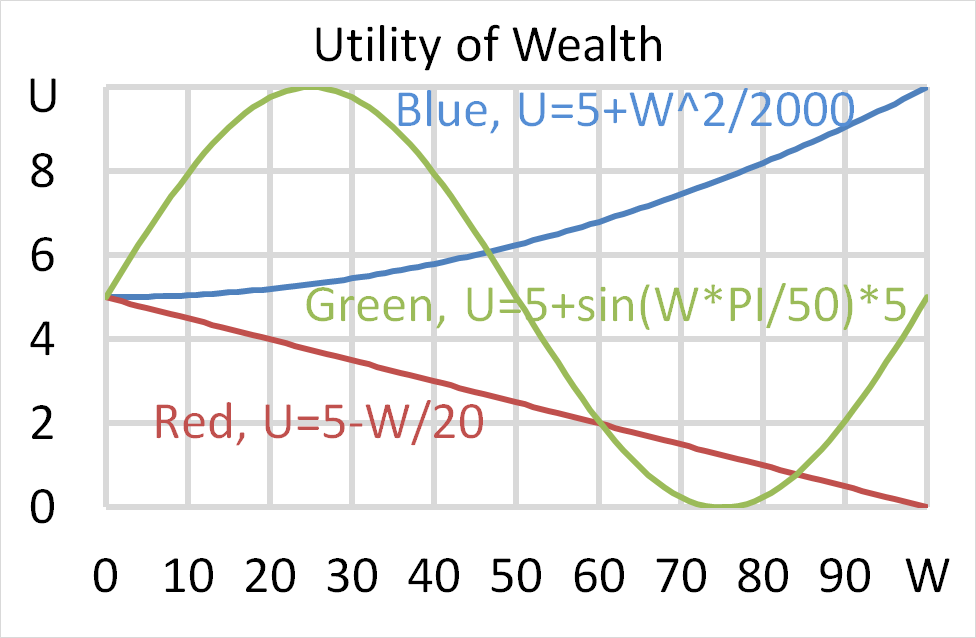

Mr Blue, Miss Red and Mrs Green are people with different utility functions. Which of the statements about the 3 utility functions is NOT correct?

Question 803 capital raising, rights issue, initial public offering, on market repurchase, no explanation

Which one of the following capital raisings or payouts involve the sale of shares to existing shareholders only?

When does a European option's last-traded market price become a sunk cost?

Question 841 gross domestic product, government spending

The government spends money on:

- Goods and services such as defence, police, schools, hospitals and roads; and

- Transfer payments (also called welfare) such as the pension, dole, disability support and student support.

When calculating GDP (=C+I+G+X-M), the ‘government spending’ component (G) is supposed to include: