A company has:

- 100 million ordinary shares outstanding which are trading at a price of $5 each. Market analysts estimated that the company's ordinary stock has a beta of 1.5. The risk-free rate is 5% and the market return is 10%.

- 1 million preferred shares which have a face (or par) value of $100 and pay a constant annual dividend of 9% of par. The next dividend will be paid in one year. Assume that all preference dividends will be paid when promised. They currently trade at a price of $90 each.

- Debentures that have a total face value of $200 million and a yield to maturity of 6% per annum. They are publicly traded and their market price is equal to 110% of their face value.

The corporate tax rate is 30%. All returns and yields are given as effective annual rates.

What is the company's after-tax Weighted Average Cost of Capital (WACC)? Assume a classical tax system.

The following cash flows are expected:

- 10 yearly payments of $60, with the first payment in 3 years from now (first payment at t=3 and last at t=12).

- 1 payment of $400 in 5 years and 6 months (t=5.5) from now.

What is the NPV of the cash flows if the discount rate is 10% given as an effective annual rate?

You have $100,000 in the bank. The bank pays interest at 10% pa, given as an effective annual rate.

You wish to consume an equal amount now (t=0) and in one year (t=1) and have nothing left in the bank at the end (t=1).

How much can you consume at each time?

Find Ching-A-Lings Corporation's Cash Flow From Assets (CFFA), also known as Free Cash Flow to the Firm (FCFF), over the year ending 30th June 2013.

| Ching-A-Lings Corp | ||

| Income Statement for | ||

| year ending 30th June 2013 | ||

| $m | ||

| Sales | 100 | |

| COGS | 20 | |

| Depreciation | 20 | |

| Rent expense | 11 | |

| Interest expense | 19 | |

| Taxable Income | 30 | |

| Taxes at 30% | 9 | |

| Net income | 21 | |

| Ching-A-Lings Corp | ||

| Balance Sheet | ||

| as at 30th June | 2013 | 2012 |

| $m | $m | |

| Inventory | 49 | 38 |

| Trade debtors | 14 | 2 |

| Rent paid in advance | 5 | 5 |

| PPE | 400 | 400 |

| Total assets | 468 | 445 |

| Trade creditors | 4 | 10 |

| Bond liabilities | 200 | 190 |

| Contributed equity | 145 | 145 |

| Retained profits | 119 | 100 |

| Total L and OE | 468 | 445 |

Note: All figures are given in millions of dollars ($m).

The cash flow from assets was:

You have $100,000 in the bank. The bank pays interest at 10% pa, given as an effective annual rate.

You wish to consume twice as much now (t=0) as in one year (t=1) and have nothing left in the bank at the end.

How much can you consume at time zero and one? The answer choices are given in the same order.

Question 545 income and capital returns, fully amortising loan, no explanation

Which of the following statements about the capital and income returns of a 25 year fully amortising loan asset is correct?

Assume that the yield curve (which shows total returns over different maturities) is flat and is not expected to change.

Over the 25 years from issuance to maturity, a fully amortising loan's expected annual effective:

Question 803 capital raising, rights issue, initial public offering, on market repurchase, no explanation

Which one of the following capital raisings or payouts involve the sale of shares to existing shareholders only?

Question 817 expected and historical returns, income and capital returns

Over the last year, a constant-dividend-paying stock's price fell, while it's future expected dividends and profit remained the same. Assume that:

- Now is ##t=0##, last year is ##t=-1## and next year is ##t=1##;

- The dividend is paid at the end of each year, the last dividend was just paid today ##(C_0)## and the next dividend will be paid next year ##(C_1)##;

- Markets are efficient and the dividend discount model is suitable for valuing the stock.

Which of the following statements is NOT correct? The stock's:

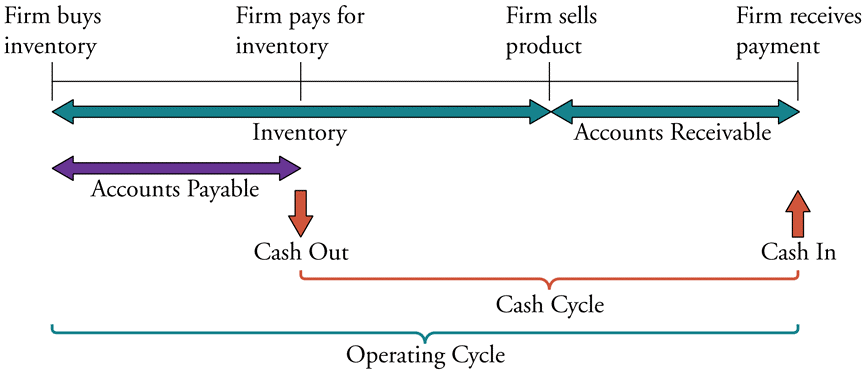

The below diagram shows a firm’s cash cycle.

Which of the following statements about companies’ cash cycle is NOT correct?

Which of the following statements about bond convexity is NOT correct?